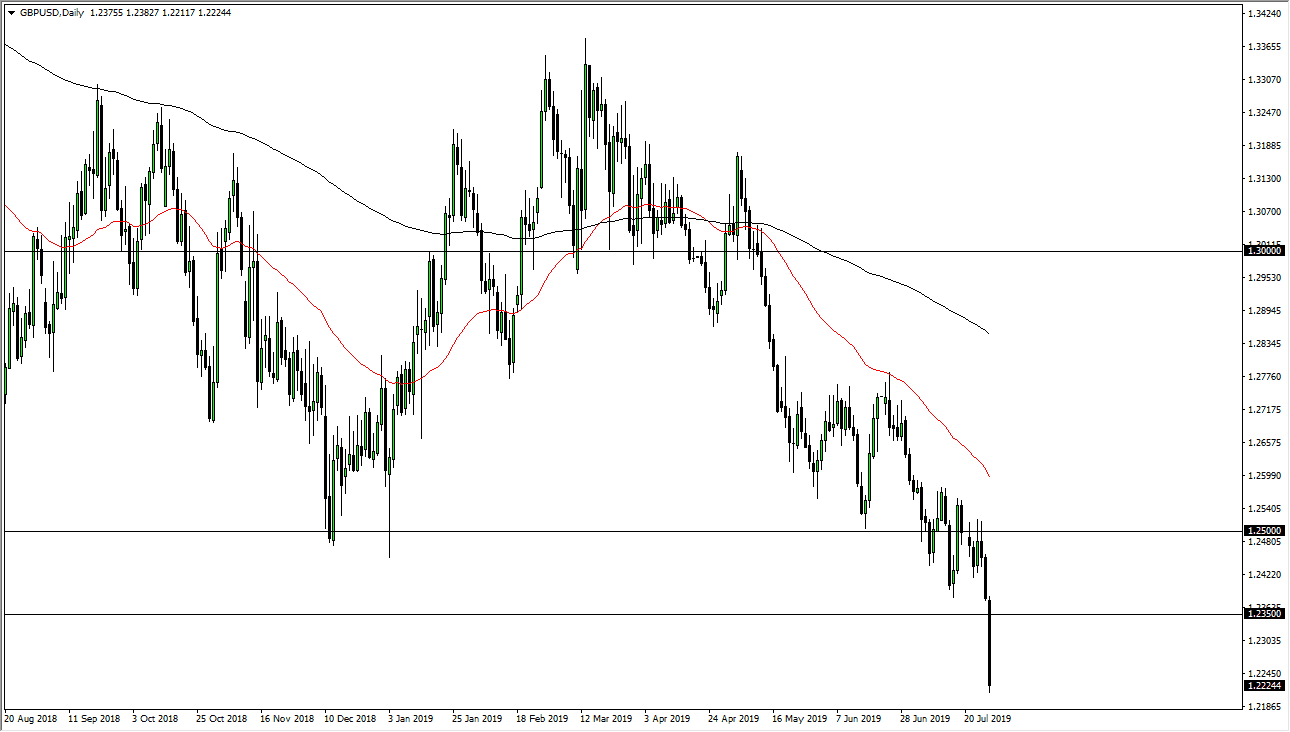

British pound traders shorted the GBP/USD pair massively to kick off the week, breaking through the vital 1.2350 level and even reaching below the 1.2250 level as well. At this point, the market looks very likely to continue the downward slide, as we have broken through quite a bit of major support. This makes quite a bit of sense, as the Brexit continues to be forefront in the minds of the currency traders around the world.

Keep in mind that there is a lot of uncertainty when it comes to the Brexit and whether or not there will be a deal. At this point, it’s very likely that markets will continue to price in the idea of a “no deal Brexit”, and at this point the British pound is likely to continue to drop significantly, and perhaps down to the 1.20 level. Just above, I see a significant amount of resistance, and the fact that we had broken out to the downside and sliced through the 1.25 handle tells me that we are ready to go much lower.

Rallies at this point should continue to be an opportunity to sell, although I would anticipate a short-term bounce as we may have gotten ahead of ourselves. Regardless, this comes down to whether or not you can take the time to wait for a bounce to start shorting again, as the average true range had been hit rather quickly during the day. Ultimately, I think that the British pound is a currency that will remain toxic for the foreseeable future, at least until we get the final “flush” when all is decided. Quite frankly, if we see the UK leave the EQ with no deal, the massive flush that would occur after that move should end up being a potential “buy of a lifetime.” Remember, quite often things look the worst in the financial markets right before we turn things around. This is akin to buying the S&P 500 in 2009, near the 666 low. I do think there is the possibility of a trade setting up like that, but obviously we are quite a while from that level right now, and therefore I think in the meantime it’s prudent to simply look for selling opportunities with an eye on the longer-term charts. So far, the longer-term charts do not show a bottoming pattern, but I do think that short-term charts definitely favor fading any attempt to strengthen.