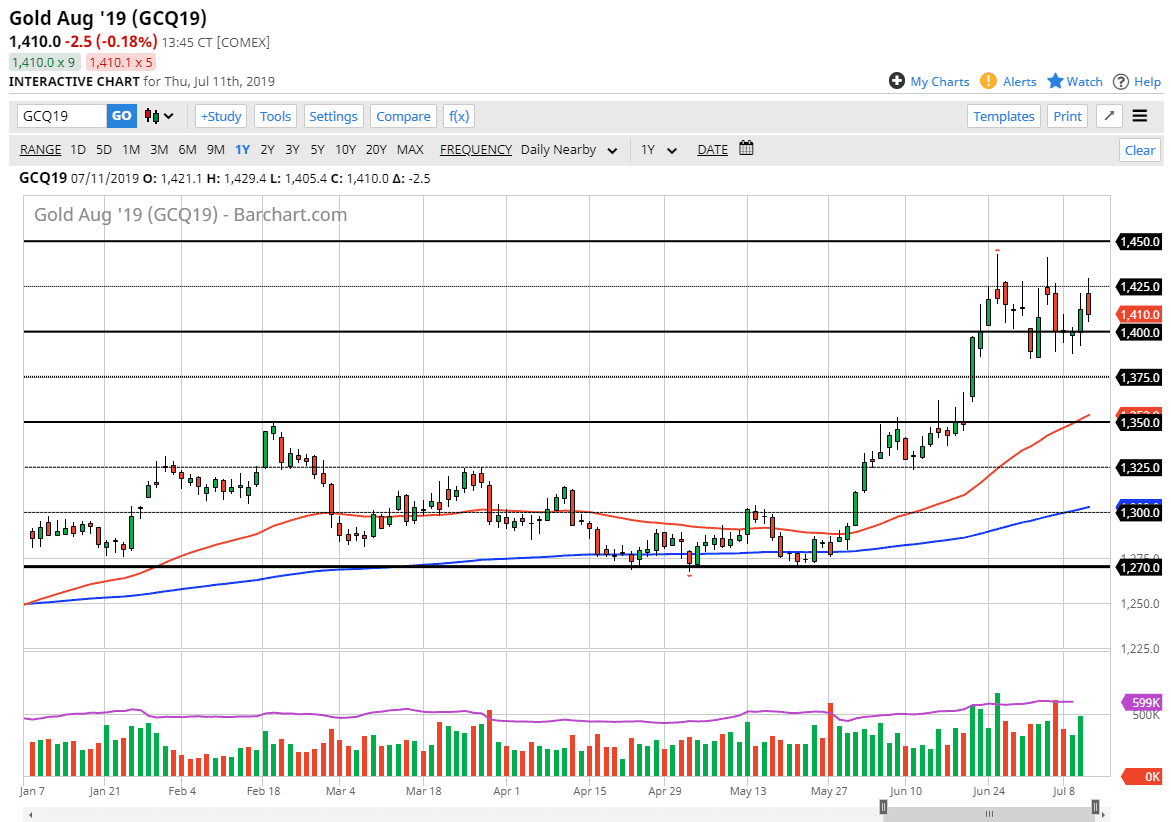

Gold markets initially tried to rally during the trading session on Thursday but then turned around to show signs of weakness. We have been consolidating in this general vicinity, as perhaps we are trying to digest the gains over the last several months.

This looks a lot like the Bitcoin market, and that tells me that the traders around the world are trying everything they can to store value outside of other markets.

Gold is getting a bit of a boost due to the fact that the Federal Reserve is going to be cutting interest rates, and it could continue to do so after the month of July. If that’s going to be the case it’s very likely that Gold will continue to finally push to the upside and break out. The $1350 level underneath is massive support, as it was a large come around, psychologically significant figure, as well as a place where we had seen a lot of sellers. Since we broke through that, it now should offer a bit of a floor going forward.

Short-term pullbacks offer plenty of buying opportunities, and I think that eventually fresh money will come in on these dips. As soon as we break out of the $1450 level, it’s very likely that the market will then go looking towards the $1500 level which is a psychologically significant figure. As far as selling is concerned, I don’t want to do that because I think there are far too many fundamental reasons to think that gold will continue to attract fresh money, not the least of which is the fact that the Federal Reserve has flip-flopped when it comes to the monetary policy situation. I cannot stress enough how important that is for this market.

Dips at this point should be thought of as value, as gold is more than likely going to go much higher, not just the $1500 level. Given enough time, this is a market that offers plenty of opportunity just below, so keep that in mind and build up a position for the longer-term move. It’s not until we break down below the $1350 level that I would start to think about the other direction, and even then I’d have to rethink the whole scenario. Gold to me looks like it’s probably going to be one of the better trades of the next several months, if not years.