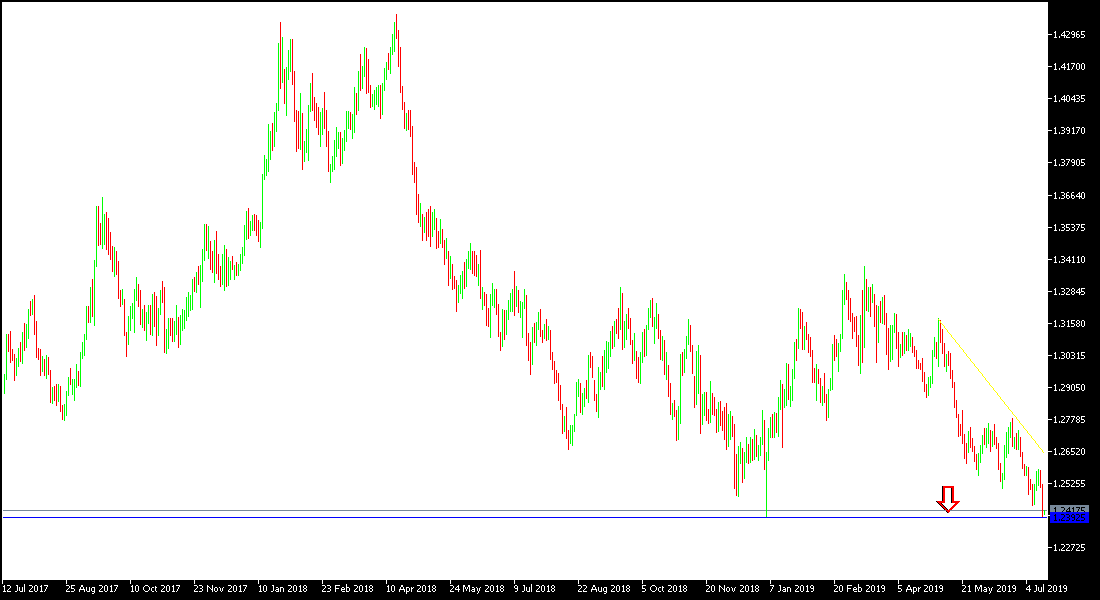

Ahead of the announcement of inflation figures in Britain, the GBP / USD fell to the 1.2382 support level at the time of writing, the lowest level since the mid-April trading of 2017. The performance of the pair still confirms our continued expectations of selling the pair from every bearish level as the uncertainty around Brexit's future will continue to have a negative impact on any chances for the GBP to gain. The pair has not benefited much from announcing Britain's wage growth to its highest level in 11 years, the country's unemployment rate stabilized at its lowest level in 44 years and expectations of a near-term cut in US interest rates.

Investors do not care about the pound reaching historical buying levels as the future of Brexit continues to be uncertain two and a half months away from the deadline. Expectations are growing daily that the country may eventually have to leave the EU without an agreement, which would be more disastrous for the pound and the British economy.

The US dollar may have an important date this month as the US central bank cuts interest rates, according to confirmation by Federal Reserve monetary policy officials, led by Bank Chief, Jerome Powell, who indicated the bank's fear of continuing global trade tensions and concerns about the future growth of the global economy, directly affecting the US economic outlook.

Technically: the GBP / USD performance is still supporting the continuation of the move within its violent bearish channel, and reached the support areas we have anticipated. The nearest support levels for the pair are currently at 1.2375, 1.2300 and 1.2220 respectively. The performance of the pair ignores the technical indicators reaching full saturated areas. On the upside, the correction will not be a strong upside without stability above 1.3000 psychological resistance. Overall we still prefer to sell the pair from every ascending level. As the pound remains under threat of any negative development for the future of the BREXIT.

On the economic data front: Today's economic calendar will focus first on the announcement of British inflation figures, CPI, and producer prices. From the U.S, the building permits and housing starts data.