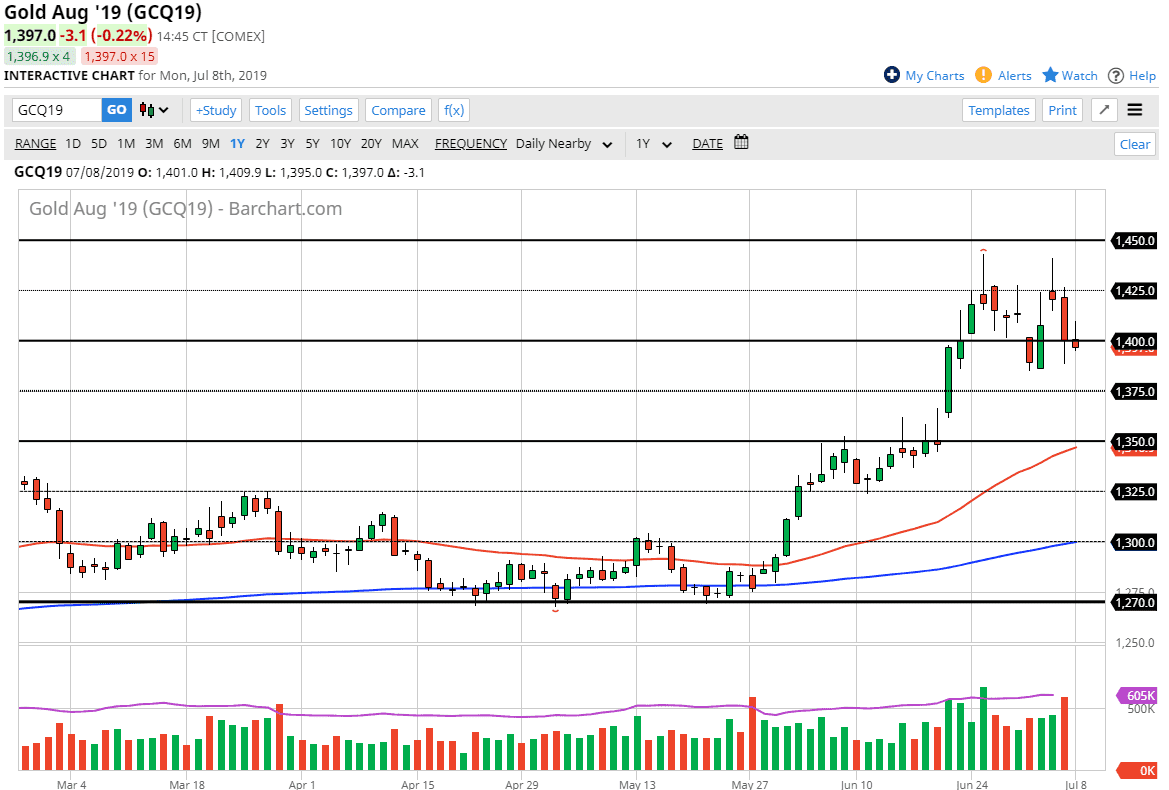

Gold markets initially tried to rally during the trading session on Monday but gave back the gains to form a less than attractive looking candle stick from the bullish sign. At this point, it’s very likely that we are going to continue to show signs of uncertainty, because on the weekly chart this doesn’t look that great. On the weekly chart, we have a couple of shooting stars which is a very negative sign, and therefore shows that we probably will roll over.

As an analyst and a trader, my email box and cell phone has been ringing off the wall when it comes to gold. Everybody wants to know whether or not they should be buying on every dip. This tells me that we are a bit overbought, and with the technical signals this tells me that buying gold at this point will be very difficult. However, this doesn’t mean that you should be selling gold. It is most certainly in a nice uptrend and I do think that there are plenty of reasons to own gold longer-term. In the short term though, it’s very likely that the market will need to cool off after shooting straight up in the air.

Beyond that, we have a nice gap below that should offer plenty of support. That support should extend all the way down to the $1350 level, which is also tidy when it comes to the idea of support as not only do we have the gap, but we also have the 50 day EMA. At this point in time it’s very unlikely that the market will settle for this overall move to the upside, but I think that you need to look at value when it comes, and I think it is coming rather soon.

What I have been telling people lately is that patience will be needed in order to benefit from this marketplace. We have seen an explosive move to the upside, so it’s difficult to imagine a scenario where you can sell the market. Yes, I’m almost positive we will eventually go lower to fill the gap, that doesn’t mean I’m willing to risk my money betting on that. Keep in mind that the area that I mentioned that should be supportive also represents the 50% Fibonacci retracement level, so although we could drop, I think it makes it much more interesting trade to be a buyer on signs of support. The alternate scenario is that we break above the $1450 level, which would decimate any resistance and send this market straight to the $1500 level above.