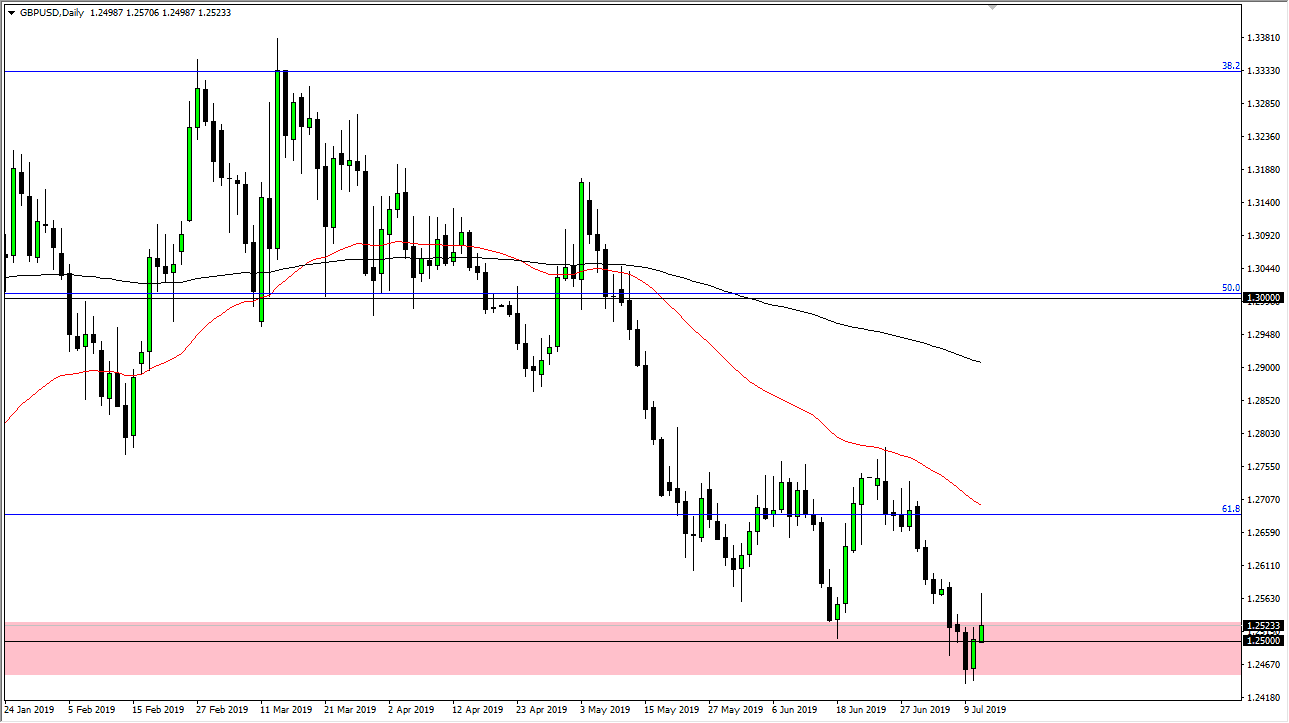

The British pound rallied a bit during the trading session on Thursday, reaching towards the 1.2560 level before turning right back around. We did end up forming a shooting star here, and unlike the Euro, this is a market that is much easier to sell. If we break down below here, we could finally smash through the lows and drop down to the 1.2250 level. This is a market that continues to be negative due to a whole host of reasons, not the least of which would be the Brexit.

Looking at this chart, if we were to break down below the lows, the market could very well fall apart and goes down drastically. Negative headlines about the Brexit could be one of the reasons to break down, but at the same time you should continue to keep in mind that the Federal Reserve is likely to cut interest rates later this month. If that’s the case, the market will more than likely favor to other currencies than the greenback, but at this point the British pound will probably be a bit of a laggard as compared to the others due to all of the issues.

If we were to break above the top of the candle stick during the trading session on Thursday that would be a very bullish sign, and probably have the market go looking towards the 50 day EMA or the 1.27 level above. Expect to see a lot of noise in that area, so it’s very likely that exhaustion would probably show up in that area. If we were to break above there it would obviously be a very bullish sign but I don’t see a scenario where the British pound takes out to the upside.

In the short term, it’s very likely that the rallies will be sold, so overall it’s very unlikely that you can place long-term money here. Most long-term opportunities are going to be to the downside anyway, so keep that in mind. Now that we have already determined that an interest rate cut is very likely in July, the question now we will be featuring is whether or not there will be more? If there are that could lift other currencies against the US dollar, but right now we still have a bit of repricing to do anyway. Expect a lot of choppiness in this general vicinity.