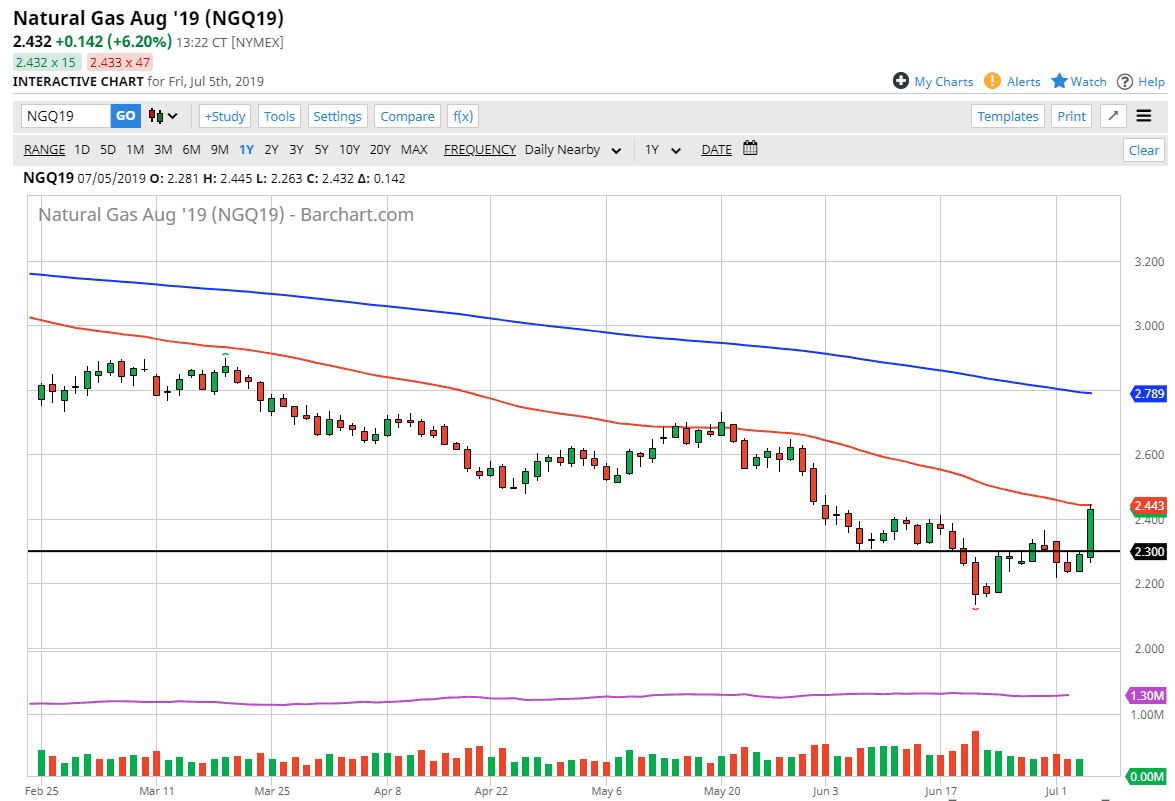

Natural gas markets pushed higher to the trading session, reaching towards the 50 day EMA. That is obviously a very bullish sign, but ultimately this is a marketplace that is an as heavily traded as some of the other futures markets or takes a lot less to push it around. Friday’s action was due to warmer than anticipated weather forecasts for the month of August, at least in the United States. That of course should drive demand higher for natural gas to cool off homes but that is a temporary thing, and at the end of the day not nearly as demand inducing at this point as the cold temperatures will drive the market in the winter place.

While we have had a nice rally during the day, gaining over 5%, the reality is that we are still very much in a bear market. I still like the idea of selling this market, because quite frankly only the gamblers are trying to buy here and swing for the fences. We are currently trading the August contract, so it makes sense that we would see a lot of bullish pressure but at the end of the day we are just now testing the first major moving average, although we did break through a slight resistance barrier in the form of the $2.40 level.

Above there, we have the $2.50 level and of course the $2.60 level. The $2.60 level should be massive resistance, and a bridge too far for the buyers. I think that it’s only a matter time before you see an exhaustive candle that you can start shorting. After all, a heatwave in August isn’t all that rare, and there is more than enough supply. Beyond that, after the heatwave will come the fall, and that will be enough to drive markets higher. It’s wintertime that we start to see a lot of demand enter the marketplace, so I think we are a few months away from seeing the futures market react to that. Short-term rallies make a lot headlines, but at the end of the day there is still plenty of resistance that we can start fading on long wicks that appear on daily candlesticks. To the downside I suspect that we could go as low as $2.15, perhaps even the $2.00 level after that. Although impressive, I don’t think the Friday rally changes much.