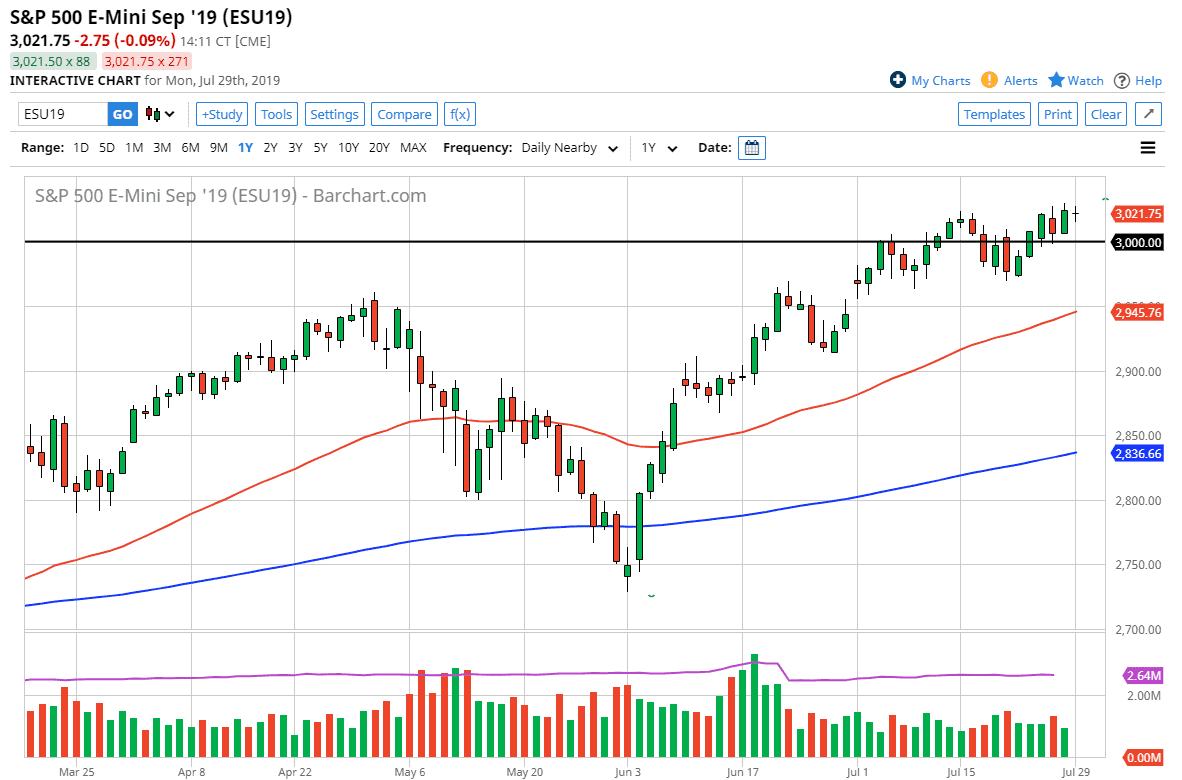

The S&P 500 did very little during the trading session on Monday, but quite frankly we have a major interest rate decision coming out on Wednesday that will have a major influence on this market. Ultimately, I think that short-term pullbacks should be buying opportunities, especially near the 3000 handle which of course is a large, round, psychologically significant figure. As long as we can see above there, it’s very likely that we will continue to find plenty of buyers. That being the case though, even if we broke down below there is a massive gap underneath near the 2950 handle, and that should offer plenty of support.

Beyond that, we also have the 50 day EMA reaching into that region, so I think it’s only a matter time before buyers would come back in. I think with the Federal Reserve making this decision, if we can get a dovish enough statement, then it’s likely that traders will feel that the “Federal Reserve has their backs”, and that of course is what we have seen for the last 12 years or so.

Remember, it’s not earnings or really at this point anything that has to do with the economy that dries the S&P 500. It’s cheap and easy money. The question now is whether or not he gets more of it. If for some reason the Federal Reserve doesn’t give Wall Street the sugar that it wants, this is a market that will probably roll over quite drastically. That being said though, let’s face it here: The Federal Reserve doesn’t like disappointed Wall Street, and it is most certainly held hostage to what that group of people need. They have shown themselves time and time again to give Wall Street exactly what it wants, and I think that changes this week.

Once we get that overly dovish statement, then I believe the stock markets will continue to go to the upside and go looking towards the 3050 handle. If we can break above that level, then it’s likely that we will then go looking towards the next large number at 3100 or so.

If for some reason we were to break down below the 50 day EMA, that could be very toxic for this market, and send it back down to reality. We haven’t seen much of that over the last decade or so, so that obviously will be the most likely of scenarios.