The US dollar fell rather hard against the Japanese yen during the trading session on Wednesday after the Federal Reserve Chairman Jerome Powell released his opening remarks for the Humphrey Hawkins congressional testimony. It shows that there is the proclivity of the Federal Reserve to cut interest rates, so that of course will work against the greenback.

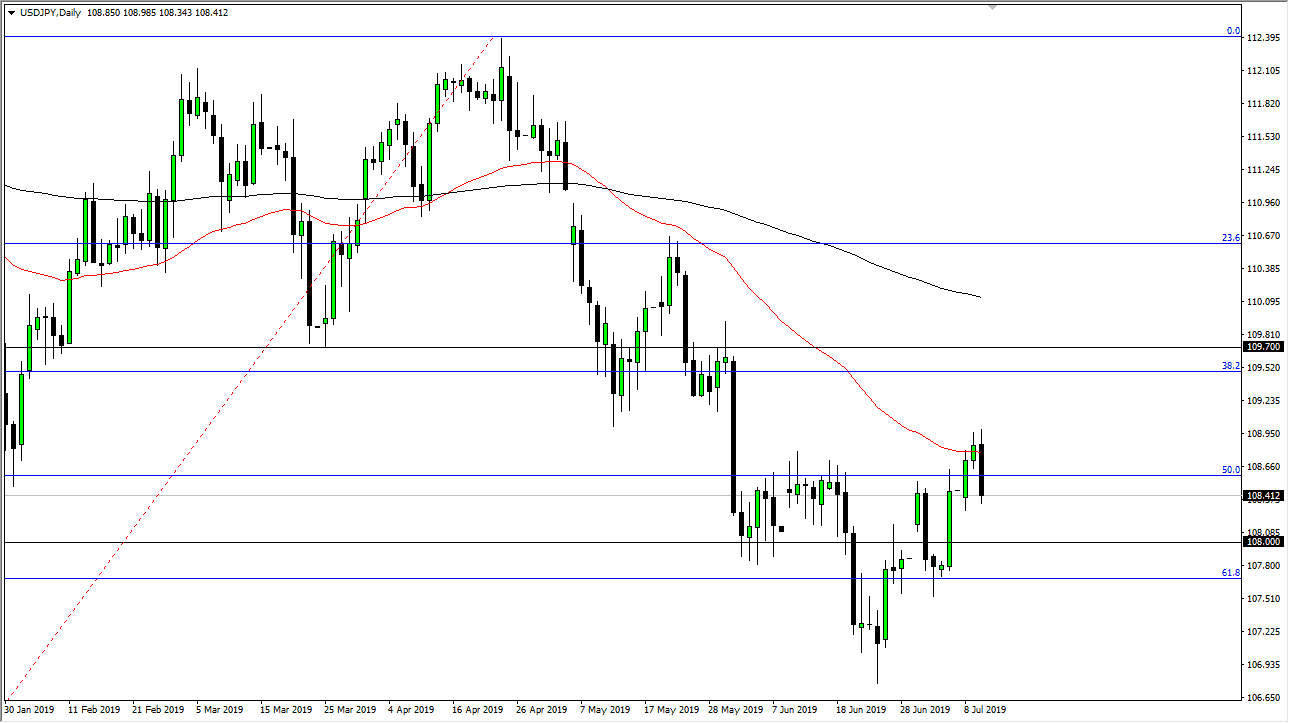

The 50 day EMA has offered resistance and we are reaching back towards the ¥108.40 level as I write this. Overall though, I think there is plenty of support underneath, extending to at least the ¥108 level, if not the 61.8% Fibonacci retracement level underneath. At this point, I’m looking for a hammer or something to that effect. That being said, if we can break above the highs of the last couple of sessions, then we will probably go towards the ¥109.60 level. I do believe it’s only a matter time before we get there, because even if the Federal Reserve is going to be very dovish, the reality is that this pair will quite often follow the stock market so let’s see if the S&P 500 can rally so that this market can turn around and do the same.

Looking at the charts, you can see that we have been trying to form some type of bottoming pattern, and as a result it looks like we are starting to form a nice longer-term base that can be used to enter this market to the upside. Even though we have a very negative candle stick for the day on Wednesday, the reality is that there is a lot of interest in the gap that formed a couple of weeks goes well, so I think it’s only a matter time before big money flows back into the market.

Keep in mind that the Japanese yen is crucial when it comes to risk appetite, and if we get more of a “risk on” move, that will send money away from the Yen anyway. Ultimately, this is a market that I don’t have any interest in shorting, at least not until we get significant selling pressure. At that point, we could go to the 107 young level, possibly even lower than that. Although we fell during the day, it should be noted that we did break resistance just two days ago, so it’s probably only a matter time before we get a hammer or some type of impulsive green candle to follow.