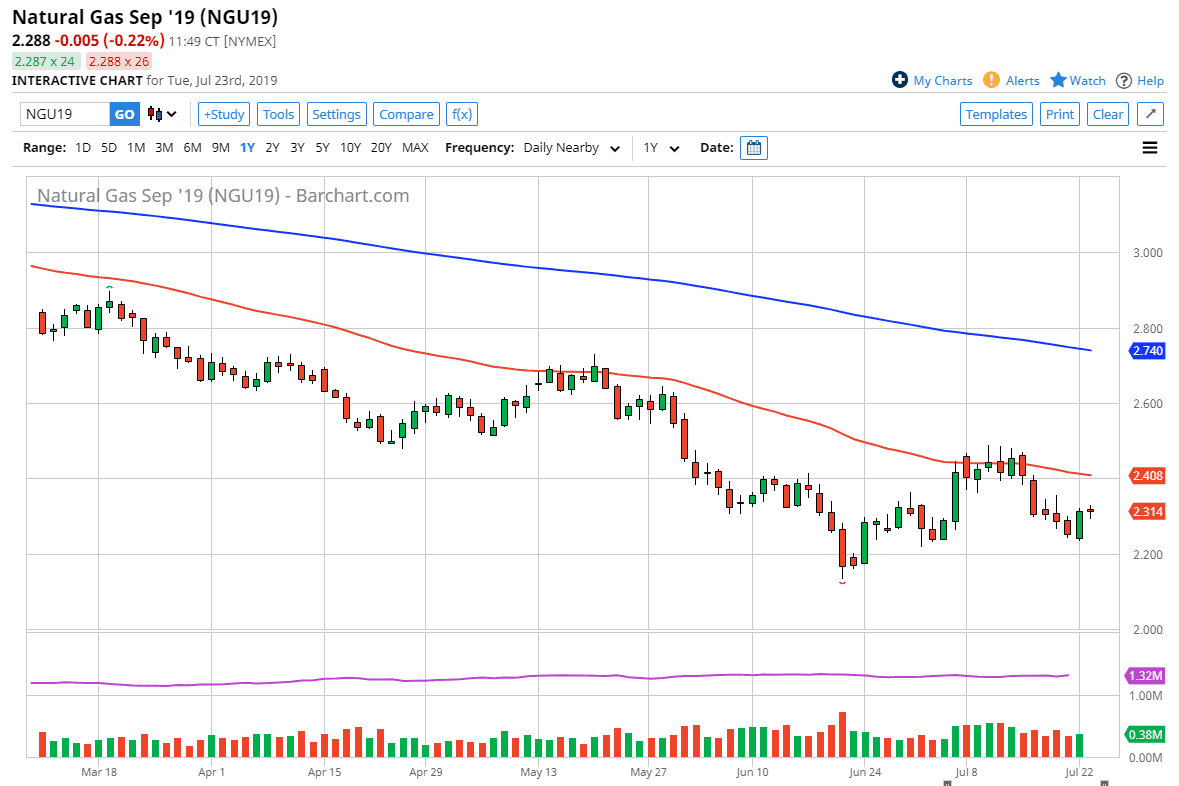

Natural gas markets rallied initially during the trading session on Tuesday but sold off almost immediately. While we did rally initially, it was very short lived and we turned around to break towards the $2.28 level. Ultimately, the market looks as if we are going to go down to the $2.25 level in the next 24 hours or so, and then perhaps down towards the $2.20 level underneath.

Short-term rallies should continue to offer selling opportunities based upon exhaustion, but you need a short-term chart to enter the marketplace. The markets continue to show a lot of choppiness at this point but it’s likely that we continue to see sellers run the show. After all, the natural gas markets are oversupplied to say the least. The natural gas markets of course are very cyclical and it should be noted that we rolled over to the September contract. We are getting closer to the cold temperatures though, and that should offer a bit of support. There is a cyclical trade to the upside when that happens but we obviously aren’t quite ready to do so yet.

The $2.20 level underneath should be a target, as it was previous support. If we can break down below there, it’s very likely that the $2.00 level underneath will be the juicy target that everybody is aiming for, with or not we can get there might be a different scenario. I suspect that’s what sellers are trying to do, so it would not surprise me at all to see that level hit.

To the upside, the 50 day EMA should offer a bit of resistance, especially considering that it is near the $2.40 level, an area that has offered resistance in the past, not to mention the fact that this market does tend to move and $0.10 increments. Ultimately, this is simply a matter of waiting for short-term charts to form something to the effect of a shooting star or bearish and golfing candlestick that take advantage of. This is a market that has been an extraordinarily bearish, as the Americans and the Canadians both have more natural gas than they would know what to do with. It’s almost impossible to imagine a scenario where supply becomes an issue for more than a short amount of time as we have recently seen due to the tropical storm and heatwave.