The NASDAQ 100 is going to be like any other stock index in the United States, simply waiting around for the Federal Reserve interest rate cut and of course the accompanying statement. It will be the statement that drives the market going forward, as we will be looking to see whether or not the Federal Reserve is looking to stay extraordinarily easy going into the future. My bet is they are so therefore I believe that we are about to see a move to the upside. By breaking above the top of the hammer like candle that is starting to form for the session, we will leave the 8000 handle behind, and go much higher.

Remember, stocks have absolutely nothing to do with the underlying economy, and everything to do with whether or not you can get a real return for something along the lines of a bond. Ultimately, quantitative easing forces money back into the markets, which we have seen for over a decade now. If central banks around the world are all coordinated to do so, then we will see more interest in stocks in the United States, not only from domestic traders but also from international traders as well.

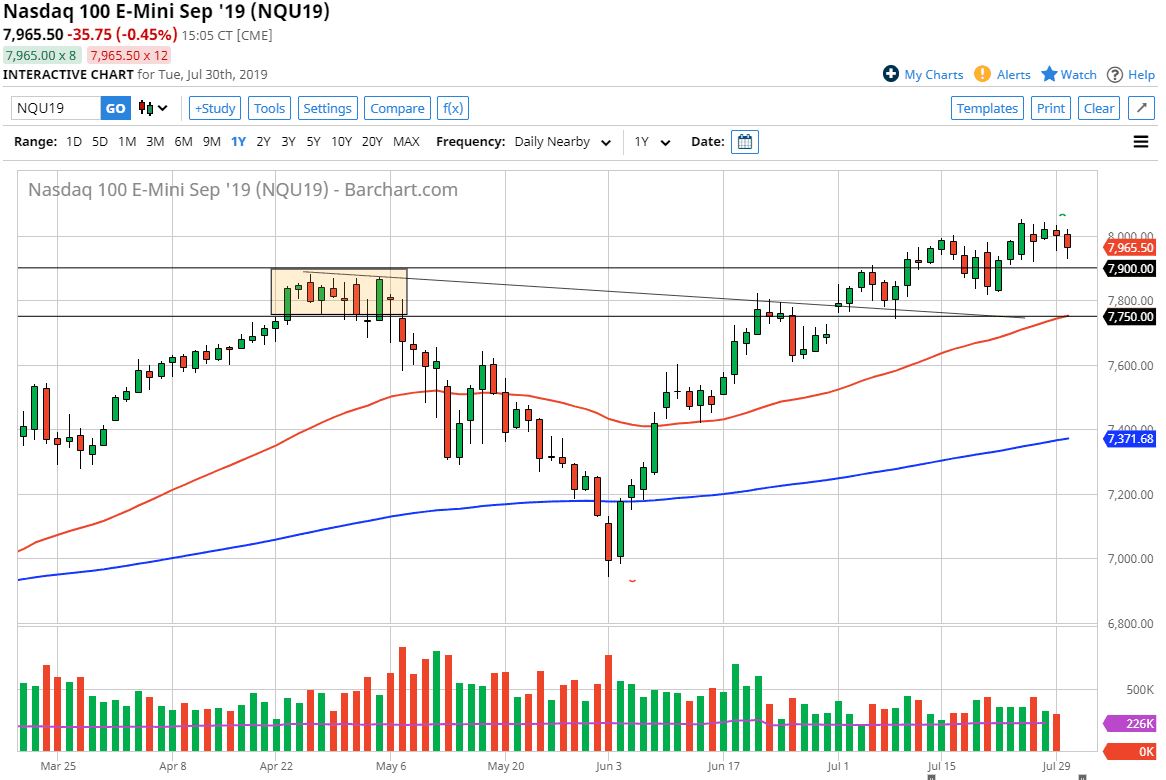

Ultimately, this is a market that has a ton of support underneath, and I believe that the “floor” in the market is closer to the 7750 handle. We not only have a trend line and a gap forming in that area, but we also have the 50 day EMA now testing it. This market has been extraordinarily bullish for some time, heading into the last couple of weeks. The last couple of weeks of course have been a little less explosive to the upside, but I do believe that we are simply waiting to make sure that the Federal Reserve is going to cover traders in Wall Street, and therefore start moving higher later in the year.

Yes, I understand that the markets are heavily inflated at this point, but the reality is that we are not only inflated now, we’ve been inflated for over a decade. Anybody who’s tried to short stocks for a significant amount of time has been slaughtered over the last 12 years or so and I think that’s going to continue to be the case. That being said, if we get a daily or even a weekly close below the 7750 level, that could be the beginning of something rather substantial.