The British pound fell again during the trading session on Wednesday as traders start to focus on the Independence Day holiday on Thursday. Even if you aren’t in the United States you should be where the fact that New York will basically be off-line, so that puts a lot of danger in the marketplace.

Beyond that, the jobs number is on Friday so that will have an influence on the greenback as well. If we get a jobs number that disappoint, that may actually be good for equities, but at the same time be good for this pair as it would almost ensure that the Federal Reserve is in fact going to start cutting interest rates. (It should be noted that Wall Street has that chance at roughly 100% anyway) therefore, it’s very likely that we will see buyers come into this pair sooner or later.

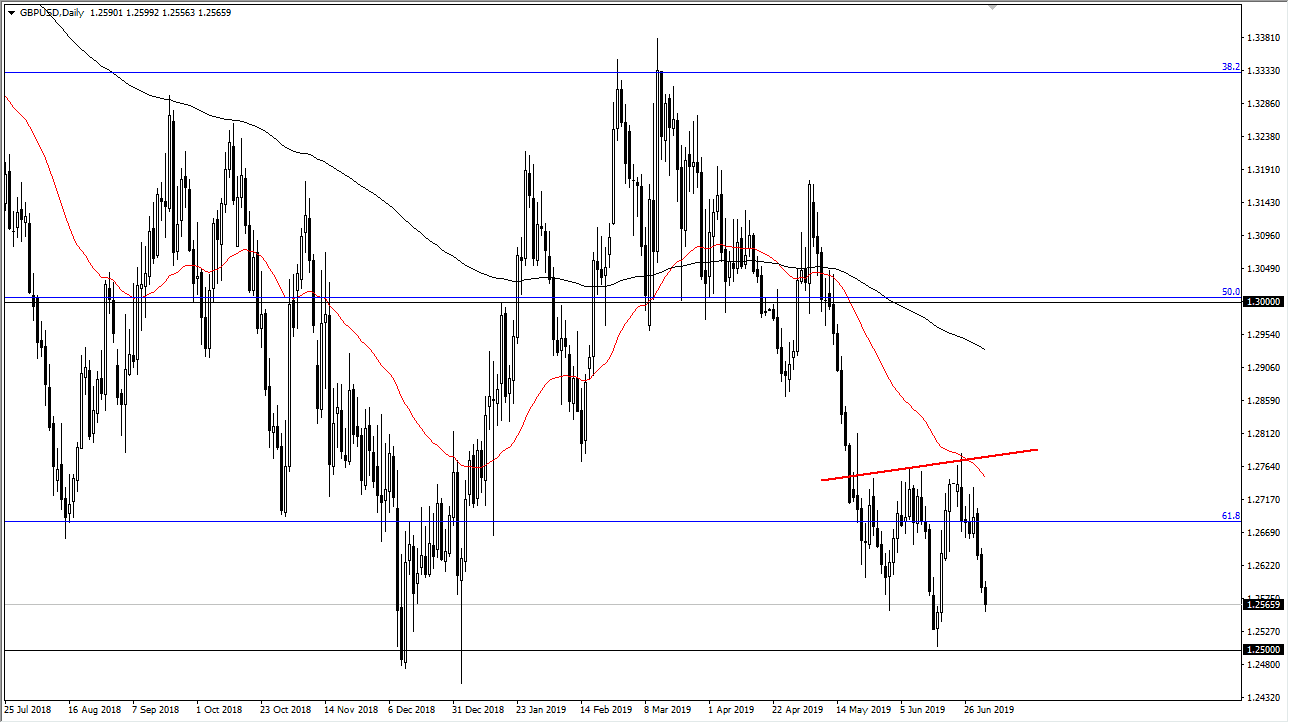

Looking at the chart, I recognize the 1.25 level as a psychologically and structurally important level, so I think that somewhere between here and there we should see buyers return. The jobs number could be the catalyst, or it could just be a simple lack of liquidity. Never know, perhaps the British could do something to settle the Brexit, but I wouldn’t hold my breath on it considering that they’ve had three years to do so. If we can break above the highs of the trading session on Wednesday, that’s obviously a very bullish sign and I think we would probably go looking towards the red line I have marked on the chart above. That could, at least in theory, form a bit of an inverted head and shoulders which is obviously a bullish sign. That gives the market an opportunity to take off to the upside and go looking towards 1.30 level above based upon the measured move.

The alternate scenario is of course we break down below the 1.25 handle. If we do, that would be an extraordinarily negative turn of events and it’s likely that point the market would probably try to pick up another 250 pips to the downside. That being said, the best friend to the British pound right now is probably the Federal Reserve, so a break down is a little less likely due to that. However, if we see this pair break down below the 1.25 level, you may actually get a bit more traction shorting the British pound against other currencies, as the Fed is trying to kill off the dollar.