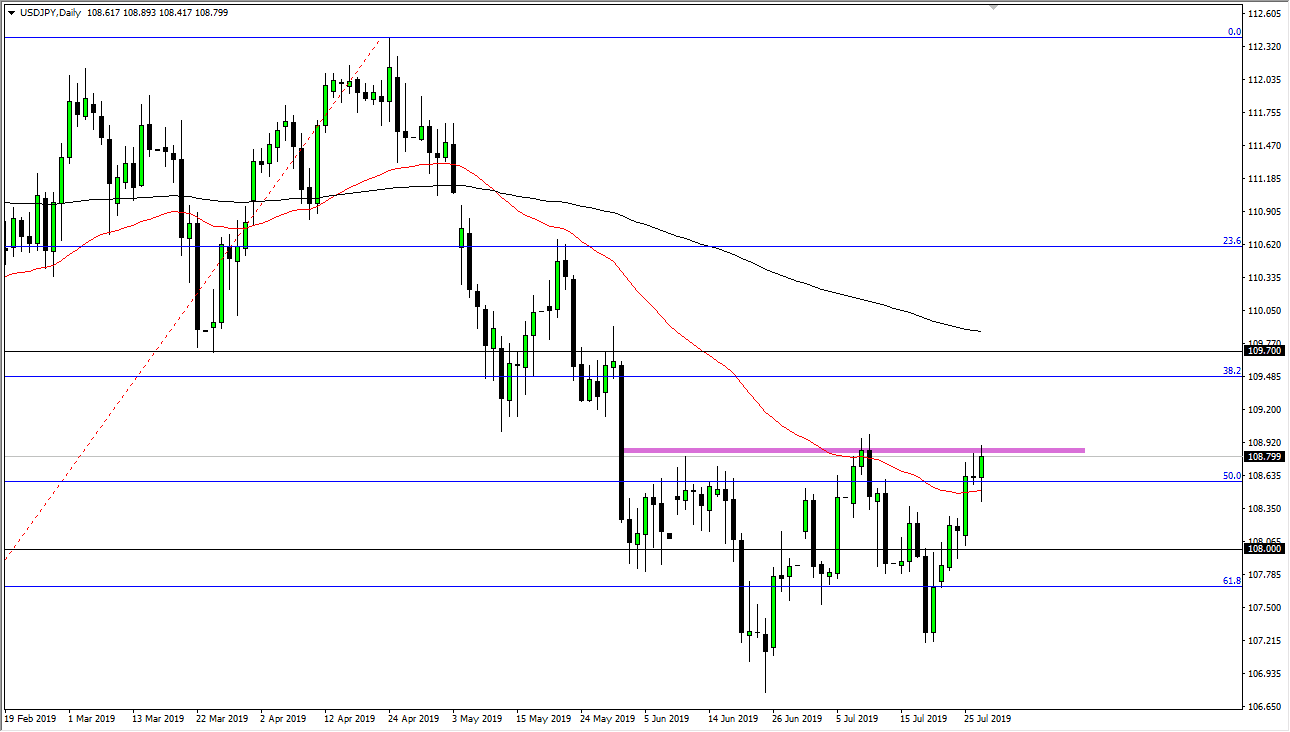

The US dollar has initially fallen during the trading session on Monday but found enough support underneath the 50 day EMA to turn things around and show signs of life. The fact that we are testing the top of the shooting star for the previous session is of course a very bullish sign, so if we can break above the ¥109 level, it’s likely that the market will continue to go even higher. I think this shows that there is more of a “risk on” attitude than anything else right now, as unlike other currency pairs, the US dollar will rally significantly in that scenario, and people are waiting for the Federal Reserve to cut interest rates so that they can liquefy the markets.

The candle stick is very bullish looking, so if we can break above the ¥109 level, then I think it opens up the door to the ¥109.70 level. If the Federal Reserve does in fact cut rates and suggest that they are going to do even more, it’s likely that we will see this market go higher, coincides nicely with the S&P 500 and other stock indices.

This will be because people will be shutting risk in general, and the Japanese yen is without a doubt the “safety currency” for the world. At this point, I think the ¥108 level is massive support, just as the ¥107 level is. If we were to somehow turn around to break down below the ¥107 level, it would be an extraordinarily negative sign. At this point, it looks more likely that we are trying to form a “W pattern”, which of course is a bullish sign as well. That measures for a move of roughly 200 pips, meaning that longer-term, we could be looking at a move towards the two ¥111 level. Regardless, this is a market that is going to continue to be choppy and noisy, so keep in mind that you are likely going to have to take your time and be patient with gains. Ultimately, we do look bullish but the reality is the next couple of days could be more of a slow grind than anything else. I favor the upside, but also recognize that position sizing should be rather small as trying to put money to work ahead of the Federal Reserve is probably more or less gambling, and risky to say the least.