The US economy succeeded in adding more new jobs in the non-farm sector than expected in June, thus boosting support for the US dollar. With those results, investors ruled out the possibility of a Fed rate cut this month. Therefore, the GBP/USD dropped sharply to the support at 1.2480 in Friday's session, the lowest in six months, before settling around 1.2530 at the time of writing. With the announcement of these positive figures, the Fed reiterated that it would act as necessary to maintain economic growth, while noting that most central bank officials have lowered their interest rate expectations. The Fed's statement came in its semi-annual report on monetary policy.

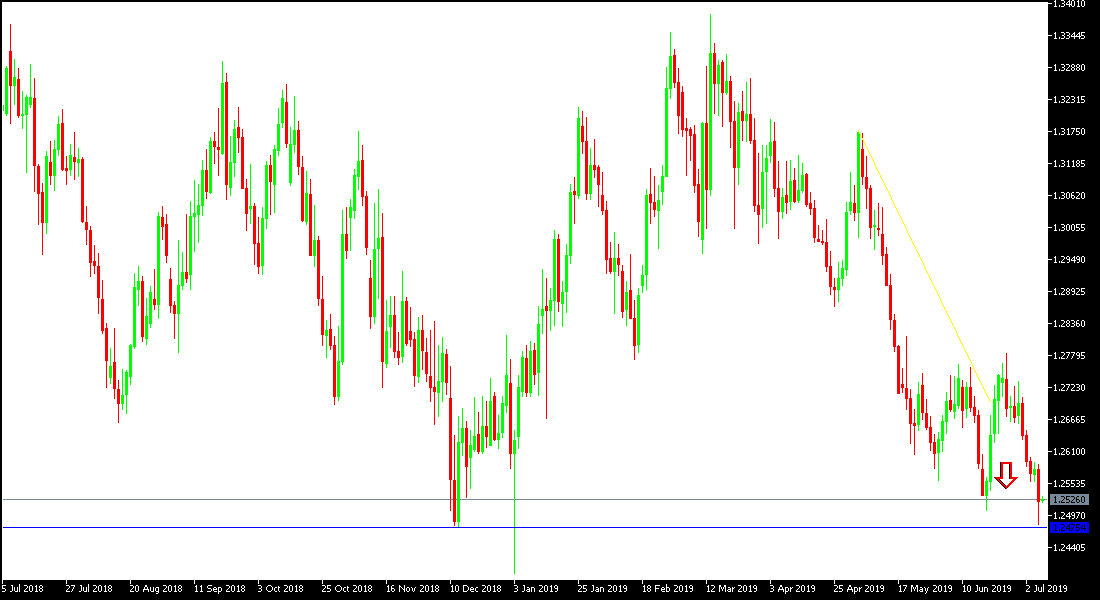

On the daily chart, the pair is still moving within its bearish channel. The British pound still faces the unknown about Brexit, the most influential part on the Pound's performance. All technical indicators point to oversold areas, but signs of a bullish correction are still very weak. We saw the entry of the important British service sector into recession and the manufacturing sector still suffers.

BREXIT, officially scheduled three months from now, is still watching for the official announcement of Teresa May’s successor in leading the future of the UK at a very sensitive time and stage. The Bank of England, confirmed what they had said earlier that there will be no change in the bank’s policy without taking into account the developments of Brexit, as leaving the EU without an agreement would be catastrophic for the British economy and the pound, and therefore, the bank will have motivating plans at place. If an agreement is reached between them, the bank may move towards gradually raising interest rates in limited terms.

Technically: The GBP/USD is still moving within its bearish channel since it dropped of the psychological top of 1.3000, and with no signs of a near bullish correction, the support levels should be at 1.1470, 1.2400 and 1.2330, the closest to the current performance of the pair. Upward, there will be no strong bullish correction without settling on top of the 1.3000 resistance. I still prefer to sell this pair from each bullish level, as gains might be vulnerable to any negative development in Brexit future.

On the Economic Data front: The economic calendar today expects no important data from the U.S or the U.K.