Although the US dollar was adversely affected by the testimony of Federal Reserve Chair, Jerome Powell, before the US Congress, and what was a confirmation of the contents of the minutes of the Fed’s last meeting in June, the gains of the GBP / USD did not exceed 1.2538, bouncing from the 1.2440 support level, the lowest in six months. The uncertain future of Brexit continues to negatively affect any bullish correction chance for the pair. The Pound did not react to the announcement of Britain's GDP growth as expected, and the country's manufacturing output improved less than expected. But the US dollar evaporated its recent gains from optimism resulting from US jobs figures for June, with expectation that the US Federal Reserve will cut interest rates this month raised to 100% after Powell’s Friday's testimony before the US Congress. It is expected the he will confirm today what he said yesterday. The minutes of the bank's recent meeting were not far from Powell's testimony, and the bank's monetary policymakers' concerns about the continuing impact of global developments on the performance of the US economy continued.

When can we buy this pair? The opportunity to buy will not be stronger without identifying who will succeed Teresa May in the Brexit leadership, and knowing his policy plans to manage this file that determines the future of the country. If Britain leaves the EU without an agreement, this could lead to a further collapse of the Pound exchange rate. And vice versa, in the event of an agreement between the two parties, that will ensure a smooth relationship between them, it would mean a strong uprising of the Pound.

The Bank of England continues to stress that any shift in the policy of the Bank of England depends on the future of Brexit.

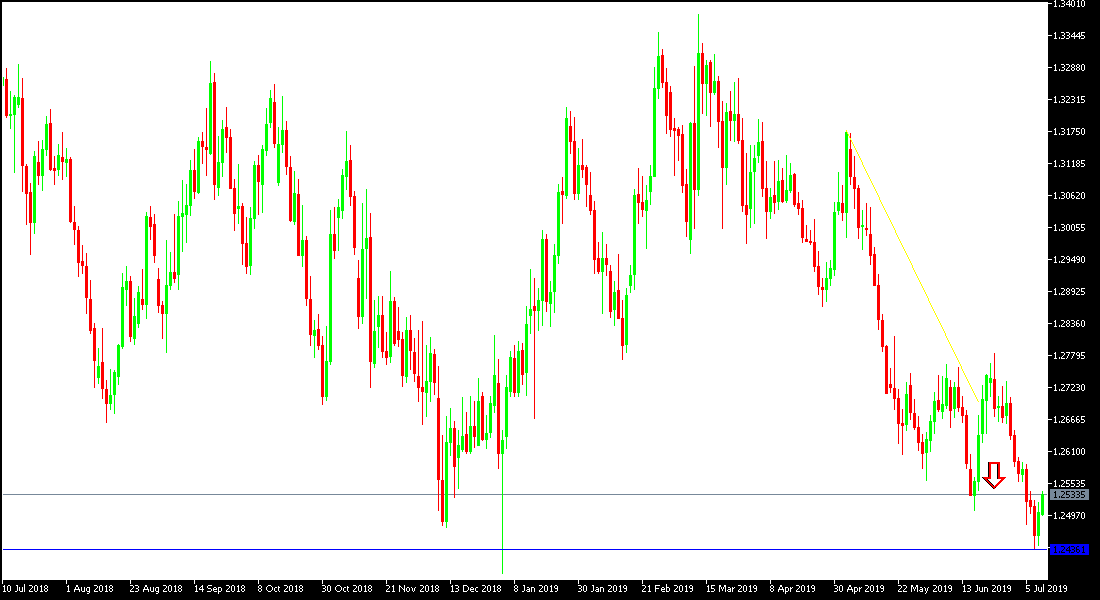

Technically: GBP / USD is still bearish and has not shown any strong signs of a near upward correction, and therefore, support levels are still at 1.2460, 1.2400 and 1.2330, which is closer to the pair's performance, consolidating the strength of the trend this year. On the upside, the upward correction will not be strong without stability above 1.3000 psychological resistance. I still sell prefer selling this pair from each rising level. Gains may be vulnerable for any negative development of Brexit’s future.

On the economic data front: the economic calendar will focus first on the announcement of the financial stability report from the Bank of England and comments from its Governor Mark Carney. From the United States, there will be the Consumer Price Index, the Unemployment Claims and the second testimony of Federal Reserve Governor Paul are before the Senate.