Natural gas markets broke down during the trading session on Tuesday as we continue to see a lot of noise in this market. Ultimately, this is a market that is struggling due to the fact that the oversupply of natural gas will continue to be a long-term problem. Quite frankly, even with the massive amounts of natural gas out there, the Americans continue to pump the market full of it, as fracking has become so efficient.

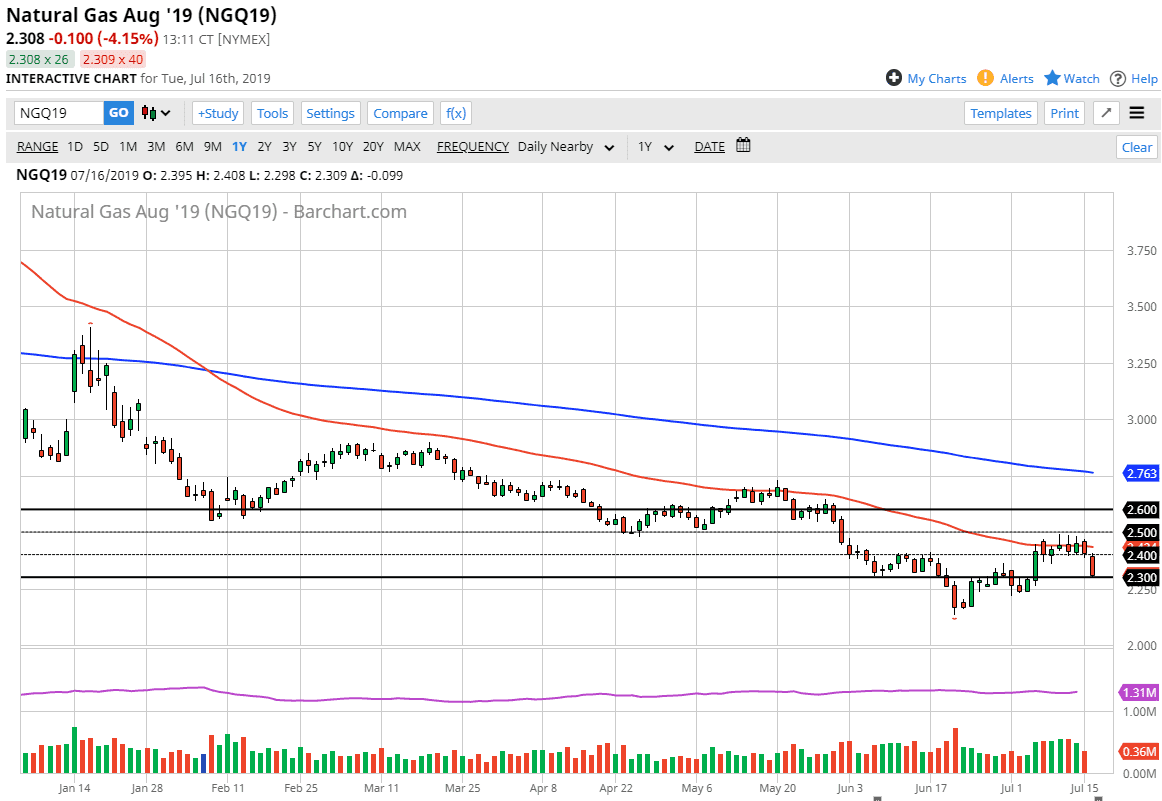

The 50 day EMA has acted as a significant resistance barrier, for the second time again. Overall, we have seen a lot of selling pressure as we broke down below the $2.40 level, which of course is a large, round, psychologically significant figure. This is an area that had previously been resistive, but now it should be supportive. However, we have been below here previously, so I think that the market will probably be able to get below there. If it does, the $2.25 level will be targeted, followed by the $2.20 level. I think that a lot of what we are seeing is a realization that the oversupply is a long-term problem.

Looking at this chart, we did get a bit of a bounce, probably due to the fact that we were oversold and there were a few other possible factors as well. For example, the heatwave in the United States of course will drive up the demand for natural gas, but that’s going to be temporary as the market will enjoy higher demand for just a couple of weeks. Beyond that, we also have concerns of the tropical storm disrupting supply from the Gulf of Mexico but we have gotten past that and it has been very minor to say the least.

The daily candle stick of course is very negative, and the fact that the market is closing towards the bottom of it suggests that we are going to continue to go much lower. With that in mind I continue to fade short-term rallies, and I do think that we could find ourselves going as low as $2.00 sometime during the summer. Once we start trading fall contracts, there is the possibility of a huge surge higher which is a cyclical issue every year as we have much higher demand in the United States at the colder temperatures that will certainly be coming. With that, I am bearish until then.