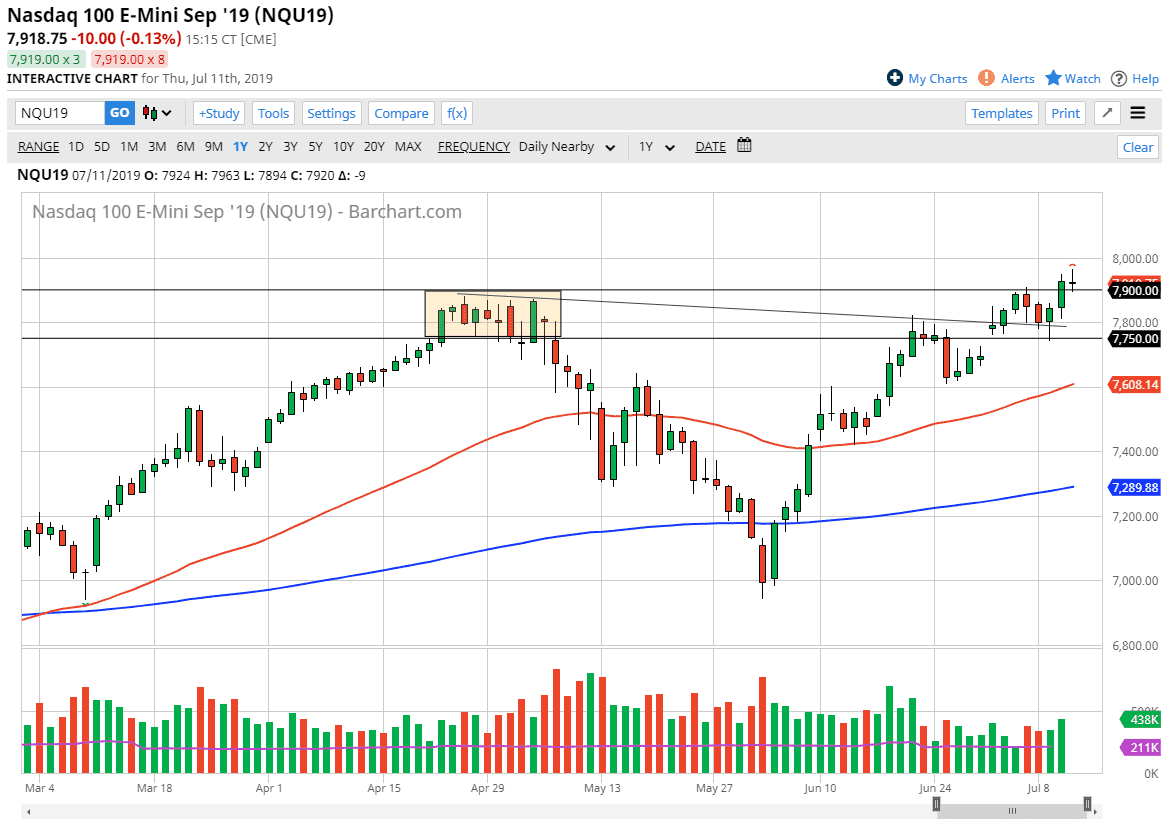

The NASDAQ 100 went back and forth during the trading session on Thursday, initially reaching to a fresh, new high again, but failed to break above the 8000 handle. By doing so, it looks as if the market is going to continue to look at the 8000 level as a major barrier. The fact that we pulled back isn’t exactly a good look, so it’s possible that we get a short-term pullback. That being said, there is a lot to digest in this area now that we have had two days of testimony from Jerome Powell in front of Congress.

The 7900 level underneath is major support due to the fact that it was previous resistance. By pulling back from here, it’s likely that we will eventually find support underneath. There is a previous downtrend line that reaches to the 7800 level. At this point, the market looks very likely to find plenty of support in that area as well, so I think that a little bit of a pullback might be good for the overall bullish attitude. Otherwise, if we were to break above the top of the candle stick for the trading session on Thursday, then we could go much higher. A break above the 8000 level would allow the market to go much higher, perhaps the 8200 level based upon the measured move.

Looking at this candlestick, it does suggest that perhaps a little bit of exhaustion has come back into play, and therefore the exhaustion could be taken advantage of at a lower level. I suspect that market participants are now trying to figure out where to go next, mainly because the markets are completely confused as to global growth, the direction of the US/China trade talks, and of course whether or not the Federal Reserve cutting interest rates will be enough to boost the market.

Ultimately, this is a market that is bullish and you can’t fight the overall trend. You can’t fight the Fed either, but that doesn’t mean that this is going to be the easiest trade. Ultimately, market participants are looking for value, so a pullback of a couple dozen points or so could be the exact remedy for that. Keep in mind that this pair is highly sensitive to the US/China trade situation which Trump was chirping about during the Thursday session yet again.