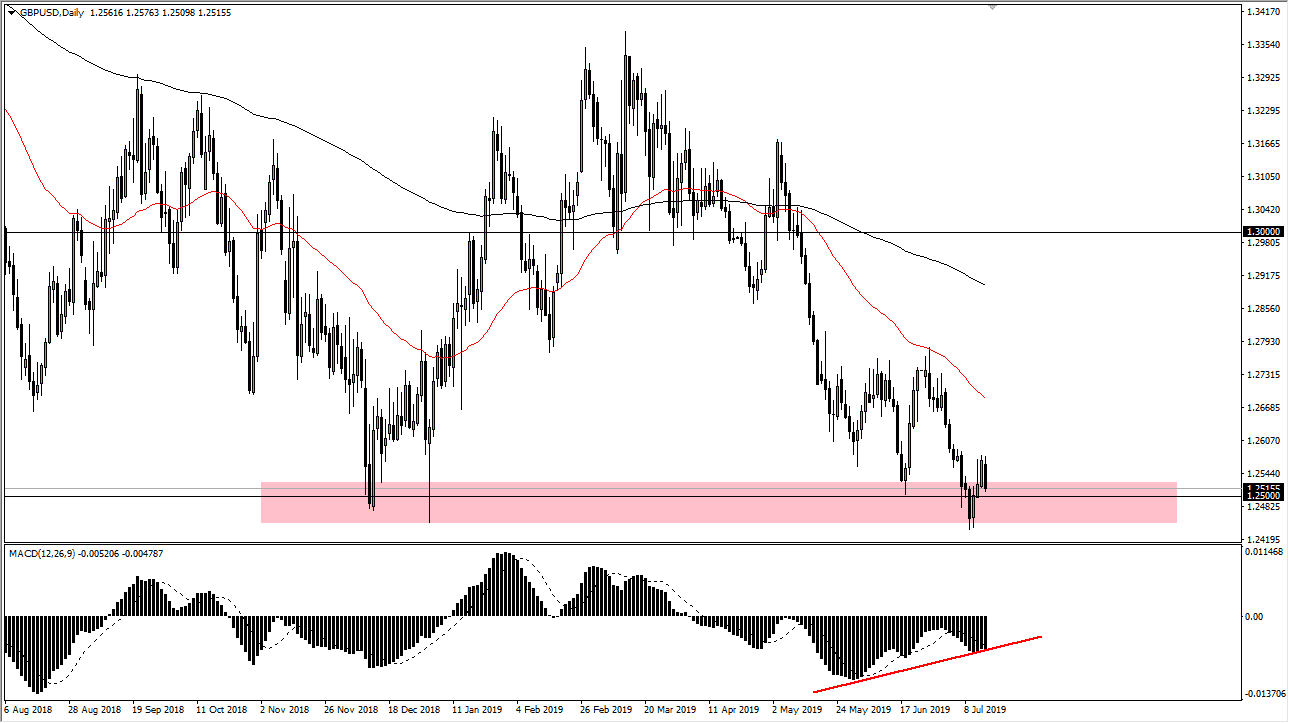

The British pound fell a bit during the trading session on Monday, reaching down towards the 1.25 level. That’s an area that of course attracts a lot of attention because it is a large, round, psychologically significant figure, and an area where we have seen historical action. Because of this, these levels always catch my attention and I start to look at them for potential trade setups.

The bearish candlestick during the trading session on Monday of course shows that we still have a lot of questions out there, not the least of which is going to be risk appetite. The Federal Reserve looking to cut interest rates of course has an effect on this pair, and that could be part of what has caused the recent bounce. I believe the round number also has done the same thing for the market.

When you look at the chart, the Moving Average Convergence Divergence indicator is rising while price has been dropping, so that is a bit of a divergence between an indicator that is widely followed and the market itself. This could be a sign that we are about to see a bit of a trend change, but ultimately I think there is a lot of resistance above that could keep this market somewhat lower. If we were to break to the upside and the red 50 day EMA of course will be one of the first places that technical traders will look to start selling again. Beyond that, the 1.2750 level offers significant resistance as well, so I think at this point if we do rally from here, we are probably going to simply return to the previous consolidation.

To the downside, if we make a fresh, new low, the market will then break down towards the 1.2250 level, perhaps even the 1.20 level after that. Ultimately, this is a market that is becoming a bit more erratic but it also has to deal with the Brexit in general. The Brexit will continue to possibly throw headlines out there that cause major issues, but at the same time we have the Federal Reserve looking likely to cut interest rates in July which does offer a little bit of support. In the short term, we could see a nice bounce from here but I think it is going to be short-lived more than anything else.