Natural gas markets initially broke down during the trading session on Tuesday as per usual, as this market has been very bearish for the longest time. However, we are trading the August contract and there is recent news driving prices higher due to the fact that August should be hotter than anticipated in North America. If that’s going to be the case, then it should drive up the demand for natural gas in the short term. However, I would leave you with this piece of wisdom: heat waves in the United States last for days or weeks under most circumstances. In other words, this is probably a short-term phenomenon and the longer-term downtrend certainly does favor that concept as well.

As opposed to November, when I become wildly bullish in natural gas, this is a short-term burst just waiting to happen. In the winter months, there is high demand for natural gas for months on end that of course does help influence on where the market goes. All that being said, it doesn’t mean we can’t take advantage of this set up just waiting to happen.

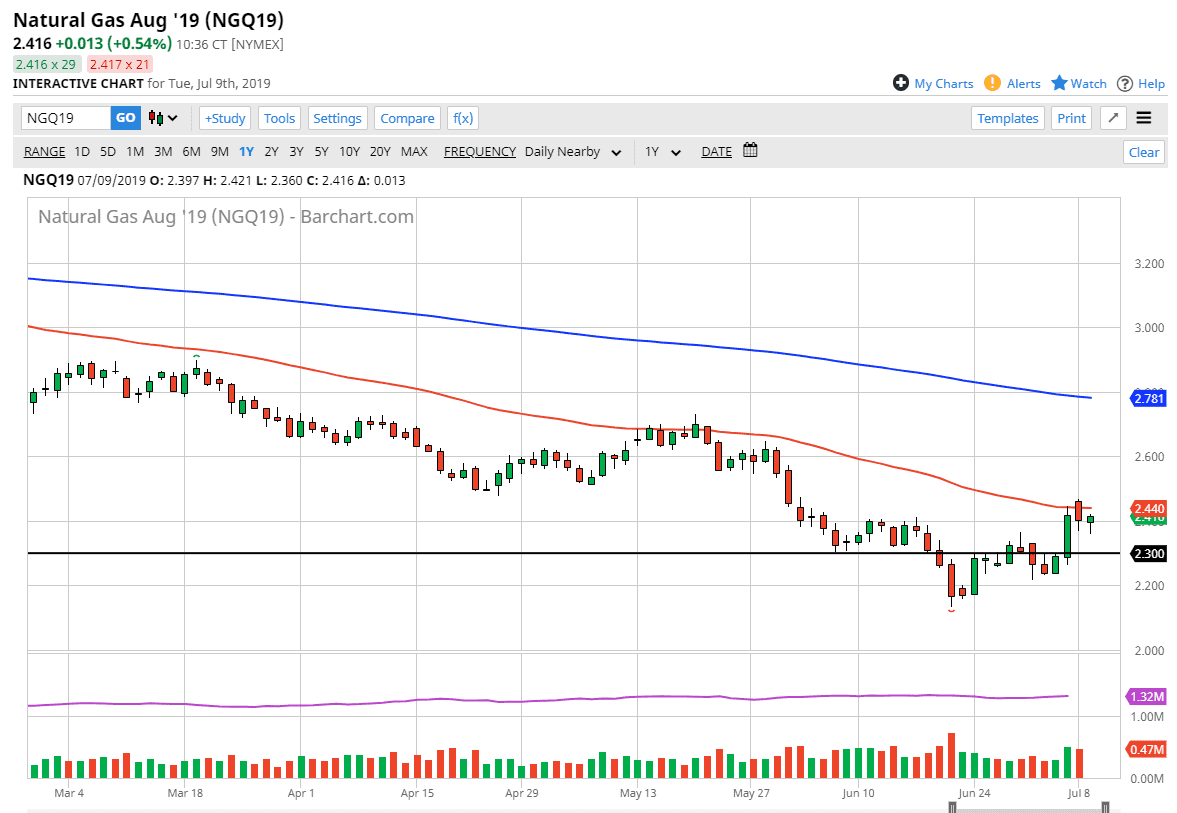

We are currently dancing around the red 50 day EMA. Although we are trying to form a hammer for the trading session on Tuesday, I don’t necessarily look at it as a bullish sign. I will use his hammer to the step away for the market and look for higher levels to start selling from, most notably the $2.60 level, if not the $2.50 level. It will just depend on whether or not I get some type of negative candle at the bounce a trade off of. The alternate use for the hammer is that if we break down below it, it shows that support has failed and then we should go to the $2.30 level, possibly the $2.20 level.

If you are patient enough you should get plenty of selling opportunities in a market that is so oversupplied it’s not even funny. The demand will never take out the supply, at least not in the foreseeable future. There are 14,000,000,000,000 ft.³ of proven reserves in the ground in the United States alone. There’s even more in Canada. In other words, we are light years away from worrying about supply. In fact, if you’ve ever wondered what the flame is on top of an oil rig? Most the time it’s the drillers burning off natural gas because it’s not worth capturing.