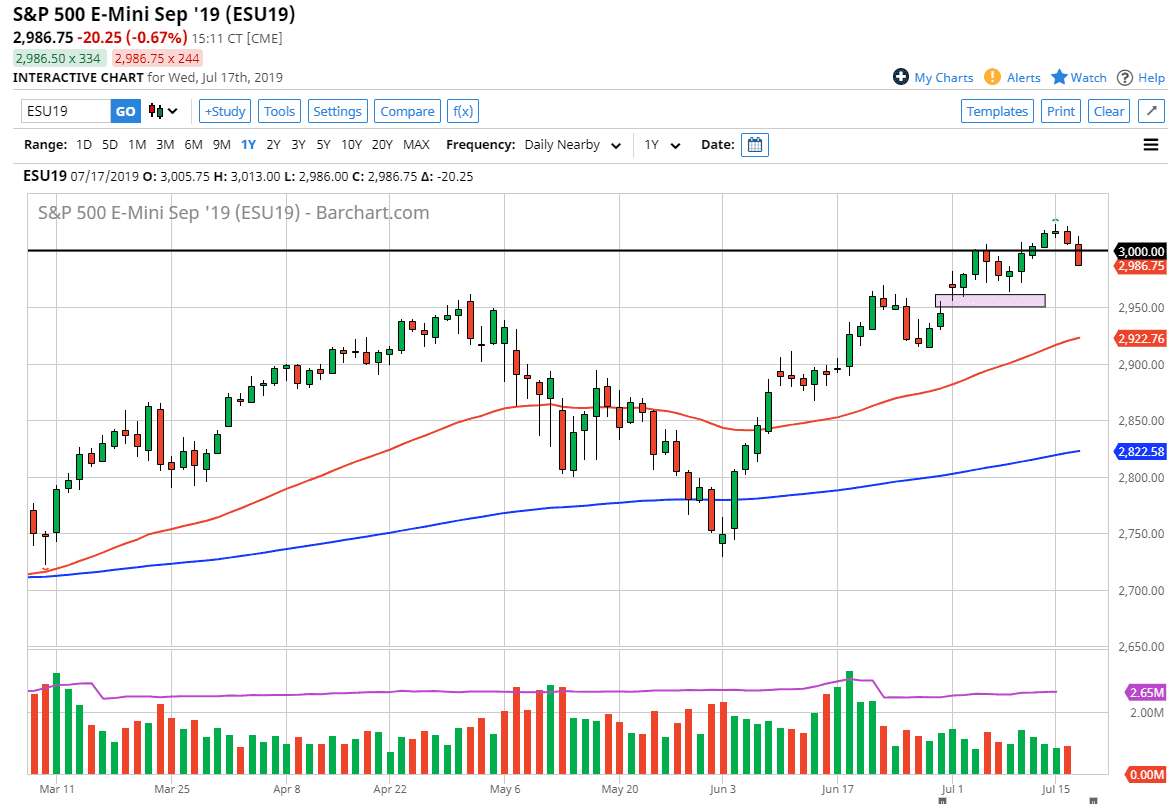

The stock markets initially tried to rally during the trading session on Wednesday but found the area above to be far too resistive, and we have broken through the 3000 level rather decidedly. That being said, we are closing at the bottom of the candle stick as well, which of course is a very bearish sign. I think this shows that the market is ready to pull back, but this is still a bullish market and therefore you should be paying attention to the uptrend scenario.

Looking at this chart, the gap underneath at the 2950 level should continue to offer massive support, and the 50 day EMA is reaching towards that area. I think any type of supportive candle in that general area should be an excellent buying opportunity as the market will pay close attention to it. At this point in time I don’t have any interest in shorting the S&P 500 although we have got a bit ahead of ourselves. Ultimately, this is a market that is going to continue to pay attention to the Federal Reserve and its monetary policy, meaning that we are looking at the interest rate cuts coming.

The interest rates being cut is about the only thing that the market truly cares about. At this point, I think that any bounce is an invitation to start buying, and I do think that eventually we will be comfortable with the S&P 500 above the 3000 handle. That being said, if we were to turn around and break through that gap underneath and perhaps even the 50 day EMA, then the uptrend could be in serious trouble. Overall though, this is a market that shows no significant bearishness other than the last 24 hours, so even then you need to keep in mind that we were only down about 0.75% or so. While it was a negative day, it wasn’t exactly an earth shattering one. At this point in time, I like the idea of picking up value as it is offered, but it’s going to take a while before we see that. It might be a day or two, but by the end of the week I would not be surprised at all to see this market turned around as traders continue to look for that cheap monetary methadone to push the stock markets to the upside.