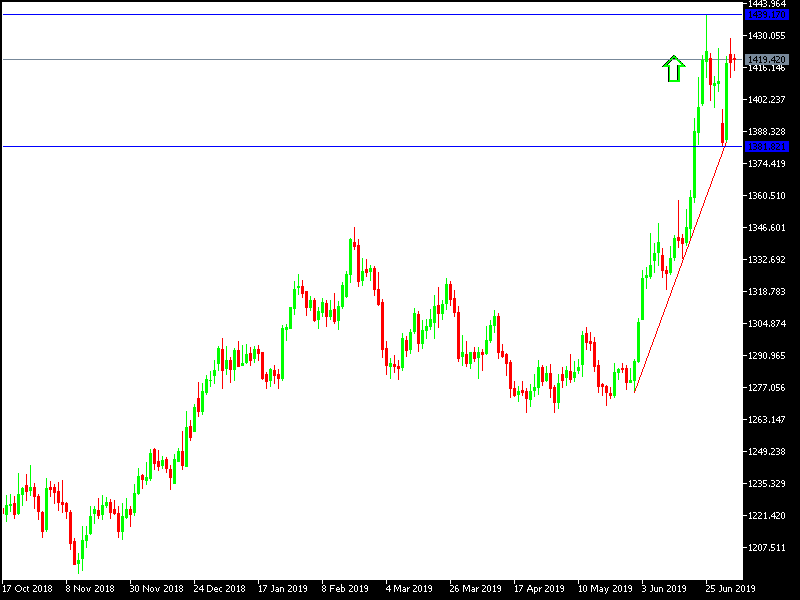

The performance of the yellow metal during the Tuesday session was a consolidation of the upward trend strength. This confirms the extent of investors buying gold in light of the increasing global geopolitical and trade tensions, and thus investors are escaping to gold to hedge against those concerns. This has pushed the price to 1428 dollars an ounce during yesterday's session, before settling around $1420 per ounce at the time of writing. The recent correction moves pushed gold to support $1383 after optimism over renewed US-China negotiations to end the biggest global trade dispute threatening global economic growth. The strong gold gains are due to the loss of trust among investors towards Trump. As he often negotiates and agrees and eventually impose more tariffs. This time the situation will be dire for the global economy and thus protect investors are hedging with safe heavens, most importantly, gold.

The last correction is very natural and we pointed out that gold has reached strong overbought areas and can be corrected at any time. At the same time, we still prefer to buy gold from a bearish level. Continuing global trade and political tensions, along with the falling US dollar means further gains for gold prices. World trade war has clearly contributed to slowing world economic growth and has helped pressure central banks to ease monetary policy. The agreement between the two parties means more risk appetite and therefore gold abandoned its recent gains

We have confirmed in recent technical analysis that US interest rate cut signals will support the decline of the US dollar and further gold gains.

Technically: Gold prices today confirm the strength of the bullish move around and above the psychological peak at $1400, and therefore the nearest levels of resistance might be 1415, 1428 and 1440 respectively, which were already reached and holding to it with the recent correction with profit taking through sales. On the downside, the nearest support levels for gold today are 1410, 1395 and 1375, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will have all its focus on the US dollar level during the U.S holiday today. Gold will also be affected by investors' risk appetite, as gold is one of the most important safe havens.