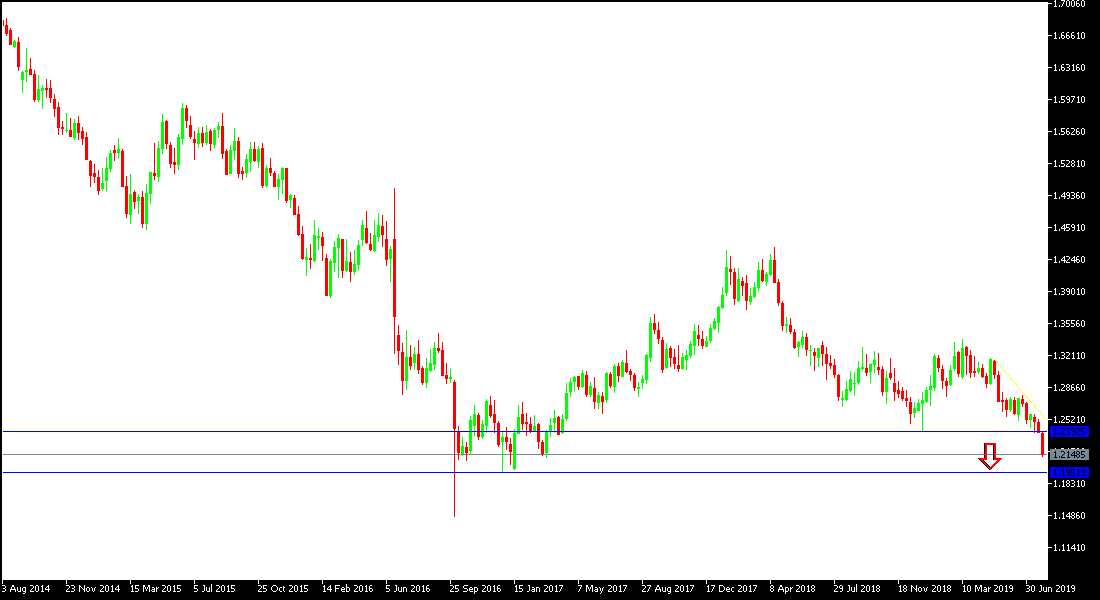

Expectations are growing daily that Britain is closer to leaving the EU without an agreement, and those expectations have gained momentum from Boris Johnson assignment. The new British Prime Minister, who is a controversial figure that claims his country is ready to leave without an agreement is ignoring all domestic and foreign warnings that Brexit without an agreement would increase pressure on the British economy and support the collapse of the sterling. This pessimism pushed the GBP / USD to collapse towards 1.2119 support level in today’s morning trading to its lowest level in 28 months. This will support the pair's move towards 1.2000 psychological support, which will lose the confidence of investors.

Boris Johnson says he will make every effort to get Britain out on schedule, Oct. 31, even if with no deal, and that he is ready to renegotiate with the EU on the terms of May’s agreement, which has been rejected several times by the British parliament, and was the reason for May's resignation. Today, the Federal Reserve will start its meeting to determine the interest rate and the future of the Bank's policy in the light of global changes and the beginning of the US economic growth slowdown, with expectations suggesting strongly that the bank will cut rates for the first time in 10 years by a quarter point as a first step to stimulate the US economy.

Technical analysis: As we expected previously, and confirm now, the GBP/USD's performance will continue to move within its bearish channel and test all the support levels we have identified, and is now closest to test the 1.2000 psychological support level, and then we will provide new support levels for the pair. On the upside we did not see any signs of near bullish correction. In general, we still prefer to sell the Sterling from every rising level. The pound remains under threat of the future of the Brexit.

On the economic data front: The economic agenda will focus today on the US Consumer Price Index (CPI), which is the preferred measure of inflation for the Federal, as well as the average income and spending of the US citizen, ending with the announcement of pending home sales and US consumer confidence.