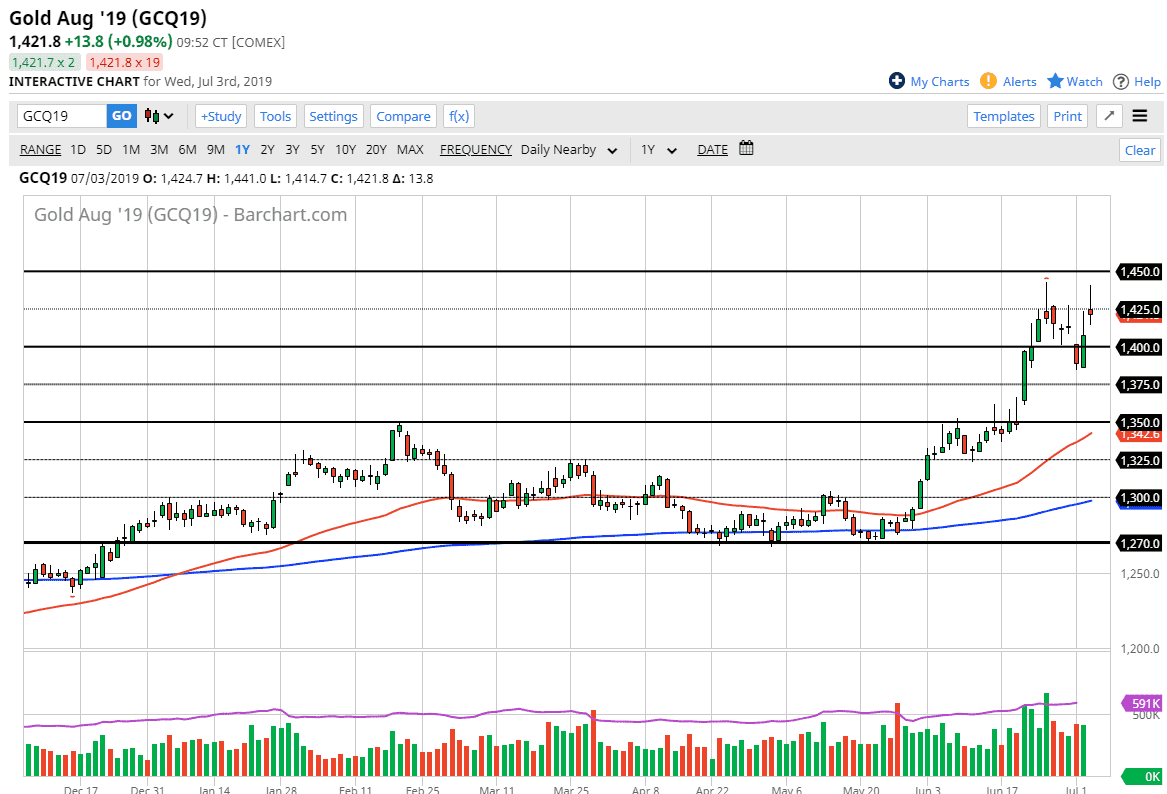

The Gold markets gapped higher to kick off the day on Wednesday, before pulling back and then shooting straight up in the air again. It by doing so, the market has formed a bit of a shooting star at highs, and therefore it suggests to me that the Gold markets are quite ready to break out above to a fresh, new highs again. That being the case, this is a market that continues to look bullish longer-term, but I think there are a lot of buyers underneath just waiting to get involved. In other words, I think a pullback is probably necessary, and therefore looking for value is probably the way to play this market.

I think the $1400 level is a significant round figure that will attract a lot of attention, just as the recent low from a couple of days ago could be. I do recognize that the Gold markets tend to move every $25, as I have marked on the charts. Furthermore, the $1350 level underneath will be the “floor” of the market, as we have seen a gap there, and of course it is the 50% Fibonacci retracement level from the entire move to the upside. Ultimately, I do believe that as long as we can stay above the $1350 level, it’s very likely that we are still in an uptrend, regardless of what happens in the short term.

Beyond that, the 50 day EMA is just below that level, and by the time we get down to that level, it’s very likely that the 50 day EMA will either be there, or above. Somewhere between here and there I think that a $25 level will offer plenty of support. I prefer the $50 level such as the $1400 level in the $1350 level, and I do think that longer-term we are going to see a lot of buying pressure due to the Federal Reserve cutting interest rates.

The alternate scenario is that we break above the $1450 level, which it opens up a move to the $1500 level if that happens. However, I actually prefer a pullback over the next couple of sessions as it would offer plenty of value. With the July forth trading session upon us, it’s very likely that the lack of liquidity could give us a sudden move in electronic trading. After the jobs number, it’s very likely that we could get a bit more liquidity that helps. Short-term pullbacks are preferred.