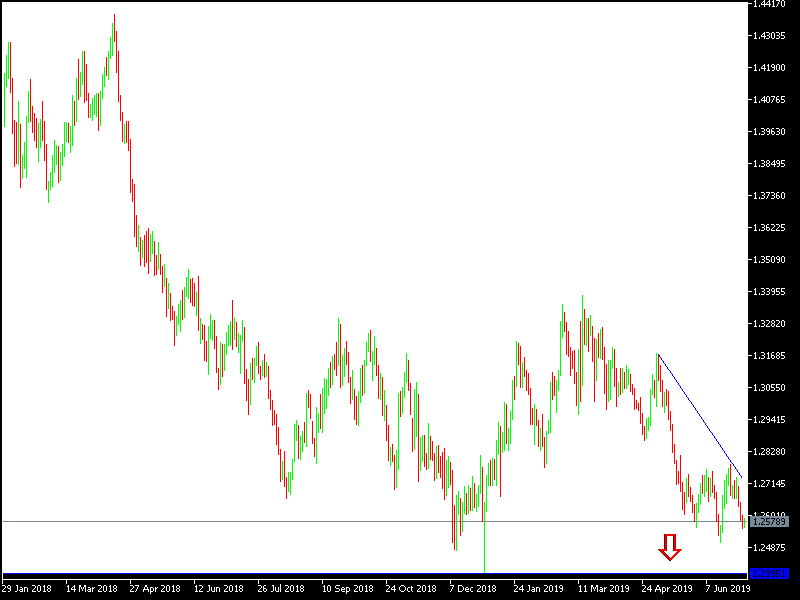

On the daily chart, GBP / USD is still holding to lower performance as pressure on the pair increases. The negative economic data from the UK confirms the extent to which the British economy is affected by the uncertainties of Brexit future and the consequences of the global trade war. The pair is moving in a bearish channel that pushed it towards the support level 1.2556, and didn’t move below that for two trading sessions. Technical indicators point to oversold areas but signs of a bullish correction are still very weak. We have witnessed the entry of the important British services sector into recession and the manufacturing sector is still suffering.

BREXIT, officially scheduled three months from now, is still watching for the official announcement of Teresa May’s successor in leading the future of the UK at a very sensitive time and stage. The pound still suffers a crisis of confidence due to Brexit future. The governor of the Bank of England, Mark Carney, confirmed what he had said earlier during his testimony on Britain's inflation report, where Carney suspended any shift in the Bank of England's policy on the future of the Brexit. Going out of the EU without an agreement would be catastrophic for the British economy and the pound. If an agreement is reached between them, the bank may move towards gradually raising interest rates in limited terms.

The Bank of England is major economy central bank and the only one that is looking to raise the interest rate at the moment, but the uncertainty of the future of the Brexit prevents it. Since the UK vote to exit the EU, we have always recommended selling the pound, and the pound’s gains will remain good opportunities to sell.

Technically: GBP/USD establishing again below 1.3000 still support the bearish correction for the pair despite the recent correction, and the support levels are still 1.2540, 1.2470 and 1.2400 are the nearest to the pair’s performance, and at the same time, confirm the strength of the bearish correction. On the upside, the correction will not be able to without the stability above 1.3000 resistance. I still prefer selling the pair from every ascending level as gains may be in the wind of any negative Brexit development.

On the Economic Data front: The economic calendar today expects no important data. Today is a holiday in the U.S.