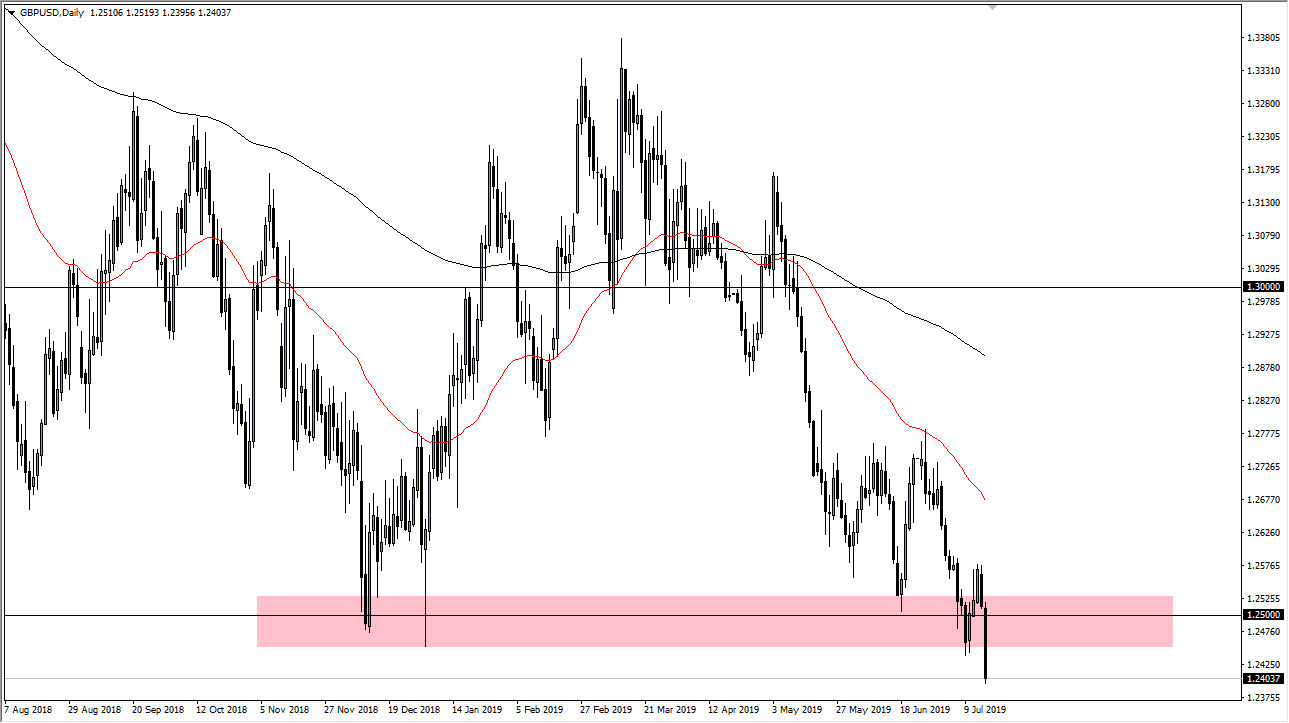

The British pound broke down during the trading session on Tuesday, slicing through the 1.25 handle. We have made a fresh, new low, and that of course is a very negative sign. I think that the British pound is ready to go much deeper to the downside as the market has been in a downtrend and we have now extended to the downside. That being the case, I think that short-term rallies will continue to be faded, because there’s no reason to think anything different will happen.

The Brexit of course continues to be a major issue, as the uncertainty with that scenario is going to cause problems with the British pound. The fact that the Federal Reserve is cutting rates and we are going to continue to go lower tells me just how negative the British pound truly is at this point. In fact, at this point I don’t have any interest in trying to buy this market until we break above the 1.2750 level above, something that seems very unlikely to happen at this point.

Beyond that, we also have the 50 day EMA and that should offer resistance as well. The market breaking above that is of course the first signs of strength, but it’s not until we break out above that will .2750 level that I think we can start to talk about a change in trend. The British pound continues to disappoint every chance it gets, so I think short-term selling is probably about as good as this pair gets.

To the downside I believe that the market is probably going to reach towards the 1.2250 level, and then eventually the 1.20 level after that. That doesn’t mean we need to get there overnight, but we almost certainly will get there. Think of it this way: we’ve been falling for what seems like forever, and it continues even at this massive level underneath.

At this point there only two scenarios that I see saving the British pound: either the Brexit get solved somehow, and perhaps magically, or the Federal Reserve becomes overly dovish, perhaps adding some US dollar weakness into the picture. The fact that we are closing at the bottom of the candle stick is of course a very negative sign. Ultimately, I see no reason to think about buying this market, so overall the play is to simply wait for signs of exhaustion to take advantage of.