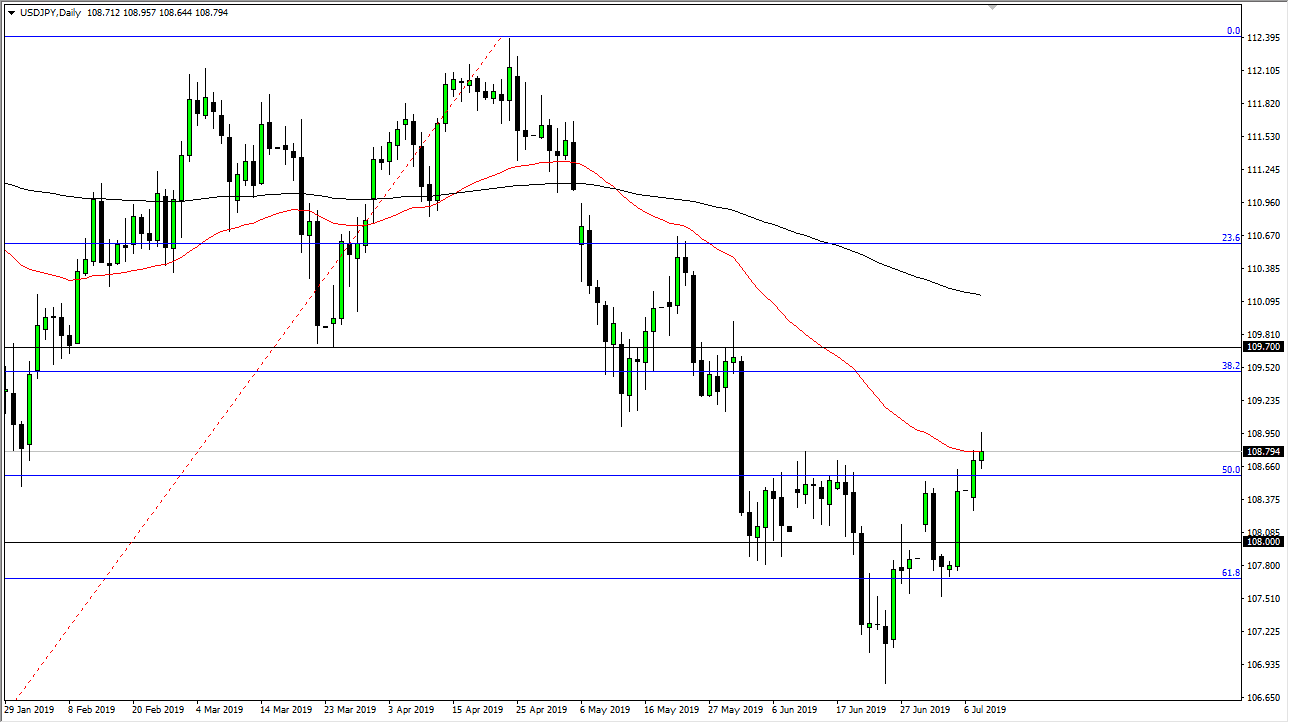

Looking at the US dollar, you can see that we were rather bullish to kick off the trading session on Tuesday but haven’t ran into a significant amount of resistance above the ¥108 level. This makes sense, because we have the Humphrey Hawkins testimony in front of Congress over the next couple of days, which features Jerome Powell explaining monetary policy to lawmakers. That will be paid close attention to, at least for hints of what’s going to happen next with US monetary policy.

All things being equal, the fact that the 50 day EMA is here as well is yet another reason to collect profits for anybody who has been profitable over the last several days. With the testimony, it’s likely that the market will be very noisy, especially considering that these days we have machines that read headlines and trade based upon that nonsense. This leads to a lot of false trades, but ultimately the market will make a huge decision, and once it does we will see where we go next.

This pair is going to be a bit different than many of the other ones, because if the US dollar falls apart in other currency pairs, perhaps due to dovish statements coming out of Chairman Powell’s mouth, the US dollar could gain over here. That’s because the market rises on more of a “risk on” attitude in the markets, specifically the S&P 500 lately. If the S&P 500 can crack the 3000 handle, and let’s face it: Jerome Powell can make that happen to be chooses to, this pair will more than likely go higher.

That being said, the technical signal is that if we can break above the highs of the trading session on Tuesday, a lot of sellers will be trapped at that point. That will cause a bit of a short-term rally, perhaps to the top of the wipeout candle from May that extends to the ¥109.60 level. That’s the trade I’m hoping to see, but I also recognize that we could pullback as well. If we do, and as long as we can bounce from somewhere above the ¥108 level, I would be a buyer of that move as well. If we do not hold the ¥108 level then it’s time to sit on the sidelines and reassess the entire situation. One thing you can count on is what a bit of noise.