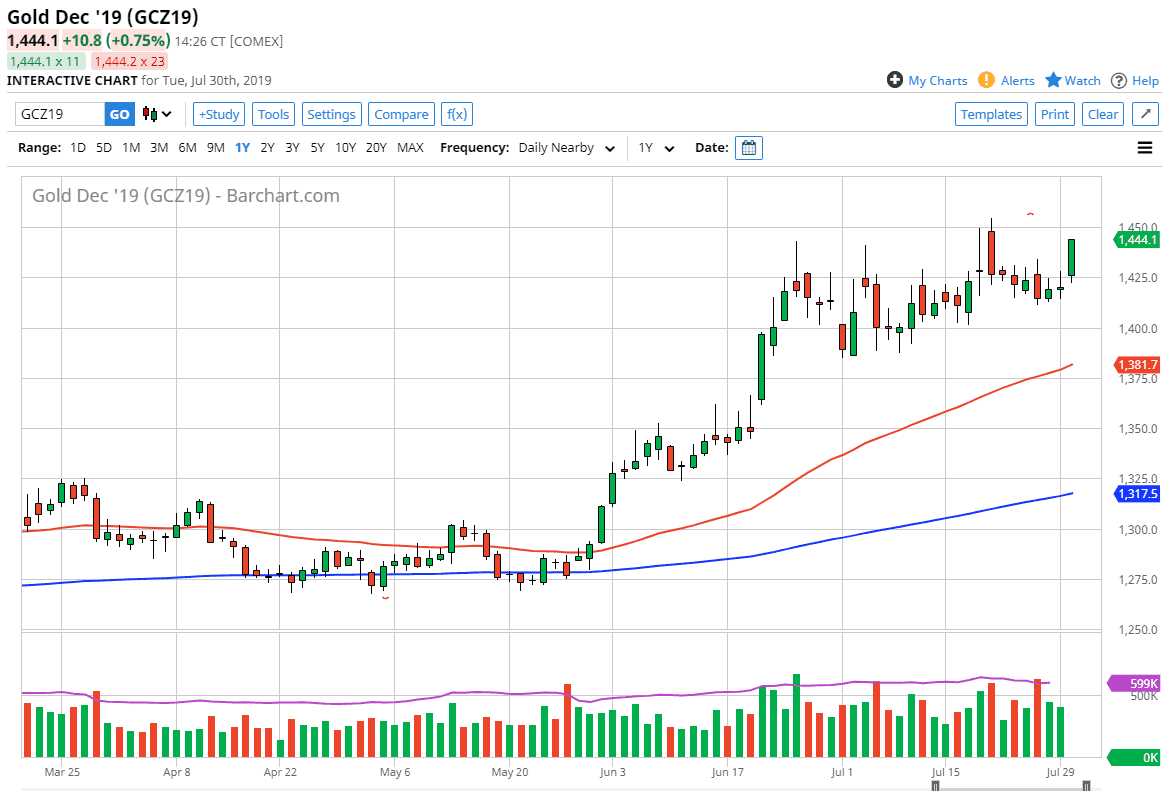

Gold markets gapped a bit higher to kick off the trading session on Tuesday, as we await the Federal Reserve interest rate decision. I do think that they cut rates, but there’s very likely going to be an accompanying statement that is parsed heavily by traders around the world. If the Federal Reserve sounds like it’s going to continue to be overly dovish, it makes sense that the Gold markets will rally because of that. Beyond that, we have been in a nice uptrend, and as a result it looks likely that buyers will continue to look at dips as an opportunity to pick up gold “on the cheap.”

All things being equal, I don’t have any interest in shorting Gold unless of course the Federal Reserve does something crazy like disappoint the market. The Federal Reserve is known to be at the behest of Wall Street traders, and they want cheap money. With that in mind, it’s very unlikely that the Federal Reserve will disappoint. I believe that they will go “all in” when it comes to the dovish notice. At that point, I think that we break above the $1450 level, and then go looking towards the $1500 level above.

Precious metals of course are favored by traders when interest rates are going to be cut, because as the Federal Reserve floods the market with cheap money, people start looking for “hard money.” All things being equal it’s likely that even if we do dip from here, there should be plenty of buyers as we have seen the lot of support and the $1400 level, extending down to the $1390 level. Beyond that, the 50 day EMA is starting to reach towards that area as well, so I think it’s only a matter of time before somebody jumps and based upon value if nothing else.

Pay attention to the US dollar, because if it starts to lose value, that should be very good for this market. We are in an uptrend anyway, so I don’t think this is going to upset too many traders and I do recognize that the $1500 level makes a lot of sense as a potential target due to the fact that it is so psychologically important. Beyond that, it’s very likely that the market would be more of a “buy-and-hold” type of situation above the $1500 level. I have no interest whatsoever in shorting this market.