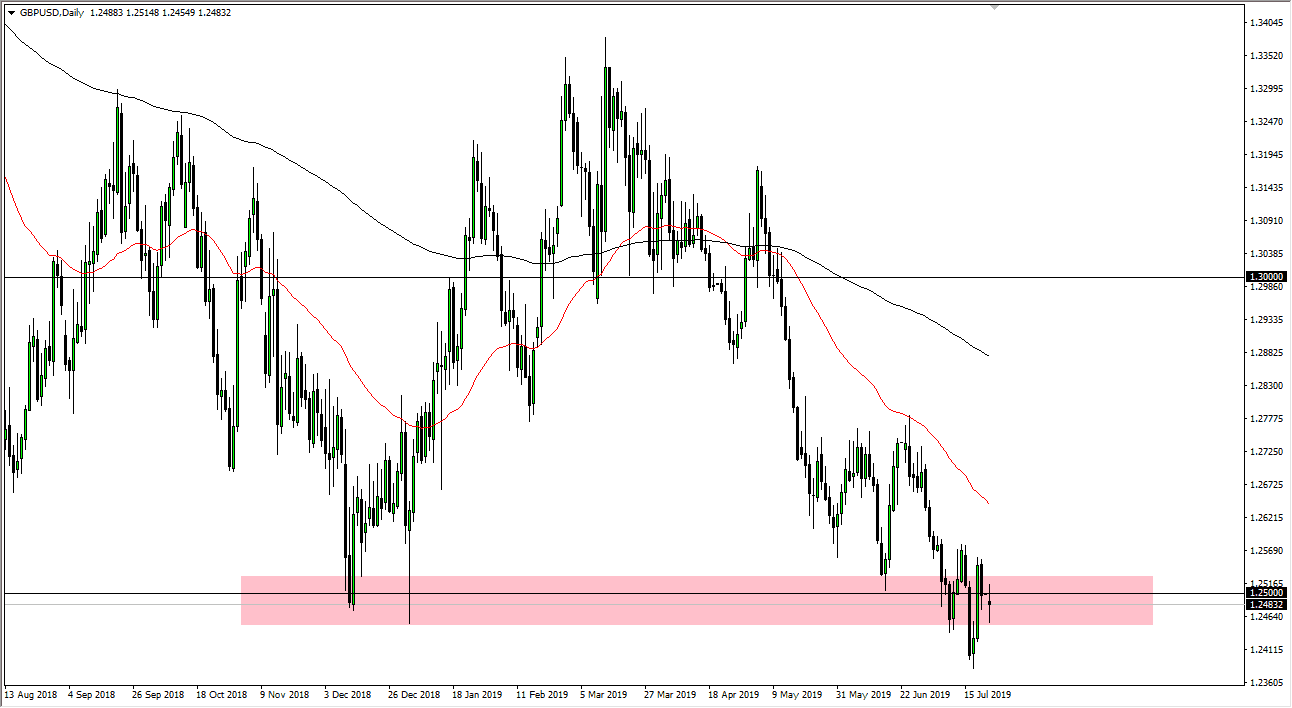

The British pound gapped lower to kick off the trading session on Monday, then turned around to rally to fill that gap, and then broke down before bouncing again. The 1.25 level offers significant resistance above, which makes sense considering it is a large, round, psychologically significant figure. Ultimately, this is a market that continues to drift lower, even though we know that the Federal Reserve is going to cut interest rates.

British pound continues to suffer at hands of Brexit

The British pound continues to suffer at the hands of the Brexit, as the headlines and the questions about the Brexit continues to be up in the air, therefore it undermines any type of confidence when it comes to owning the currency, and of course in the economy. With the Federal Reserve ready to cut rates, this shows that the market truly doesn’t trust Sterling, as it is falling against the currency that we already know is going to be cutting rates.

Rallies at this point in time should continue to be selling opportunities based upon the fact that we have no confidence, especially near the 1.2575 handle, perhaps even the 1.26 level. Longer-term, one of the things you need to look at is where we could go from here, and that could be the 1.2250 level, perhaps even the 1.20 level after that. If that can happen in the face of interest rates being cut, this is an extraordinarily negative sign.

Various levels

There are various levels above that could cause significant resistance, which I will be looking at for selling opportunities. The 1.25 level is the most obvious, but then the 1.26 level after that is a selling opportunity. Beyond that, we have the 1.2750 level is also a selling opportunity. We also have the 50 day EMA underneath that level, which of course could cause a lot of selling opportunities as well.

I’m looking at exhaustive candles as a selling opportunity, but I also recognize that breaking down to a fresh, new low could send this market down to those previously mentioned levels, even as low as the 1.20 level. The fact that the Federal Reserve is cutting rates seems to make no difference, and the fact that we have “lower highs” and “lower lows” tells me everything I need to know. After all, you should be trading what “should happen”, rather what “is happening.”

As far as buying is concerned I don’t have any interest in doing so, at least not until we break above the 1.2750 level on a daily close. Ultimately, if we have that happen it’s very likely that the market could go to the 1.30 level, and then beyond. I do believe that the most likely scenario for buyers to get back in will be the conclusion of the Brexit and the “flush lower”, as traders will then look to take advantage of the British pound being overly cheap, and therefore the overreaction should be taken advantage of. The meantime though, we have a long way to go before that happens.