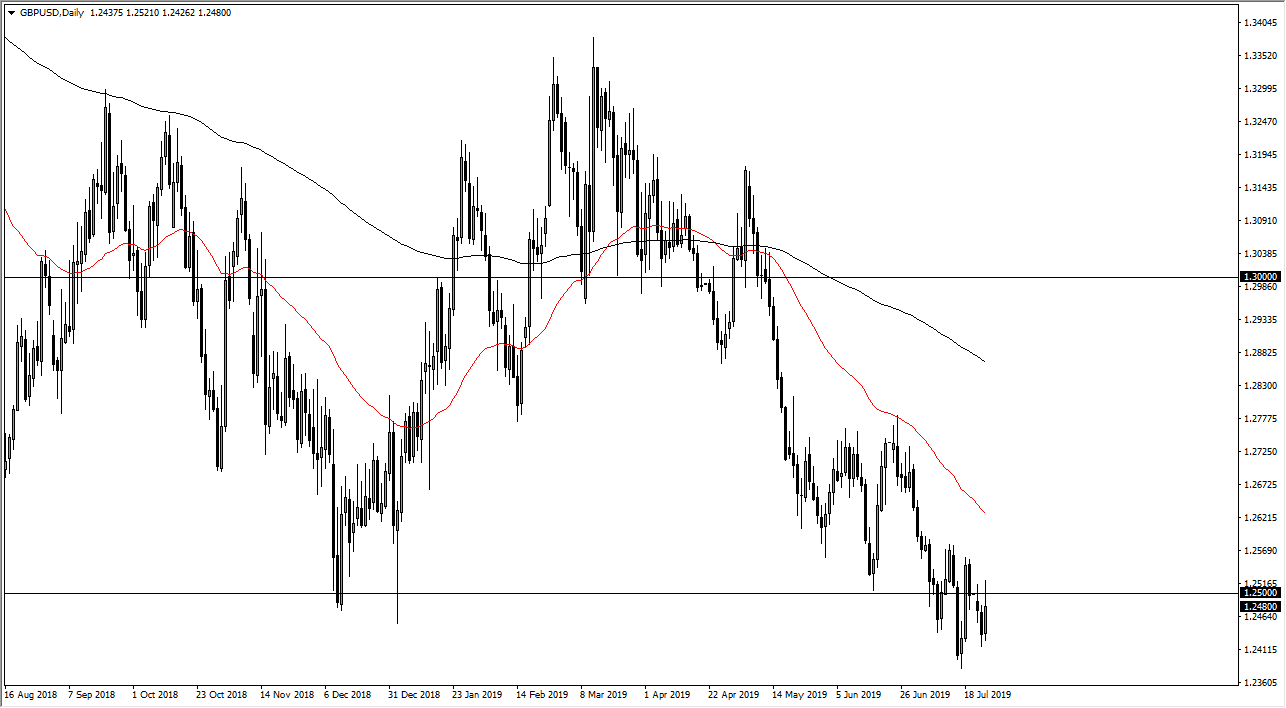

The British pound initially rallied during the trading session on Wednesday, to break above the 1.25 level. That’s an area that will attract a lot of attention obviously, because it is so important. That’s an area that was a major support as well resistance in the past, so it makes quite a bit of sense that we would see markets go back and forth. In this scenario we find ourselves on Wednesday. The market rallied to break above the 1.25 level but has pulled back rather significantly from there again.

I personally can’t think of any other currency around the world that has more noise and nonsense around that right now that the British pound. We are still looking at the possibility of a no deal Brexit, and that of course scares a lot of people. This makes the idea of owning the British pound untenable, because there is so much uncertainty attached to it. The election of Boris Johnson is a bit of concern for some people, because he is hell-bent on getting the UK out of the EU on October 31 and has reiterated this. That means there could very well be the dreaded “no deal Brexit.” Ultimately though, that might be the best deal the United Kingdom finds.

Someday, probably closer to Halloween, we will get a massive “flush” lower to the downside if something like that happens. We will eventually get stability, and when we do it will suddenly be a market that offers an extraordinarily high amount of value. In fact, I truly believe that buying the British pound after that flush could be a career making trade for large money traders. However, in the meantime we are sure to see a lot of volatility with a downward slant. I think the 1.26 level is also resistance, and most certainly the 50 day EMA is as well. I would not be surprised at all to see this market break down again and start going towards the 1.2250 level.

The only positive aspect to this pair is the fact that the Federal Reserve is looking to cut interest rates, and that does work against the greenback, but this is probably the one place where the US dollar simply won’t be able to soften itself against a competing currency. There is always one in the ground, and at this point it could be the British pound.