The British pound has been very bearish as of late, breaking apart on Monday, and then continuing some of the bearish behavior on Tuesday. However, the Wednesday session is going to be quite a bit different as we have the Federal Reserve interest rate decision, and probably more importantly the Federal Reserve statement after that. At this point, I believe that the market is going to continue to be negative in general, but at this point with the Federal Reserve stepping into the picture, we may be able to give the downtrend a bit of a break.

The market is oversold, so if the Federal Reserve comes out with an interest rate cut, and more importantly a very dovish statement, then we could get a little bit of a short-term bounce. Longer-term though, the reality is that the Federal Reserve will only give a little bit of a boost of this pair and the British pound will continue to underperform other currencies against the greenback as it has for some time. Once we get past the initial shock and awe of a potential Federal Reserve statement, then we will start to see this market looking at the Brexit in general, and the massive uncertainty when it comes to that situation.

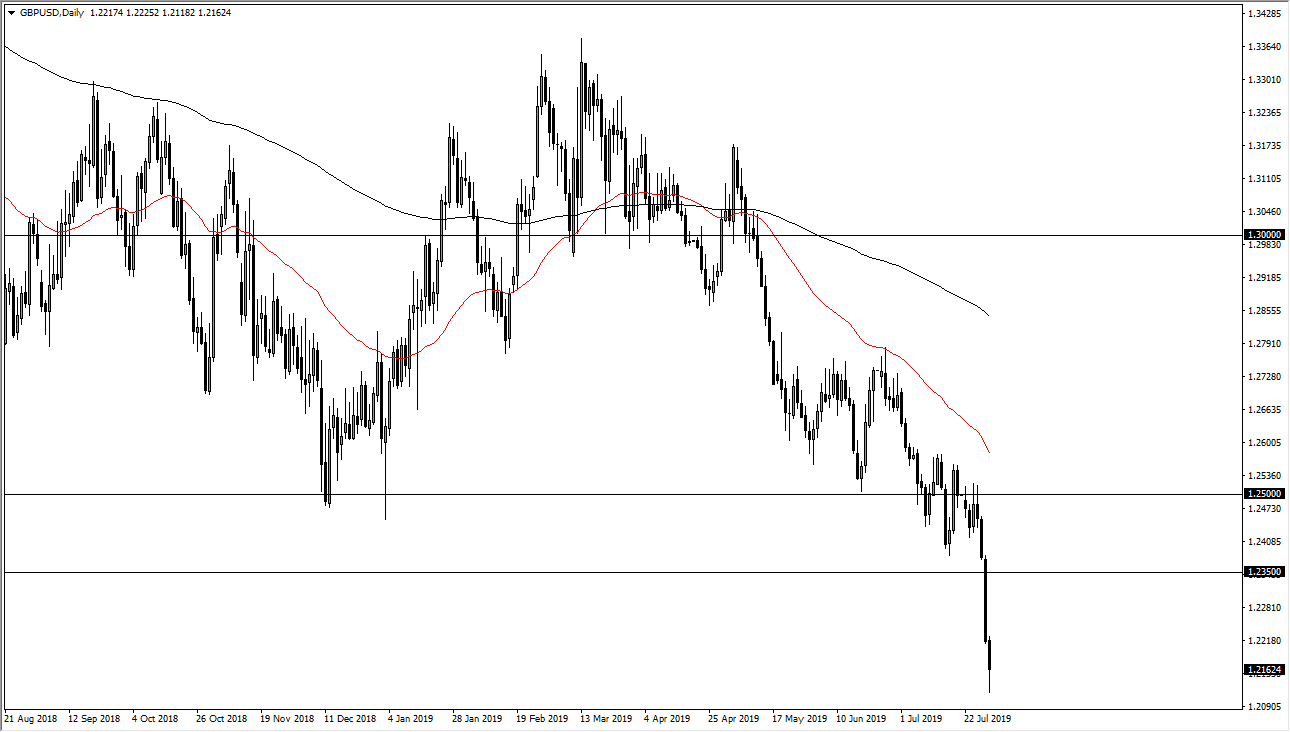

Needless to say, we are grinding away towards the deadline on October 31, which is starting to look more and more like it’s probably going to be something without a deal. With that being the case, there will be a lot of fear when it comes to the British pound, as uncertainty is horrific for risk appetite. I think at this point we will eventually see this market flush lower, and that will be the longer-term buying opportunity that people have been waiting for. In the short term, I think that it’s likely the 1.2350 level will be the beginning of significant resistance that extends to the 1.25 handle above there. Overall, I’m expecting some type of bounce here that we can start fading at the first signs of exhaustion in that range. The alternate scenario of course is that we break down below the bottom of the candle stick for the trading session on Tuesday, sending this market towards the 1.20 level, which is the target for me regardless of whether we bounce from here and then fall or if we break down below the candle stick and fall.