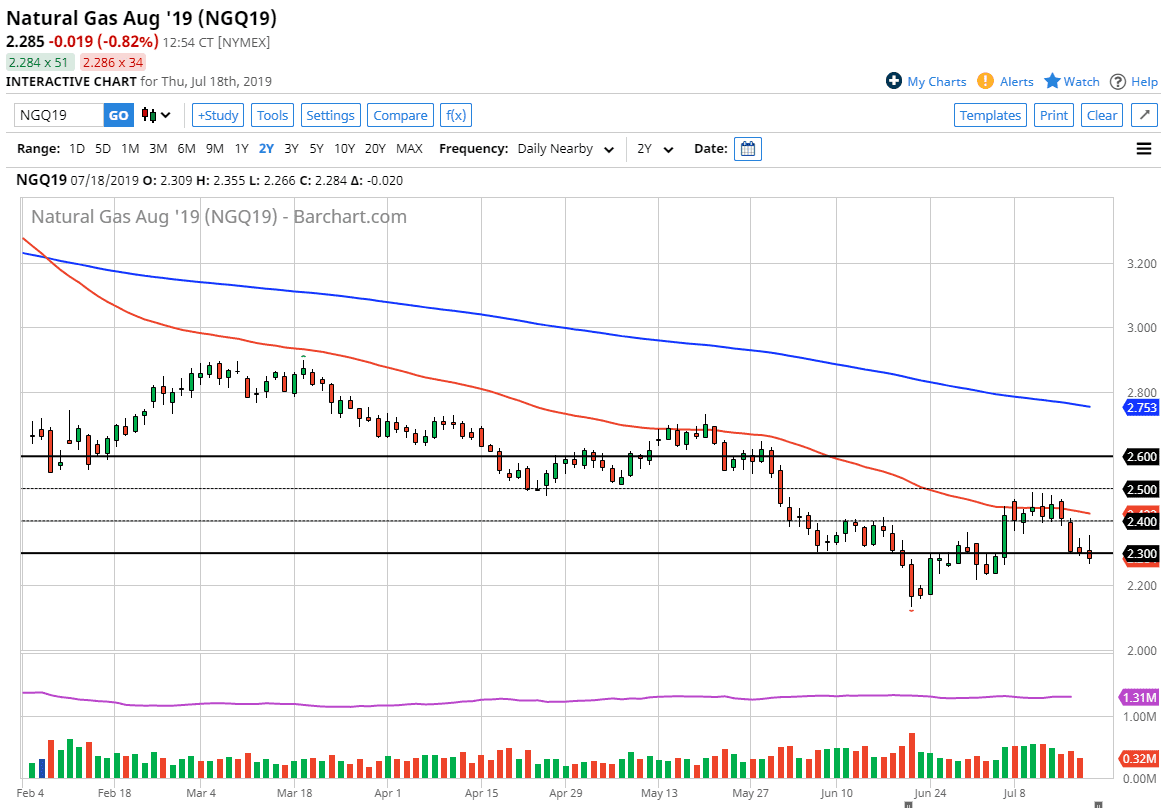

Natural gas markets tried to rally initially during the trading session on Thursday, reaching towards the $2.35 before rolling over after the inventory numbers came out. While the inventory numbers were a little bit more bullish than anticipated, they were quite as bullish as people wanted. At this point, we continue to see the negative attitude coming back into play, as the longer-term trend continues to be very negative.

As we initially rallied during the day, a lot of value hunters came in to start shorting as the trend is most decidedly negative. By breaking below the $2.30 level, this is a market that looks bound to reach towards the $2.25 level, perhaps even the $2.26 level after that. While there were hopes of a market rebound due to the tropical storm slamming into the Gulf of Mexico, the reality is that the damage done was minor to say the least, and as a result it’s very likely that traders will be disappointed as the disruption of supply didn’t come to fruition. Beyond that, there was concern about heat picking up in the United States. That of course would drive up demand for natural gas to cool off homes. However, both of these situations would have been short-term to say the least, and therefore it’s likely that the longer-term outlook continues to come into play.

This being the case, the market is one that you should be fading every time we rally and show signs of exhaustion. Short-term trades continue to be the best way to go forward, and therefore I think it’s very likely that we will continue to have short-term opportunities. This is a market that continues to pay close attention to the 50 day EMA which is pictured in red on the chart, as it has offered dynamic resistance a couple of different times.

If you want to play the cyclical trade, then it’s obvious that the market is one that you can be a buyer of once we start talking about colder temperatures in North America, because it drives up the massive amount of demand. At this point, the market very likely will spike very high once we get towards the fall in more importantly the winter contracts. We are not at that point yet, so there’s no interest on my part in trying to buy natural gas markets.