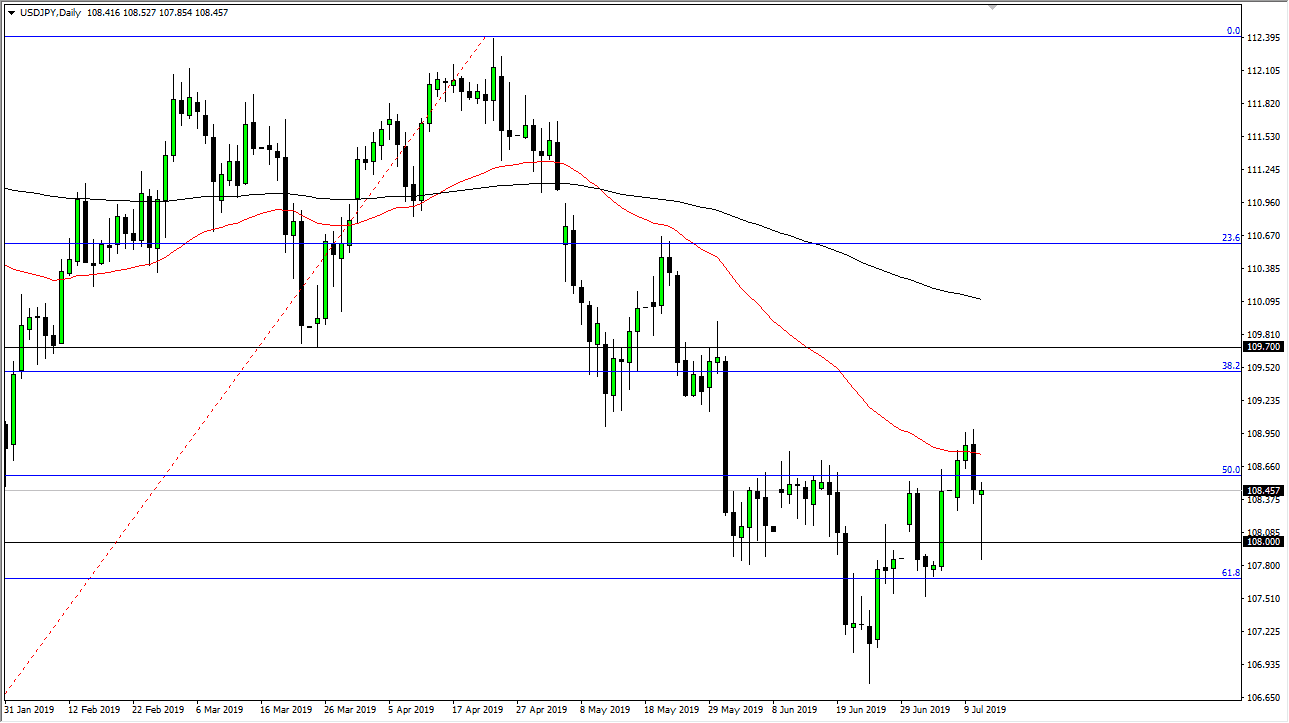

The US dollar initially tried to rally during the trading session on Friday but then collapsed against the Japanese yen as the greenback got sold off against just about everything. Not only that, but we broke down below the bottom of the hammer that looked so promising on Thursday. That of course is a very negative turn of events but we are at an area that shows extreme support. In other words, this could go either way but my experience leads me to believe that the fact that we have wiped out the hammer foretells of a very negative move coming.

Beyond that, we are seeing the US dollar get hammered against other currencies such as the Swiss franc, Australian dollars, and a whole host of others. With that being the case, I think that we could continue to see a bit of selling pressure here, reaching down towards the ¥107.50 level, and maybe even below there if this continues. I find it interesting that we have wiped out this candlestick, and that people are willing to buy the Japanese yen and the Swiss franc going into the weekend, at least against the US dollar. This suggests that perhaps people are concerned about something in America.

If we start to worry about trouble in the United States, that could be a deathblow to risk appetite around the world. After all, the United States has been the one place that we have seen significant growth. All that being equal, the Federal Reserve is looking to cut interest rates so while that could lift the stock market, it could also work against the value of the US dollar as well. I think at this point we are seeing mass confusion played out in the USD/JPY pair, as we are getting conflicting signals on an almost weekly basis.

The 61.8% Fibonacci retracement level is just below, so if we were to break down below there the market could unwind rather rapidly and go much lower. At that point I would expect the market to perhaps try to target the ¥105 level. To the upside, if we can turn around and break above the 50 day EMA, the market could then go to the ¥109.70 level above where we have seen such significant selling pressure previously. A break above there would in fact be a trend change but I don’t expect to see that anytime soon. The fact that we could not hold the signs of a rally for just 24 hours tells me how bad things could get.