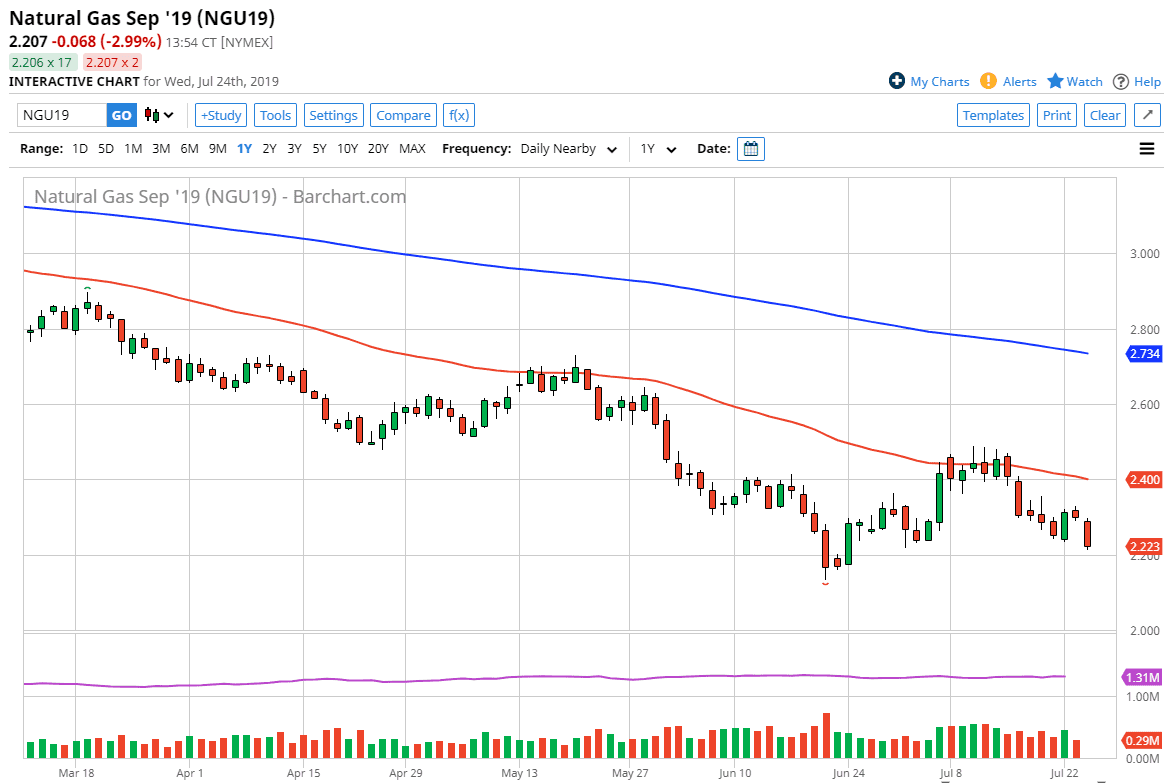

Natural gas markets have broken down significantly during the trading session on Wednesday, reaching towards the $2.20 level and closing towards the bottom of the overall range. That is a very negative sign, and therefore it should indicate that we are going to have follow-through to the downside. This isn’t a huge surprise, because natural gas is so oversupplied there’s no reason to think that buyers are going to come in and pick this market up anytime soon. In fact, the negativity should hold until we get cold months.

As far as futures are concerned, we are currently trading the September contract. While that is the end of warmer temperatures, it’s not the beginning of cold temperatures. We are probably a couple of months away from getting the pop that we get every year, so in the short term it makes quite a bit of sense to sell rallies. Ultimately, if we break down below the $2.15 level then it is a fresh, new low, and has the market looking for the next psychologically important level. That of course would be the $2.00 level, which is a large, round, psychologically significant figure.

At the $2.00 level I anticipate that there will probably be buyers willing to jump in and try to pick this thing up. I would fade rallies that show signs of weakness going forward recognizing that the $2.40 level above is massive resistance, that happens to coincide with the previous support level as well as resistance, and the 50 day EMA as well. I have no interest in buying this market anytime soon and think that people will continue to look at rallies as opportunities to take advantage of what has been such an obvious range and trend.

If we were to break down below the $2.00 level, it’s very likely that the market will flush much lower, as it would be such a major and monumental break down of this market. Ultimately, I do think that it’s going to be very difficult to break down below the $2.00 level and I would be surprised if it happened. However, this is a market that is extraordinarily negative so I think at this point it’s likely that the overall trend continues, so you simply don’t fight this type of move. However, there is going to come a day in a couple of months where we get an impulsive candle stick to the upside. If that happens, then it could kick off the winter trade.