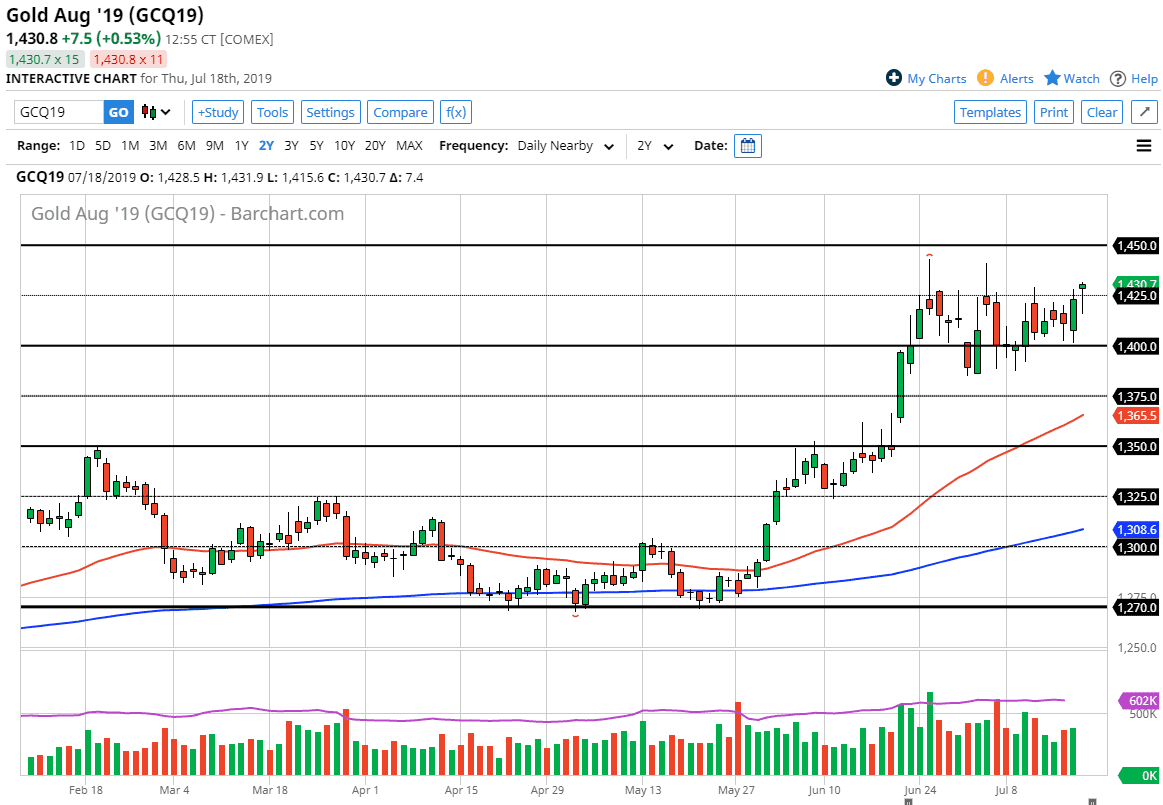

Gold markets initially gapped higher to kick off the Thursday session, but then pulled back rather significantly to find buyers underneath. By doing so, we have turned around to form a hammer which of course does suggest that perhaps the buyers are ready to come back in. At this point in time it’s obvious to me that the market continues to find buyers on dips and therefore you should continue to do the same. I have no interest in shorting Gold and the $1400 level underneath continues to be massive support that I think extends down to the $1390 level.

Looking at this chart, there is obvious resistance above at the $1450 level, an area that has been resistance in the past. If we can finally break through that it’s likely that we go to the $1500 level. This is a market that continues to show upward proclivity’s, which makes quite a bit of sense considering that central banks around the world are ready to cut interest rates. That of course gives more credence to the idea of owning “hard money”, which is what we are looking at.

Ultimately, even if we were to break down below the $1390 level, the market probably breaks down to look towards the gap underneath at the $1350 level. That’s an area that not only coincides with the large, round, psychologically significant figure, but also has the 50 day EMA hanging about. Beyond that, is the 50% Fibonacci retracement level so I see far too many reasons to think that this market is going to continue to find plenty of buyers regardless of what happens in the short term. Longer-term, I do believe that we go much, much higher as we are beginning a longer-term bull run in this market. After all, that has been something that we been waiting on, and at this point in time it’s very likely that people are simply waiting for value to present itself. Ultimately, expect reactions to every $25 on this chart, as it does tend to segment quite nicely. The shape of the candle stick of course suggests that there are plenty of buyers on short-term charts but given enough time it’s likely that we prove this to be a buying opportunity. However, if we do break down below the bottom of the candle stick that almost certainly sends this market testing that previously mentioned 1390 support barrier.