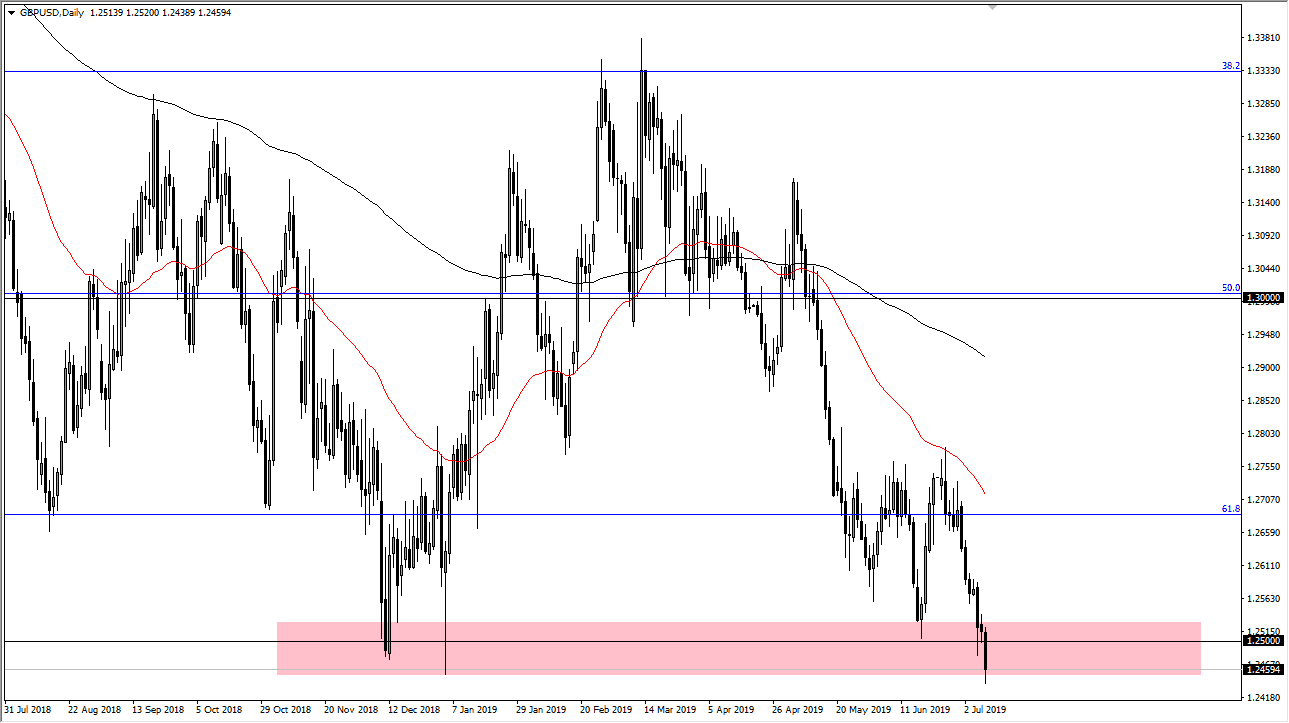

The British pound has broken down during the trading session on Tuesday, slicing through the 1.25 handle. This is an area that of course will attract a lot of attention as it is a large, round, psychologically significant figure. Beyond that, you can see that I have a rectangle marked on the chart that show signs of support over the last several months. The fact that we have broken down to a fresh, new low is a very negative sign, but we have a potential situation that could turn things right back around. That situation: Jerome Powell speaking in front of the United States Congress over the next couple of days.

The Humphrey Hawkins testimony which features the Federal Reserve Chairman can often influence where the US dollar goes for the next several months. If Jerome Powell is as dovish as the market wants them to be, we could see the US dollar take a little bit of a beating. Having said that, the other side of this pair of course is the British pound, which has its own issues. We have the Brexit, and all of the nonsense around that. Ultimately, I think that it’s only a matter time before we get some type of bounce, but I have to look at both sides of the equation here.

I believe that the market is trying to price in a “no deal Brexit.” Whether or not there is a deal, I don’t care but I do have a couple of triggers on the chart that tell me what to do. If we break down below the bottom of the Tuesday trading session, then I anticipate that the market will probably offer a couple of hundred pips to the downside, perhaps the 1.2250 level. However, if we get the bounce that could very well happen after the testimony, we could see this market break above the highs from the Monday session. If we do that, I believe that the market will probably reach towards the 1.2750 region to the upside. The 50 day EMA is currently slicing through that area as well, so I would anticipate that breaking above there would be very difficult. With all of the headlines around the British pound right now, it is difficult to imagine that it will suddenly explode to the upside against the US dollar. That being said though, if the US dollar falls apart we could get a quick snap rally to take advantage of.