Natural gas markets were very quiet and electronic trading during the holiday session on Thursday as Americans celebrated Independence Day. That being the case, the market can only be taken somewhat seriously, and at this point it’s very unlikely that we are going to see a huge move until we get a reasonable catalyst. At this point, the closest thing to a catalyst now will be the jobs figure, but quite frankly that will be minor.

There is the argument that perhaps the jobs number could suggest whether or not there’s going to be enough demand out there to drive prices higher. The thought of course is that the more jobs that are filled, the more likely you are to see factories and industrial units using more natural gas. However, it is only a matter of time before we start to look at the supply and demand situation again, which of course is very poor.

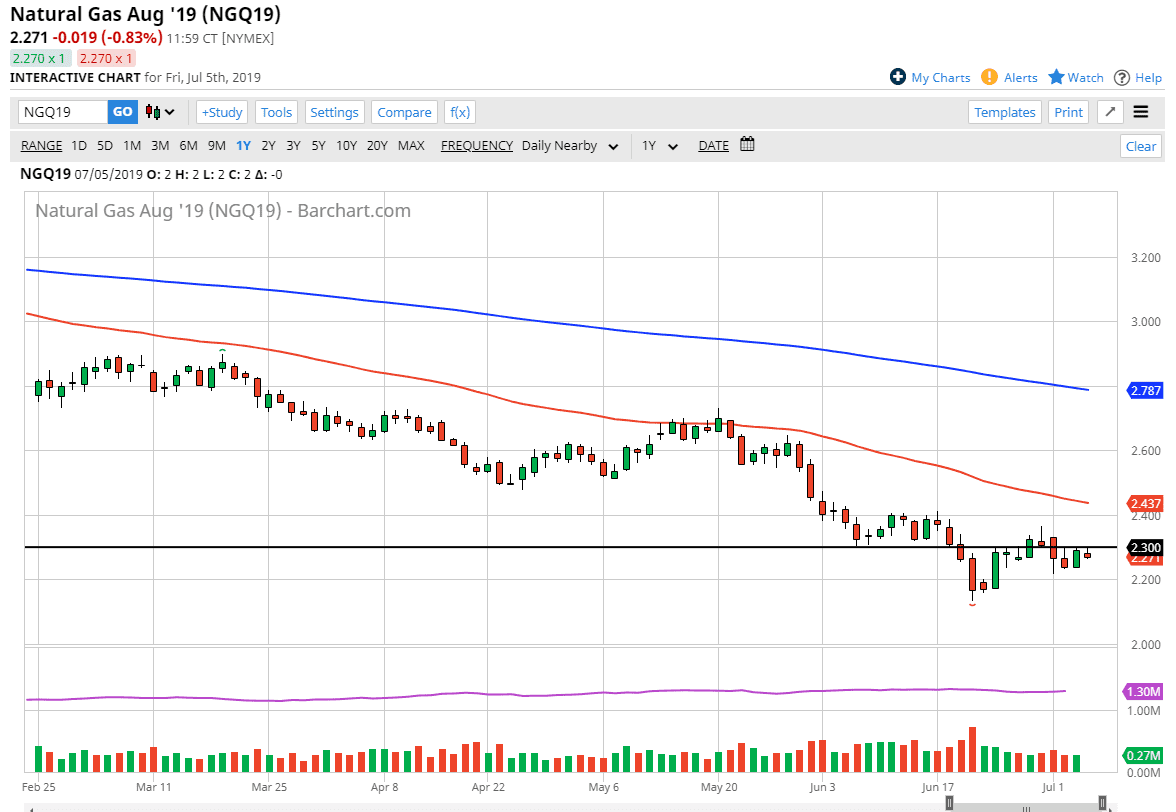

Looking at the chart, it’s easy to see that the $2.30 level has been resistance in the past, as we have rolled over from there several times. It also used to be supported which of course makes a lot of sense that it would now be resistance. Even if we were to break above there though, I think that the market has plenty of resistance not only the $2.30 level that also the $2.40 level. Some type of exhaustive short-term candle in that area makes a lot of sense to be a signal to sell as this has been a longer-term bear market for quite some time. Ultimately, there is a huge amount of supply out there that continues to keep prices lower. I don’t think that changes anytime soon, and this time of year is very difficult to think about going long in this market because demand will be slow as temperatures are warm.

That being said, it’s very likely that the marketplace will continue to be one that you can fade on rallies, as we are light years away from the fundamental situation changing. I believe that eventually we go down to the $2.15 level, and then the $2.00 level after that. I don’t know that we necessarily go below there, so I think that we will churn in this region for some time, and continue to work against the short-term pops that will inevitably happen from time to time.