The GBP / USD is trying to move away from its lowest levels in 28-year by moving towards 1.2381 and settling around 1.2460 ahead of the UK retail sales figures. The general trend of the pair is strengthening bearishly as the future of the Brexit continues to be bleak - expectations are mounting that the country is on its way out without an agreement. Leaving without a deal means tariffs would be imposed by the EU, along with restrictions on the movement of people, goods and services, which would eventually lead to stagnation and complete paralysis of the British economy. Leaving with an agreement means easing the above, and ensuring competitiveness in the European market where the UK exports has the lion's share. Despite the stability of inflation around the Bank of England’s target, it is not expected to change the policy of the bank soon. The pair did not benefit from announcing Britain's wage growth to its highest level in 11 years, the country's unemployment rate stabilized at its lowest level in 44 years and expectations of a near-term reduction in US interest rates.

Investors are ignoring the pound's reach to historical buying levels as the future of Brexit continues to be uncertain ahead, with closing deadline of the Brexit at the end of October. Expectations are mounting that Britain may eventually have to leave the EU without an agreement. The US dollar may be on an important date by the end of this month with the US central bank cutting interest rates.

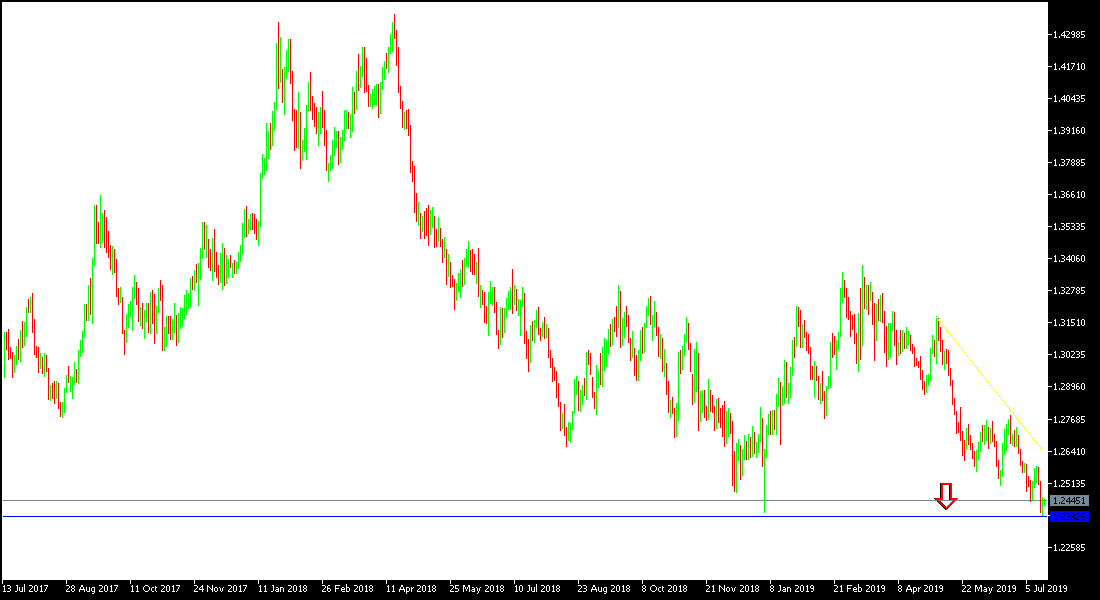

According to technical analysis: GBP / USD is still stable within its downtrend channel with no immediate break in the current situation, and has reached the support levels we have anticipated. Currently, the nearest support levels are 1.2375, 1.2300 and 1.2220 respectively, which are the levels supporting of the bearish force. On the upside, the correction will not be a strong one without stability above 1.3000 psychological resistance. Overall we still prefer to sell the pair from every ascending level. As the pound remains under threat of any negative development for the future of the BREXIT.

On the economic data front, the economic calendar today will focus on British retail sales figures. It is the United States of America, there will be announcments of the unemployed weekly claims and the Philadelphia industrial index reading.