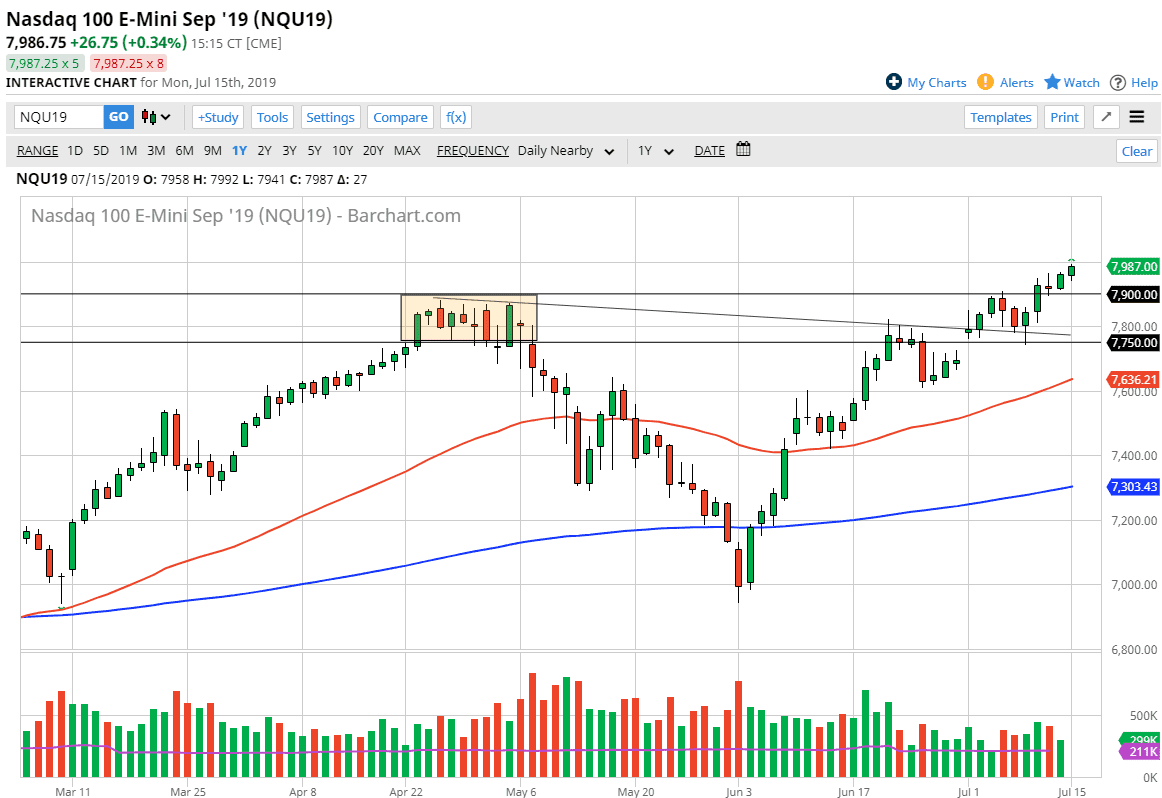

The NASDAQ 100 initially pulled back a bit during the trading session on Monday, but then turned around to shoot towards the 8000 handle. This will obviously attracted a lot of attention as we have not only broken out to an all-time high, but we are also pressing a large round number. At this point, the market looks like it is trying to break out to the upside but at this point I think short-term pullbacks continue to be what we are looking for, with the 7900 level underneath being massive support. Even if we break down below there we will probably go looking towards the 7800 level which is where the downtrend line coincides with.

Keep in mind that the NASDAQ 100 is highly sensitive to the US/China trade situation, and as a result if we remain relatively quiet in that scenario, that should help the NASDAQ 100. I also recognize that the liquidity coming out of the Federal Reserve should continue to boost the NASDAQ 100 so at this point it’s only a matter time before we should see short-term charts that show signs of buying opportunities.

Looking at this chart, if we were to break down below the gap underneath at the 7750 level, then you could start to think about a potential trend change. The 50 day EMA which is pictured on the chart in red could send this market higher as well, as we should see dynamic support based upon longer-term analysis. A breakdown below that 50 day EMA should have the market looking towards the 200 day EMA. Obviously, if we get below there it would be extraordinarily bearish.

I have no interest in shorting this market until we break down through some of those levels though, and I look at pullbacks through the prism of short-term chart and try to find some type of hammer at one of those levels mentioned previously to start going long. If we can break above the 8000 level, then the market is free to go much higher, as breaking every thousand points does make quite a bit of attraction and headline interest. Looking at this uptrend, there’s absolutely no reason to think that it will continue, but obviously we can’t go up in a straight line overall. 8000 will cause issues, but it will be nothing but a memory over the longer-term.