The British pound initially tried to rally during the trading session on Thursday, but as it was Independence Day in the United States it was very unlikely to gain any serious traction in one direction or another. Because of this, it should be noticed that we are hanging around the lows that we have been in for some time. At this juncture, we should see a lot of support underneath at the 1.25 handle, but also keep in mind that the jobs number is coming out on Friday and that will of course cause quite a bit of volatility.

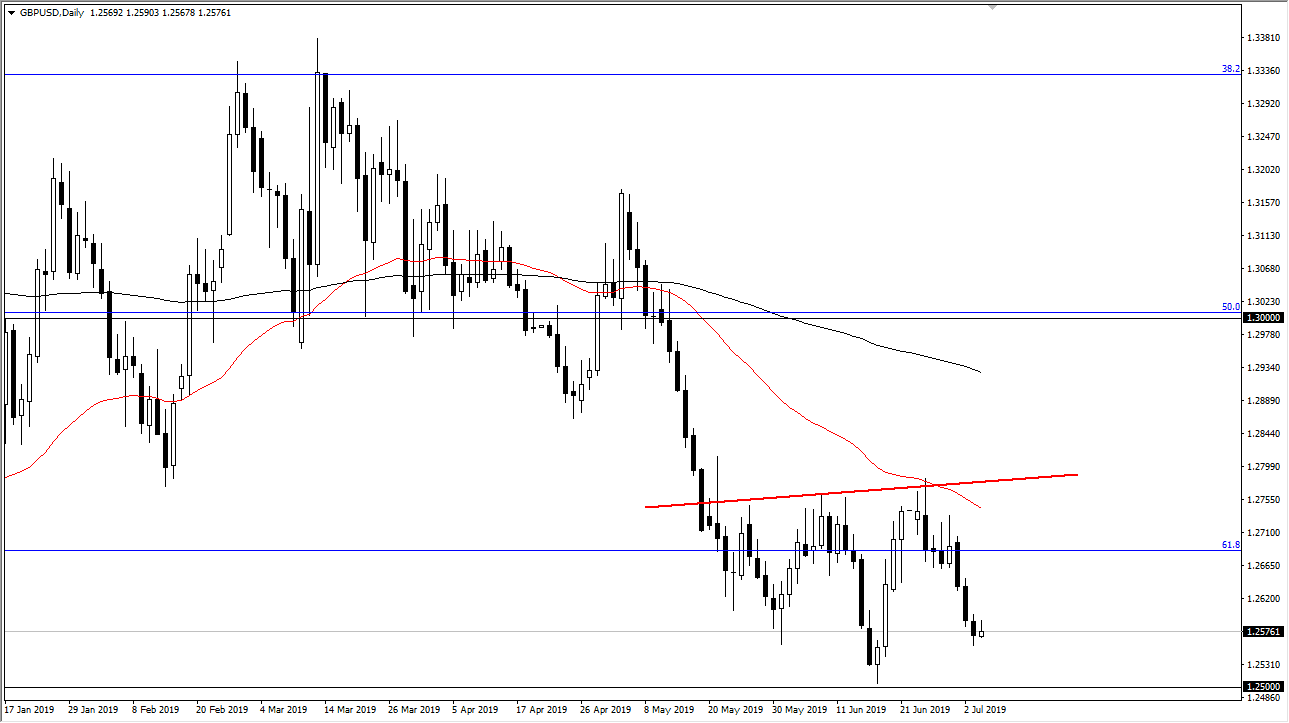

Looking at the chart, if we were to break down below the 1.25 level on a daily close, I think that could open up a move down to the 1.2250 level given enough time. Alternately, if we can stay above the 1.25 level it’s very likely that we will eventually bounce. However, one of the things that we need to keep in mind is that there will be a lot of volatility around the greenback during the session. Obviously, a lot of noise will enter the market based upon the idea of whether the Federal Reserve will be forced to cut interest rates are not. Right now though, I think most traders are expecting that and it’s very likely that the US dollar will soften in general.

However, in this pair we have to worry about the Brexit as well. Because of that, the British pound could be a bit of a laggard. I think the set up at this point is probably to short the British pound if the US dollar picked up a lot of strength over the next several sessions, but if it is the bounce I think the British pound could probably be avoided and you could get more “bang for your buck” using another pair. That being said, this market could very well go towards the 1.28 level above if we get signs of a bounce during the day. At this point, if we can break above the 1.28 level, then it forms an inverted head and shoulders. That opens the door to the 1.30 level above. I would stay out of this pair until after the Friday session, as we should have quite a bit more in the way of answers after the jobs report and the subsequent reaction happens. This week has been a bit difficult to trade simply because of the holiday and the jobs report coming.