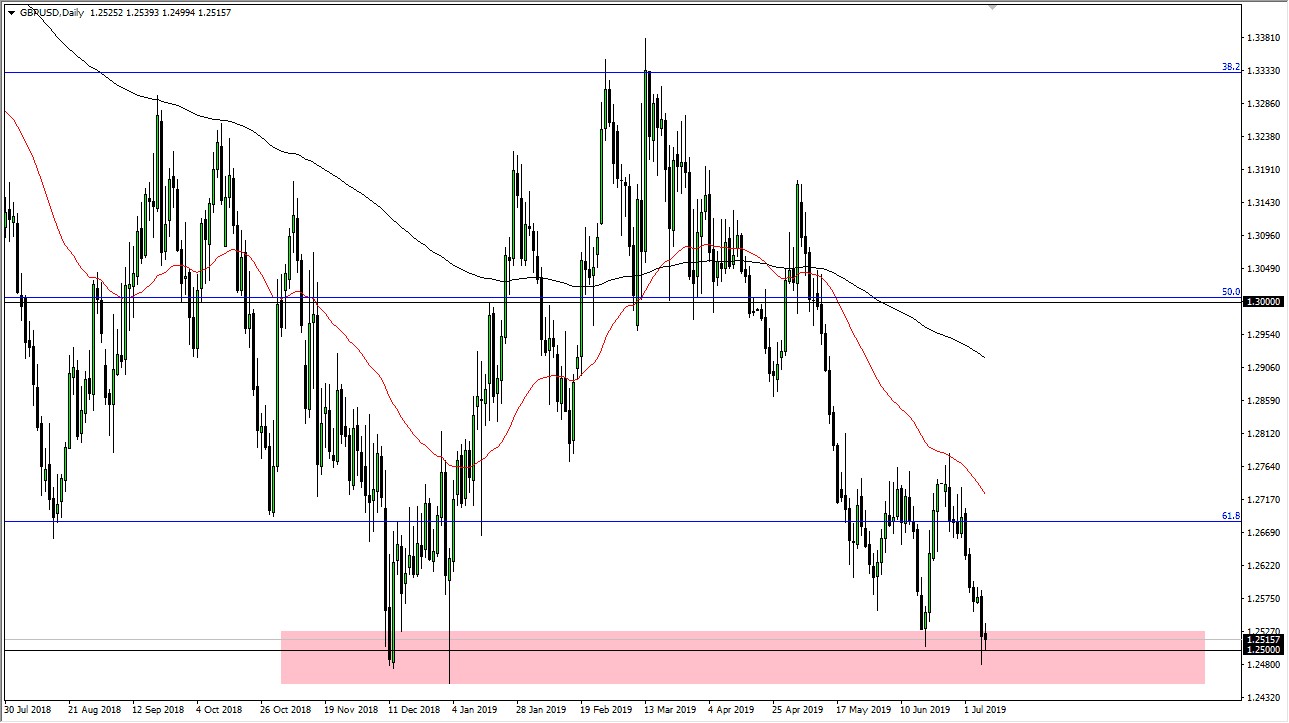

The British pound went back and forth during trading on Monday as we continue to hover just above the 1.25 handle. This of course is a large, round, psychologically significant figure, and it is of course an area that attracts a lot of attention. This is a longer-term support and resistance area, so don’t be surprised at all to see a lot of choppy in this region. If we were to break down below the lows from late last year, that opens up the door to much lower pricing, perhaps the 1.2250 level. Ultimately, I do think that the buyers will probably jump back into this market and try to push higher.

Keep in mind that the Federal Reserve is likely to cut interest rates, and of course the entire world assumes that will happen during the month of July. If that happens, we could see greenback weakness, and therefore we could a bit of a bounce in this pair as it could be a bit of sympathy when it comes down to the pair. Overall, I believe it’s going to take a large amount of downward pressure to finally break down but at this point it’s very likely that the Brexit headline or at least headwind to any upward pressure.

Even if we do get a rally, it’s difficult to imagine that we will be able to break out above resistance at the 1.2750 level above, so I think that’s about as far as the rally can carry it. It would take extraordinarily dovish comments coming out of the Chairman of the Federal Reserve to push this market to the upside and break through that resistance. Overall, this is very likely going to be a very noisy situation, but I think that upside is limited, while at the same time we have a major amount of support underneath. I believe at this point it’s likely that we stay within this consolidation area and therefore a bounce is somewhat likely, but not guaranteed.

That would be a slow move, but if we do break down below the 1.2450 level, I think that the market breaks down rather quickly, and I would become aggressively short. Otherwise, you have to play this market with small positions and be cautious about jumping in without significant price action to bank your trading thesis. If we were to have some move above the 1.2750 level, then the market is likely to go to the 1.30 level but I doubt that happens anytime soon.