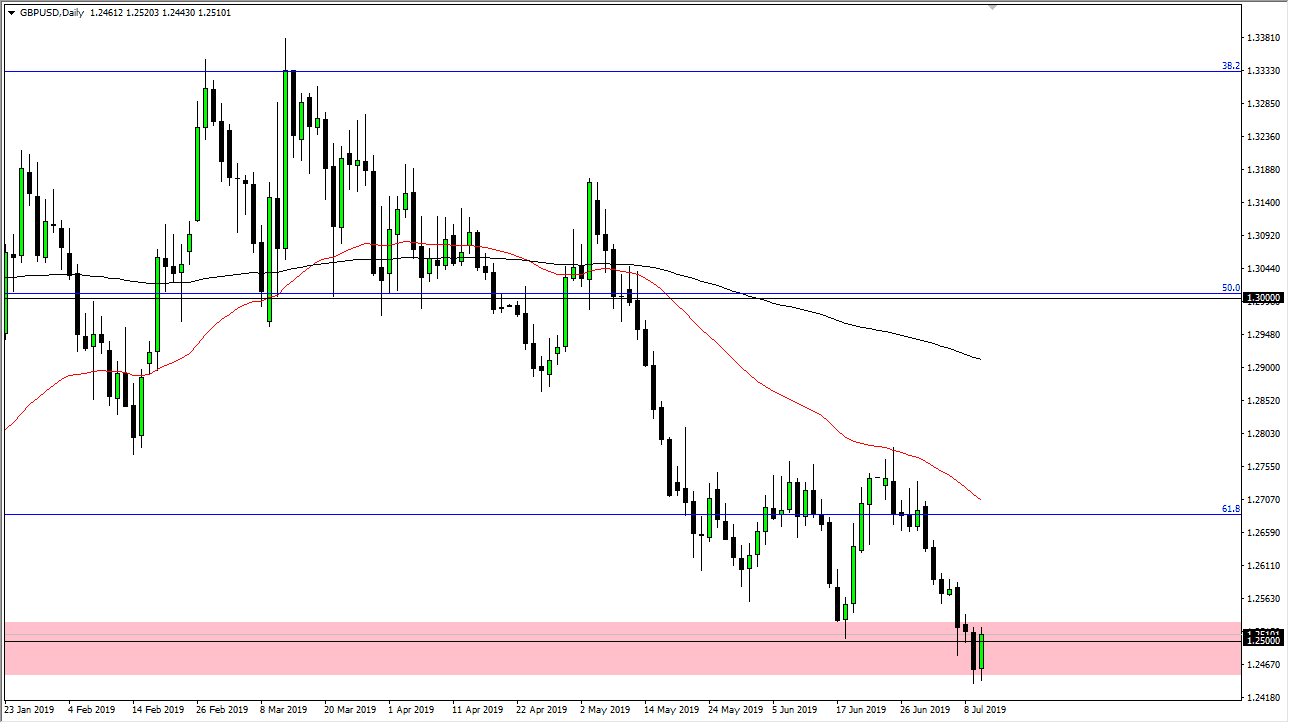

The British pound initially pulled back during the trading session against the US dollar on Wednesday, but then turned around to show signs of life again. We are currently hovering around the 1.25 handle, an area that is a large, round, psychologically important figure of course. With that being the case, the fact that we have seen historical price action in this area, it makes sense that we simply go back and forth trying to figure out which direction to go next.

The Federal Reserve looks likely to cut interest rates, and this of course was exacerbated during the opening statement on Wednesday for the Humphrey Hawkins testimony. Overall, this is a market that will probably move simply depending on whatever it is we are focusing on. On one hand, the ultra-loose Federal Reserve will of course offer the opportunity for the US dollar to fall, meaning that this pair could rally. If the US dollar starts to fall against most other currencies, then it could rise over here but I think that in general the pair could be a bit of a laggard due to the fact that we have to worry about the Brexit. With such uncertainty when it comes to the Brexit, it’s difficult to imagine that the British pound will simply just take off in the air right away.

That doesn’t mean that we can’t rally, just that it might be slower than some other currencies such as the Australian dollar, Canadian dollar, or the like. The British pound has the distinction of dealing with the Brexit, and of course we don’t know exactly what’s going to come of that. To the upside, I believe that the 1.27 level is the beginning of significant resistance so even if we do rally to the upside, I don’t think we get much further than that. Beyond that, the 50 day EMA is slanting lower, which should offer resistance. In other words, the upside is a bit limited.

If we break down during the trading session, meaning that we break down below the bottom of the last couple of candlesticks, then we could probably go down to the 1.2250 level underneath based upon the measured move. That move would be much quicker than a grind higher, so I would be much more aggressive when it comes to selling on a break down. To the upside, you are going to need to be rather patient.