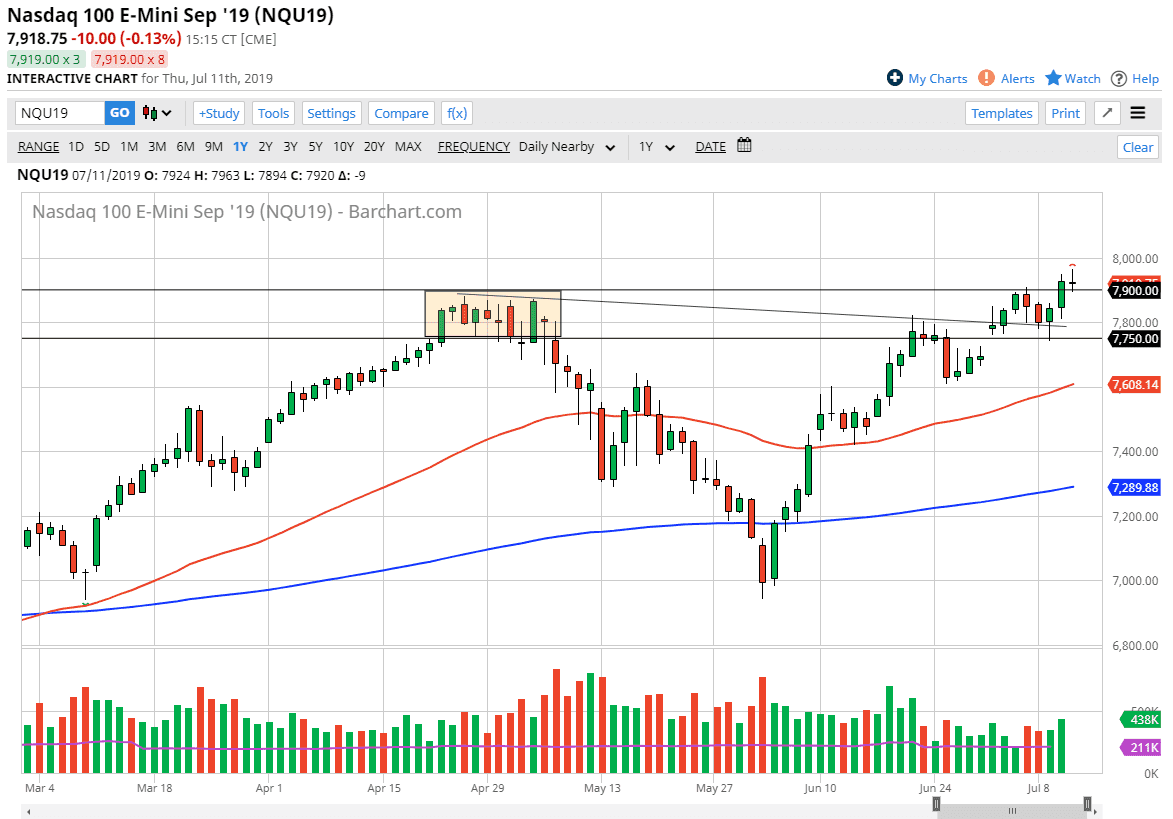

The NASDAQ 100 rallied significantly during the trading session on Friday, testing the top of the shooting star from Thursday. This is a market that continues to show resiliency, but at this point I think it’s very likely that we will continue to be very noisy. Short-term pullbacks should be buying opportunities, especially near the 7900 level. Ultimately, this market should continue to go higher given enough time, reaching towards the 8000 level. A break above that level opens the door to much higher levels but keep in mind that there are a lot of different things that we need to pay attention to.

The US/China trade tensions continue to be a major factor in the NASDAQ 100 as so many of the technology companies will be affected by that situation. Ultimately, it looks as if it is trying to sort itself out but it’s going to take a long time. More importantly than the US/China situation is the Federal Reserve. The Federal Reserve looking to cut interest rates of course will continue to propel this market higher as money needs to go looking towards higher returns as bond markets simply will not offer them.

Ultimately, the 7750 level underneath is massive support as it not only features the gap, but it also features a downtrend line that is slicing through it. That resistance barrier should then offer support. Ultimately, this is a market that is trying to find its footing, but at this point it’s difficult to imagine a scenario that makes it easy going forward. There will continue to be significant amounts of headline risk out there, and of course we are about to get earnings season but the market only seems to care about the Federal Reserve and its monetary policy in general. This will of course has the added US/China situation but at this point I would suggest that perhaps it’s only about 30% of what’s driving us higher.

There is the old expression “don’t fight the Fed”, and that certainly applies here. I have no interest in shorting, and simply look for buying opportunities as long as we can stay above the red 50 day EMA on the chart. If we can, then the market is very likely to continue going higher as there are multiple areas where the buyers could be involved. We are getting a bit stretched, so the easy money has already been made but once we clear the 8000 handle I suspect that a huge thrust of more buying will enter the fray.