For four consecutive trading sessions, gold prices are moving in a bullish correction from the support level of $1413/ounce, gaining to resistance of $1433/ounce, and is stable around there at the time of writing. This is ahead of the announcement by the US Federal Reserve about its monetary policy decisions amid expectations that the bank will cut US interest rates by a quarter of a point to support the US economy, which has been negatively affected by the continuation of trade wars led by Trump in the face of other global economies. Investors will carefully watch the monetary policy statement to be issued with the decision, and then Jerome Powell's comments at his press conference afterwards, to learn about the future of the bank's policy after cutting rates today. Economists are different about the future of the policies, between who believes of continuing policy easing and expecting further reductions throughout the remainder of 2019, and those who believe the cut will be temporary and the bank will then monitor economic performance to determine the appropriate action. In all cases, the dollar will be adversely affected and gold will have a better chance of making stronger gains.

Factors of stronger gold price is on the rise, most notably the current speculation that Britain is on its way out of the EU without an agreement. On the level of global trade tensions, there has been no strong sign from both sides of the US or Chinese negotiations on the proximity of an agreement. This may irritate Trump and thus pushes him to implement his threat to impose Customs tariffs on the entire country imports from China. Tensions in the Middle East have not calmed down so far. With these factors, investors prefer to escape to gold for hedging, as the yellow metal is still one of the most important safe haven assets for investors in times of uncertainty.

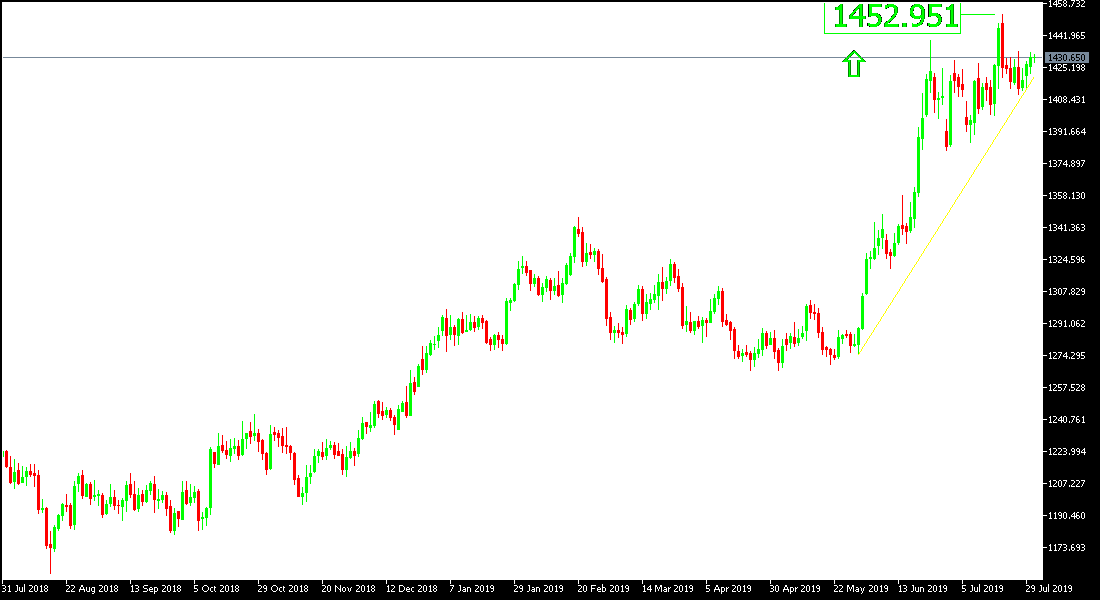

Technically: Gold prices today are in a state of vigilance and cautious anticipation of the policy decisions from the US Central Bank to complete the move within its bullish channel, which is still supported by the $ 1400 psychological summit. The nearest resistance levels are currently 1442, 1457 and 1473 respectively. To the downside, the nearest support level to buy from around 1409, 1400 and 1385 respectively. We still recommend buying gold from every bearish level.

On the economic data front: The economic calendar today contains many important and influential data on gold trends, the first of which is the Chinese manufacturing sector and the announcement of inflation and GDP figures in the Eurozone. Then to the most important items; Federal Reserve monetary policy decisions and statements by Governor Powell.