Gold markets have done very little over the last couple of days, and this makes quite a bit of sense considering that the Federal Reserve has a major meeting over the next couple of days that should continue the dovish attitude that we have seen recently. Keep in mind that on Wednesday afternoon we have an announcement, but perhaps more importantly some type of statement coming out of the Federal Reserve. It’s not necessarily that people are wondering whether or not we are going to see an interest rate cut, but more or less what we are going to see as far as future expectations.

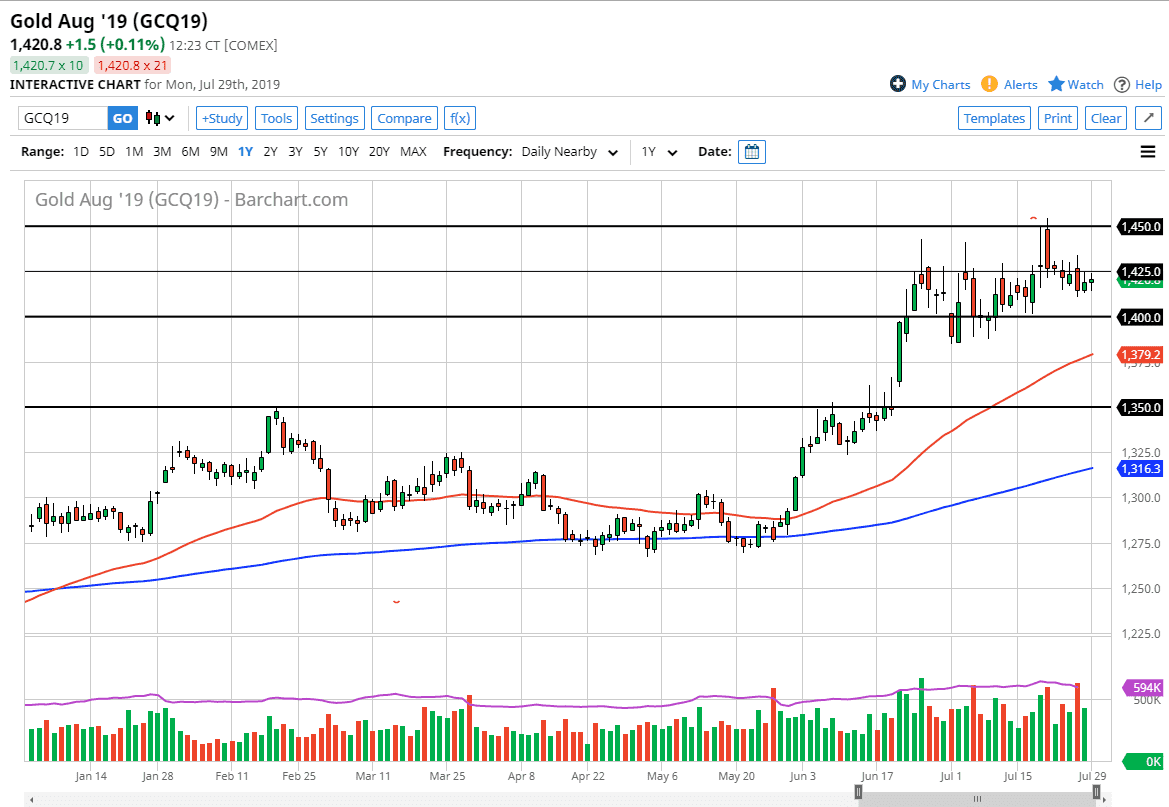

That being the case, I believe that the market might be quiet for the next couple of days with several technical levels that I am paying attention to in order to trade the gold market itself. I believe that the $1400 level underneath is massive support that extends down to the $1390 level underneath. Beyond that, the 50 day EMA is starting a race towards that level, and that of course also offer support. The market breaking above the $1425 level on a daily close would be a sign that perhaps we are going to drift higher, reaching towards the $1450 level above.

If we can break above the $1450 level, then the market could go to the $1500 level. That is an area that of course will cause a lot of trouble, at least in the short term as it is such a large, round, psychologically significant figure. Once we break above that level, the market should continue to go much higher, as it will be a major hurdle to break through. To the downside, we also have the $1400 level that I think is going to be one of the major levels to pay attention to.

At this point in time, I believe that the market is one that you can buy on dips but I would not expect much again over the next couple of days. Once the Federal Reserve comes out and gives the market everything it wants, then we should see the US dollar get hit, gold markets rise, and then we should continue to go to the upside in this market, as well as many other precious metals markets as traders start to look for “hard money” in the face of liquefying coming out of Washington DC.