Boris Johnson officially became Britain's prime minister, and in his first important remarks he said he could conclude a new agreement with the EU and that he would work on all the promises on the Brexit before the October 31 deadline. He added to market fears after hinting that the country might be forced out of the EU without agreement, but at the same time wants to build a new good and strong partnership with the Europeans. Those statements painted a clearer picture of the new official's policy, just waiting for the reaction of the European Union to what was issued. GBP / USD shrugged off Johnson's remarks, and after moving towards 1.2522 resistance during yesterday's trading session, it settled around 1.2472 level at the time of writing, confirming that the markets are quoting the current performance of the pair based on previous strong expectations of Johnson's controversial win.

Besides Brexit concerns, the US dollar gained new support after US President Donald Trump and congressional leaders approved the debt and budget deal to avoid government's closure as well as positive expectations by the International Monetary Fund for the US economy growth. On Friday, financial markets will have an important date with the release of US GDP figures and the announcement of slower growth as expected will give US interest rate cut expectations fresh impetus.

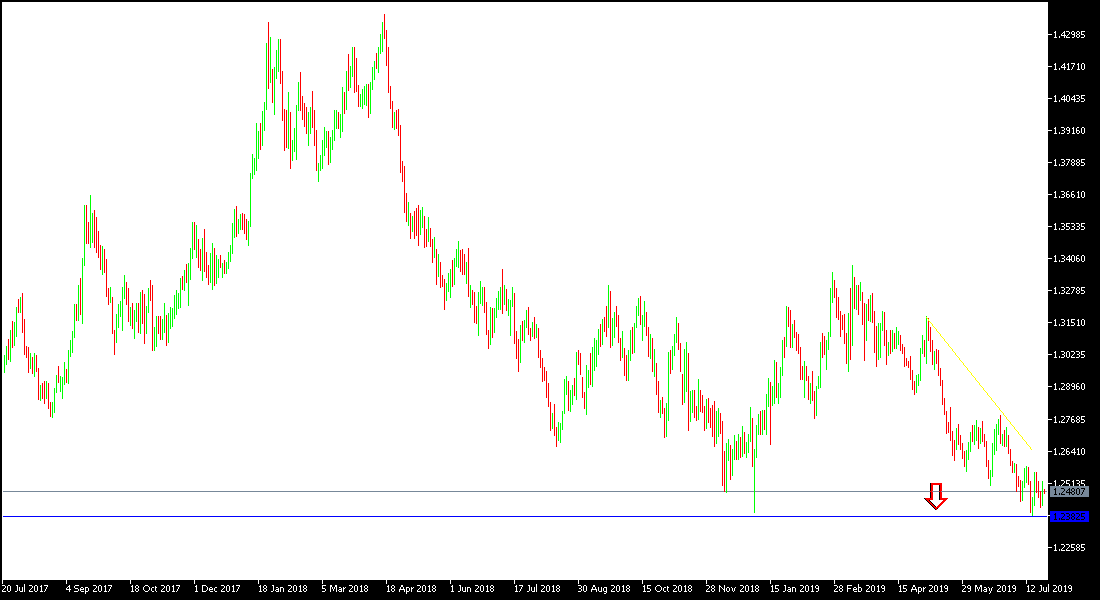

Technical Analysis: The GBP / USD is still holding onto a bearish move since shedding 1.3000 psychological resistance. As this trend continues, the nearest support levels will be 1.2430, 1.2345 and 1.2200 respectively. In the event of a bullish correction, the resistance levels will be 1.2550, 1.2620 and 1.2700, as it may support a reversal of the current bearish trend. We still prefer to sell it from every ascending level. The Pound is still under threat of any negative development for the future of the Brexit.

On the economic data front: Today's economic calendar will focus on US durable goods orders, jobless claims and trade balance for commodities. There are no important UK economic data today.