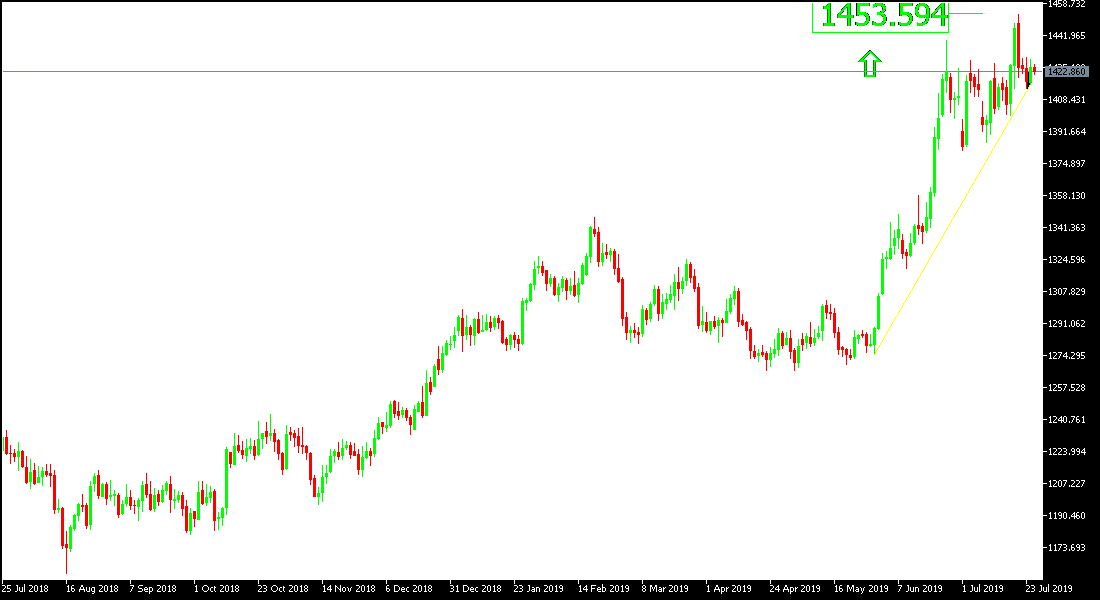

For four consecutive trading sessions, the price of gold is settled in the range between the $1414 support and the $1430 resistance, the price settled around $1424 at the time of writing. This performance confirms that the gold is determined to continue the bullish pace again but in need of stronger incentives, and as long as it is stable above $1400 psychological resistance, it will remain in a general uptrend.

The US dollar gained stronger support after US President Donald Trump and congressional leaders agreed on a debt and budget deal to avoid government closures or defaults on federal debt, as well as the IMF's recent forecast of US economic growth. Next week, Fed monetary policy officials will meet, with strong expectations that the US central bank will cut interest rates at the meeting to face fears that the US economy is slowing down after the longest period of strong economic growth in US history. On Friday, the GDP will be announced, and if the slowdown in economic growth is announced, the gains of the US dollar may be adversely affected.

Gold will remain a safe haven for investors until the US central bank announces its monetary policy and we will continue to recommend buying gold until the actual announcement of this important decision.

US interest rate cuts will continue to support the decline of the US dollar, which is an opportunity for further gains for gold.

Technically: Gold prices today are trying to resume the uptrend but the strength of the US Dollar is affecting this endeavor. Stronger buying may push gold to resistance levels at 1432, 1445 and 1460 respectively. On the bearish side, bears may target support levels of 1410, 1400 and 1385 respectively if gold does not find a catalyst to complete the bullish correction. We recommend buying gold from every low level.

On the Economic Data front: The economic calendar today will focus on the IFO announcement of the German business climate, the monetary policy decisions of the ECB and the statements of Governor Draghi. From the U.S, the market will focus on durable goods orders, unemployed claims and commodities trade balance announcement.