An important day for the performance of GBP/USD, which is facing losses and has steadily pushed towards the 1.2440 support level, the lowest level in six months. From Britain, figures on GDP growth and manufacturing output will be announced. From the United States, the testimony of Federal Reserve Chair, Jerome Powell, to a US congressional committee and later the contents of the minutes of the bank's last meeting for June, at the time when financial markets carefully watch for the most appropriate date for US interest rate cuts, or will the bank delay this deadline, especially after the announcement of US job numbers that exceeded expectations. We shall see.

Technical indicators continue to confirm that the GBP/USD has reached oversold levels, and reducing the chance of an upward correction is the lack of catalysts for investors to buy the GBP. The opportunity to buy will not be stronger without identifying who will succeed Teresa Mae in the Brexit leadership and knowing his policy plans to manage this file that determines the future of the UK. Any strong signs of the country's exit without an agreement means further collapse for the pound against other major currencies, and vice versa, the agreement between the two parties ensures a smooth relationship between them, which means a strong uprising of the Pound.

The US economy managed to add more jobs than expected, dampening expectations of a US Interest rate cut this month, which helped stronger gains for the US dollar. In contrast, the Bank of England confirmed that there would be no shift in the policy of the Bank without taking into account Brexit developments, as leaving the EU without an agreement would be catastrophic for the British economy and the pound. Therefore, Bank of England will then make stimulus plans. If an agreement is reached, the bank is aiming to raise rates gradually and in limited terms.

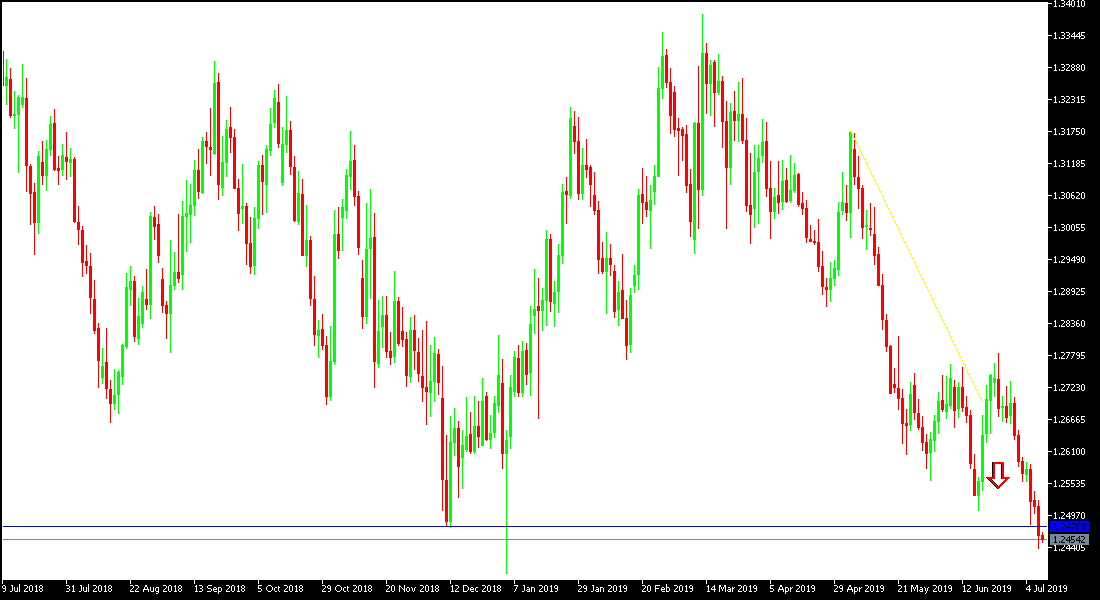

Technically: GBP / USD is still moving within its bearish channel strongly, and so far there has not been any signs of a near upward correction and therefore the support levels will be 1.2460, 1.2400 and 1.2330, the closest to the pair current performance. Upward, the bullish correction will not be stronger without stability above 1.3000 resistance. I still sell to this pair from every ascending level. Its gains may be in the wind for any negative development of the future Brexit.

On the Economic Data front: The economic calendar today will focus first on the announcement of the UK GDP, Manufacturing Production and Goods Trade Balance data. From the US, there will be Powell’s testimony in front of the congress and the content of the Fed’s last meeting.