Although GBP/USD has reached oversold areas, it was staple for several sessions around its six-month low by testing the 1.2480 support level before settling around 1.2510 at the time of writing. However, the Pound remains lacking in catalysts for investors to buy. The opportunity to buy will not be stronger without identifying who will succeed Teresa Mae in leading the Brexit file, and markets becoming familiar with his policy of managing this file that determines the future of the UK. Any strong signs of an exit without an agreement means further collapse of the Pound rate against other major currencies, and vice versa, if the agreement between the two parties ensures a smooth relationship between them, it means a strong uprising for the Pound.

The strong US economy managed to add new jobs more than expected in June, and therefore, expectations for a cut in the US interest rate by the Federal Reserve during their meeting this month, were tempered, helping the US dollar gain stronger against other major currencies. The Fed board reiterated that it would act as necessary to maintain economic growth, while noting that most central bank officials have lowered their interest rate expectations. The Fed's statement came in its semi-annual report on monetary policy.

The Bank of England, confirmed what they had said earlier that there will be no change in the bank’s policy without taking into account the developments of Brexit, as leaving the EU without an agreement would be catastrophic for the British economy and the Pound, and therefore, the bank will have motivating plans at place. If an agreement is reached between them, the bank may move towards gradually raising interest rates in limited terms.

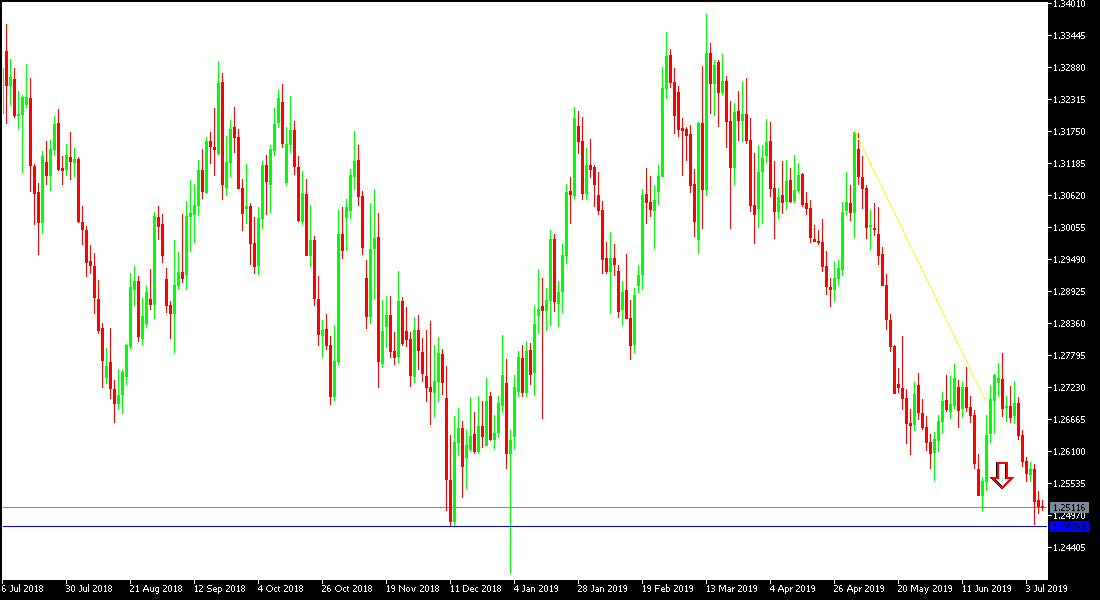

Technically: The GBP/USD is still moving within its bearish channel since it dropped of the psychological top of 1.3000, and with no signs of a near bullish correction, the support levels should be at 1.1470, 1.2400 and 1.2330, the closest to the current performance of the pair. Upward, there will be no strong bullish correction without settling on top of the 1.3000 resistance. I still prefer to sell this pair from each bullish level, as gains might be vulnerable to any negative development in Brexit future.

On the Economic Data front: The economic calendar today will focus on Powell’s comments. There are no important data expected from the U.K today.