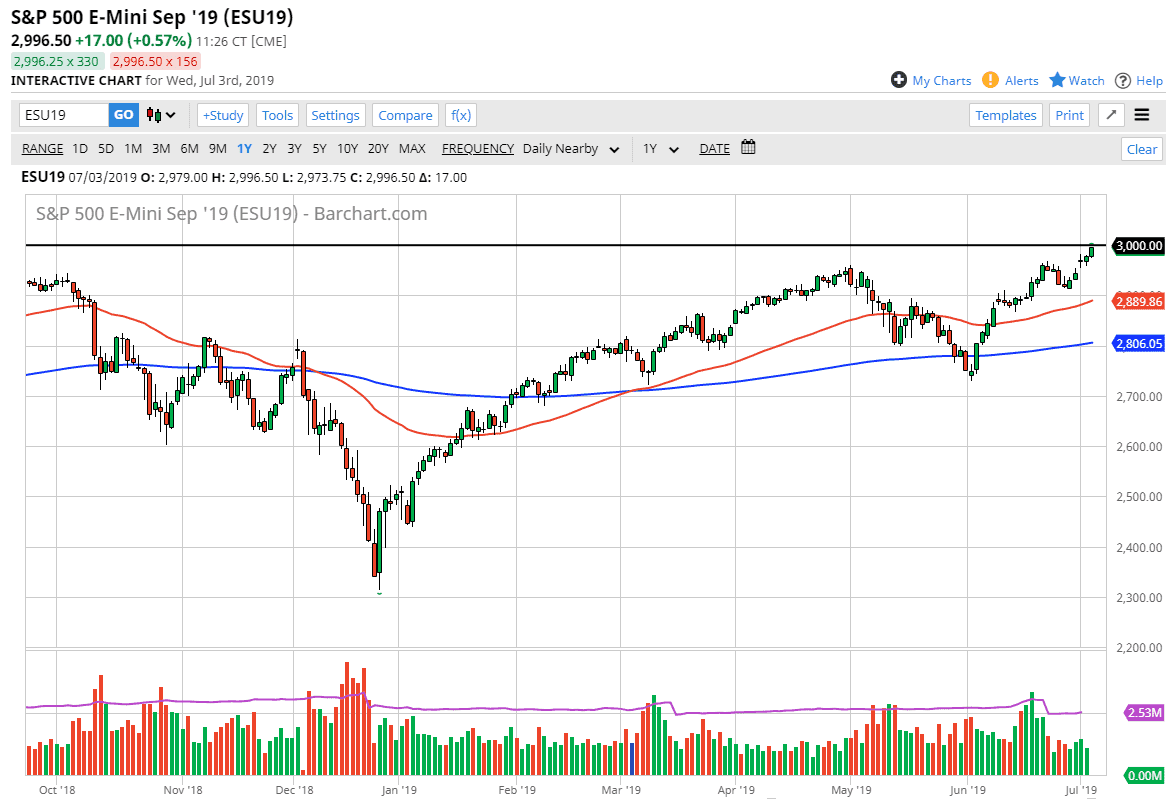

The S&P 500 has rallied significantly during the day on Wednesday, as we head into the July 4 holiday. That being the case, it looks as if we are going to press the 3000 handle, and it certainly looks as if the market is ready to make the breakout. Currently, we will have some minor electronic trading during the day on Thursday but I think that should probably be simple cannon fodder. I think pullbacks at this point are buying opportunities, as there is a gap from the beginning of the week that has yet to be filled.

The catalyst to do that could be the jobs figure, but I think that would be a nice buying opportunity. The jobs number on Friday will be a bit different than most, as there will be as many people at work, meaning that the markets will be a bit thinner than usual. That could lead to exacerbated moves, in both directions. Ironically though, this may be a scenario where “bad news is good, and good news is good as well.” After all, envision the idea of a poor jobs number. This pretty much make sure that the Federal Reserve will be cutting later this month, and of course equities will respond positively as they typically do. But what happens if we get a decent jobs number? Unless it is something outstanding, the Federal Reserve is more than likely already in a made-up mind scenario, which means not only will we get an interest rate cut, but we still have a strong employment market in the United States, a bit of a “double whammy.”

At this point, liquidity controls what happens in the marketplace, not the underlying economy. That’s been the case for 10 years and I don’t think that’s going to change in the next couple of days. Ultimately, this is a market that will break above 3000, and once it does there should be a flood of fresh money in the market after that. A daily close above the 3000 handle would be an extraordinarily bullish sign and send this market much, much higher. Keep in mind that although stock markets around the world have been struggling, the S&P 500 is essentially the “safe at stock market” in general terms. If you are a large restitution you are buying in the S&P 500 because the other indices around the world simply aren’t working longer term.