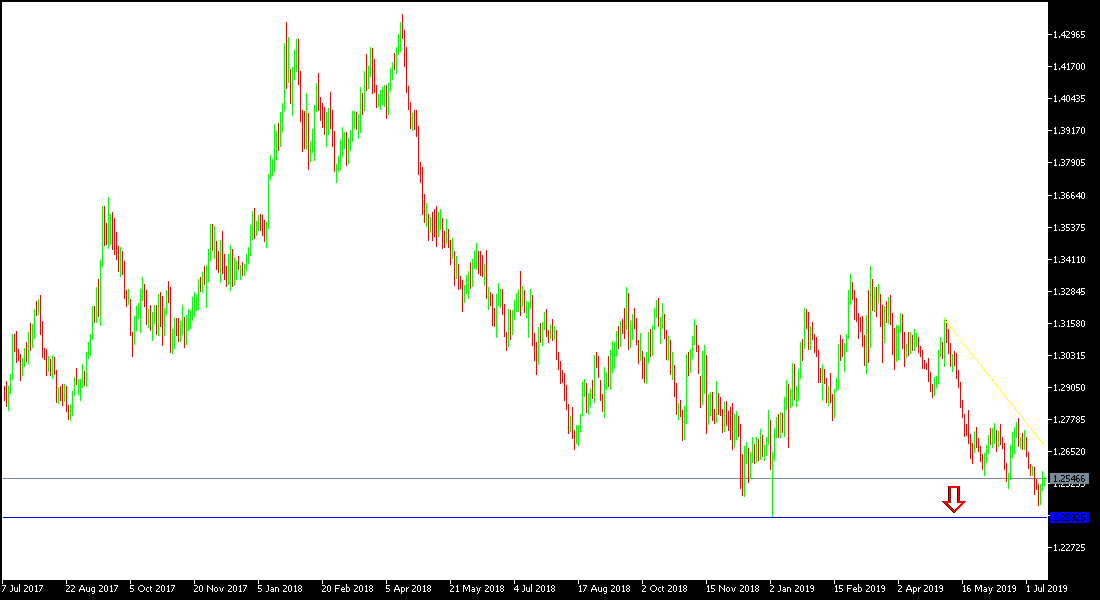

Federal Reserve Chair, Jerome Powell, stressed again in his testimony to the US Congress on what he said before, that the US central bank is ready to cut interest rates as trade tensions continue and concerns about the strength of the global economy directly affect the US economic outlook. The GBP / USD moved towards the 1.2570 resistance level before settling around 1.2540 at the time of writing. Despite the pair's recent attempts to bounce back, the bearish momentum is still the strongest and investors are anticipating any higher rebound for the pair to resume the sell-offs, as the strongest impact on the pair remains the uncertainty of Brexit future, and pressure on the UK economy is mounting from investor fears. Richard Branson, founder of Virgin Group, warned that the value of the pound would fall to one dollar if Britain left the EU without an agreement - a stark forecast that would fuel concerns about the country's economic pressures.

The Bank of England said in its report on financial stability on Thursday that UK banks were able to face the worst Brexit, but such an event would cause large fluctuations in the market. On the other hand, markets are quoting 100% chance that the Fed will cut interest rates this month.

The opportunity to buy the pair will not be stronger without identifying who will succeed Teresa May in the leadership of the Brexit and know his policy plans to manage this file that determines the future of the country. If Britain leaves the EU without an agreement, this could lead to a further collapse of the pound exchange rate.

The Bank of England continues to stress that any shift in the bank’s policy depends on the future of Brexit.

Technically: the GBP / USD is still supporting the bearish trend and there were no strong signs of a near bullish correction, and therefore, support levels of 1.2460, 1.2400 and 1.2330 remain the nearest targets for the pair to consolidate the strength of the current general trend. On the upside, the bullish correction will not be a strong without stability above 1.3000 psychological resistance. I still prefer selling the GBPUSD pair from each ascending level. The pair gains are still under threat of any negative development of BREXIT's future.

On the economic data front, the economic calendar today will focus on the announcement of the PPI in the United States. There are no significant UK economic data today.