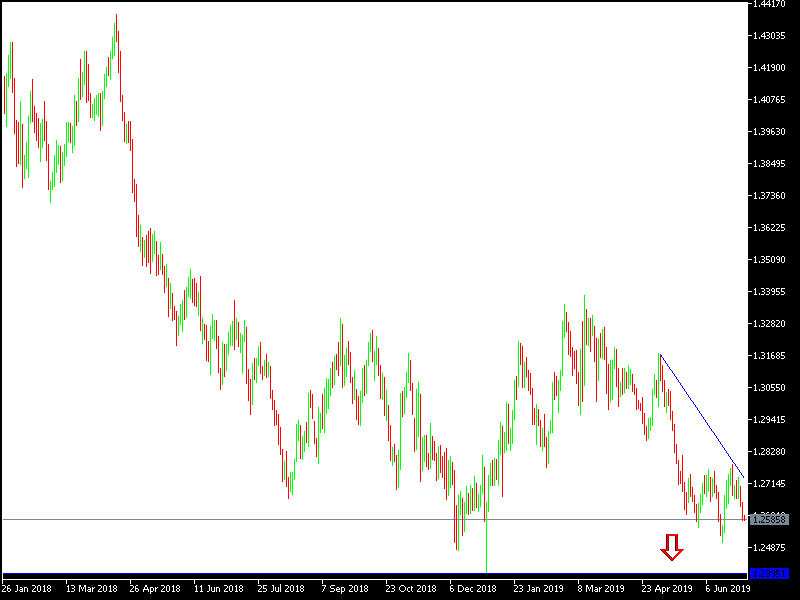

If the UK Services PMI results come out poor, it will be added to the weak results of the industrial sector to complete the picture of the extent to which the British economy has been affected by the consequences of the global trade war, and the unclear future of Brexit, officially scheduled for three months from now. Until now, there is no official announcement as to who will replace Theresa May in leading the future of the United Kingdom at a very sensitive time and stage. In this situation it was normal for the GBP / USD to continue to fall and settle around 1.2585 at the time of writing. The general trend analysis for the pair is still bearish and there are no strong signs of a near bullish correction.

The Pound still faces a confidence crisis because of the future of Brexit. Mark Carney was frank and confirmed what he had said earlier during his testimony on Britain's inflation report, where he suspended any shift in the Bank of England's policy on the future of the Brexit. Going out of the EU without an agreement would be catastrophic for the British economy and the pound sterling. The bank has been moving towards a gradual and limited rate hike.

The Bank of England is major economy central bank and the only one that is looking to raise the interest rate at the moment, but the uncertainty of the future of the Brexit prevents it. The bank has kept the interest rate and asset purchase plans unchanged, stressing that the rate hike will depend on Brexit.

The pair's performance confirms what we always recommend, which is to sell from every bullish level. Brexit fears will remain a negative factor for any pair gains. The dollar is facing a setback supported by hinting that the US interest rate could be cut soon. Since the UK vote to exit the EU, we have always recommended selling the pound against other major currencies and that Brexit will not end overnight, and not easily, as some believe, so as not to spread the infection among the rest of the EU. Sterling gains will remain good opportunities to sell.

Technically: GBP/USD establishing again below 1.3000 still support the bearish correction for the pair despite the recent correction, and the support levels are still 1.2640, 1.2580 and 1.2445 are the nearest to the pair’s performance, and at the same time, confirm the strength of the bearish correction. On the upside, the correction will not be able to rise the upward correction without the stability above 1.3000 resistance. I still prefer selling the pair from every ascending level as gains may be in the wind of any negative Brexit development.

On the Economic Data front: The economic calendar today will focus on the announcement of UK Service PMI, and the U.S ADP Non-Farm employment change, unemployment claims, trade balance and ISM Services PMI.